No recovery for difference in GSTR 3b and 2A (Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

