Original copy of GST AAR of NIS Management Ltd

Original copy of GST AAR of NIS Management Ltd

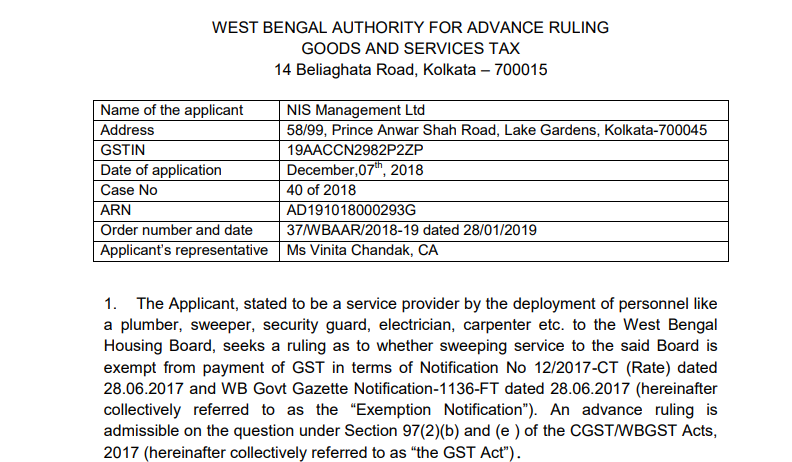

In the GST AAR of NIS Management Ltd, the applicant has raised the question regarding the exemption of the swiping services to the board in terms of Notification No 12/2017-CT (Rate) dated 28.06.2017.

Order:

1. The Applicant, stated to be a service provider by the deployment of personnel like a plumber, sweeper, security guard, electrician, carpenter etc. to the West Bengal Housing Board, seeks a ruling as to whether sweeping service to the said Board is exempt from payment of GST in terms of Notification No 12/2017-CT (Rate) dated 28.06.2017 and WB Govt Gazette Notification-1136-FT dated 28.06.2017 (hereinafter collectively referred to as the “Exemption Notification”). An advance ruling is admissible on the question under Section 97(2)(b) and (e ) of the CGST/WBGST Acts, 2017 (hereinafter collectively referred to as “the GST Act”). The Applicant further submits that the question raised in the Application is neither decided by nor pending for decision before any authority under any provisions of the GST Act. The officer concerned from the revenue raises no objection to the admission of the Application. The Application is, therefore, admitted.

2. On a careful reading of the Application and scrutiny of further submission by the Applicant during Hearing, it is clear that the questions on which the ruling is sought are specific to the sweeping services provided to the RHEs under the Housing Directorate of the Govt of West Bengal. It awarded the Applicant the contract for deployment of personnel for services of plumbing, sweeping etc. According to the work order issued on 16/07/2018, the Applicant was required to charge GST on the entire bill, including sweeping service. The Directorate, however, has since raised an objection on GST being charged on sweeping service, which, in their opinion, is part of sanitation service listed under the Eleventh Schedule of the Constitution and, therefore, eligible for exemption under Sl. No. 3 of the Exemption Notification. The discussion in this ruling will, therefore, be restricted to the sweeping services that the Applicant provides to the Housing Directorate.

3. The concerned officer from the revenue submits that the above exemption is applicable to the government or local authority. The Board is neither Government nor Local Authority, but a statutory body created by the West Bengal Housing Board Act

1972. The above exemption is, therefore, not applicable for supplies to the Board. Furthermore, sweeping is a composite supply and exemption under Sl No. 3 of the Exemption Notification is not applicable to anything other than pure services. The submission of the concerned officer is based on what the Applicant discloses in the Application. The documents that he submits at the time of Hearing, however, clarifies that the supply is being made to the Housing Directorate of the Govt of West Bengal. The discussion about the Housing Board is, therefore, no longer relevant. The supply, being made to the Government of West Bengal, is eligible for exemption under Sl No. 3 or 3A of the Exemption Notification, provided it satisfies other conditions. Furthermore, even if sweeping service is a composite supply, it may still attract exemption under Sl No. 3A of the Exemption Notification. Therefore, the distinction between a pure service and a composite supply does not, in the present context, make any material difference in answering the question of the Applicant.

Download the GST AAR of NIS Management Ltd by clicking the below image:

4. It is pertinent to examine the ambit of the exemption under Sl Nos. 3 or 3A of the Exemption Notification. They cover the supply of certain services to the government, local authority, governmental authority, or government entity. The service should be an activity in relation to any function entrusted to a Panchayat under Art 243G of the Constitution or to a Municipality under Art 243W of the Constitution. In its Circular No. 51/25/2018-GST dated 31/07/2018 the Central Government clarifies that the service tax exemption at serial No. 25(a) of Notification No. 25/2012 dated 20/06/2012 (hereinafter the ST Notification) has been substantial, although not in the same form, continued under GST vide Sl No. 3 and 3A of the Exemption Notification. Sl No. 25(a) of the ST notification under the service tax exempts “services provided to the Government, a local authority or a governmental authority by way of water supply, public health, sanitation, conservancy, solid waste management or slum improvement and upgradation.” The Circular further explains in relation to the specific issue of ambulance service to the Government by a private service provider (PSP) that such service is a function of „public health‟ entrusted to Municipalities under Art 243W of the Constitution, and, therefore, eligible for exemption under Sl No. 3/3A of the Exemption Notification. The above Circular leaves no doubt that the phrase „in relation to any function‟, as applied in Sl Nos. 3 and 3A above, makes no substantial difference between Sl No. 25(a) of the ST Notification and Sl No. 3/3A of the Exemption Notification. Under the previous service tax regime, the exemption was limited to certain functions specified in Sl No. 25(a) of the ST Notification; whereas, under the GST the ambit has been broadened to include all such functions as entrusted to a Panchayat or a Municipality under the Constitution.

The example of ambulance service also makes it clear that the phrase „in relation to any function‟ refers not to what activities the recipient of the service is engaged in, but to what service the supplier is providing. While examining whether ambulance service supplied to the Government is eligible for the exemption, the Circular does not go on to explore whether the recipient of the service is engaged in an activity listed under the

Eleventh or the Twelfth Schedules and whether the ambulance service is being supplied in relation to any such activity. It simply focuses on the nature of the service itself (ie. The ambulance service) and examines whether its classification relates to an activity listed under the schedules referred to above. 5. It now needs to be examined whether the Applicant‟s supply of Sweeping Service comes under the ambit of the exemption under Sl. No. 3A of the Exemption Notification in terms of an activity in relation to any function entrusted to a Panchayat under Art 243G of the Constitution or to a Municipality under Art 243W of the Constitution. Article 243G of the Constitution discusses the powers, authority and responsibilities of Panchayats, stating that “Subject to the provisions of this Constitution the Legislature of a State may, by law, endow the Panchayats with such powers and authority and may be necessary to enable them to function as institutions of self government ……. subject to such conditions as may be specified therein, with respect to…….(b) the implementation of schemes for economic development and social justice as may be entrusted to them including those in relation to the matters listed in the Eleventh Schedule”. The Eleventh schedule of the Indian Constitution contains the following 29 functional items placed within the purview of the Panchayats:

Article 243W of the Constitution discusses the powers, authority and responsibilities of Municipalities, etc stating that “Subject to the provisions of this Constitution, the Legislature of a State may, by law, endow,…….b) the Committees with such powers and authority as may be necessary to enable them to carry out the responsibilities conferred upon them including those in relation to the matters listed in the Twelfth Schedule”. List of 18 items covered under the Twelfth Schedule of the Indian Constitution are as follows;

6. From the Tender Notice of the Housing Directorate issued under their office memo no. 342/2E – 28 dated 13/03/2018 it appears that the Housing Directorate invites quotation for deployment of personnel at the RHEs under the Directorate for several services, including „Sweeping Service‟. The job description of a sweeper mentioned therein includes sweeping of the compound and common staircase and corridors of all floors of the buildings in the Housing Estate, cutting of jungles and bushes, cleaning and disposal of garbage, cleaning of the roof, surface drain cleaning, pit cleaning of sewerage system etc.

It is, therefore, a bundle of activities that are classifiable under SAC 99853 as „cleaning service‟. It may be eligible for the above exemption if it also qualifies as a service for public health sanitation, being an activity under Sl No. 7 (public health sanitation, conservancy, and solid waste management) of the Twelfth Schedule to the Constitution. „Sanitation and similar services‟ are classified under SAC 99945. It includes sweeping and cleaning, but only with reference cleaning of a road or street. Sweeping of premises – public or residential – is not classified under „Sanitation or similar service‟, Sweeping service that the Applicant supplies to the Housing Directorate cannot, therefore, be classified as an activity in relation to any function entrusted to a Panchayat under Article 243G of the Constitution or in relation to any function entrusted to a Municipality under Article 243W of the Constitution.

Ruling:

In view of the foregoing, we rule as under.

Sweeping Service that the Applicant supplies to the Housing Directorate of the Government of West Bengal, cannot be classified as an activity in relation to any function entrusted to a Panchayat under Article 243G of the Constitution or in relation to any function entrusted to a Municipality under Article 243W of the Constitution. The exemption under Sl No. 3 or 3A, as the case may be, of Notification No 12/2017-CT (Rate) dated 28.06.2017 and WB Govt Gazette Notification-1136-FT dated 28.06.2017 is not, therefore, applicable to such supplies. This ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

Source: http://gstcouncil.gov.in/sites/default/files/ruling-new/WB_37_2018-19%20-NISML.pdf

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.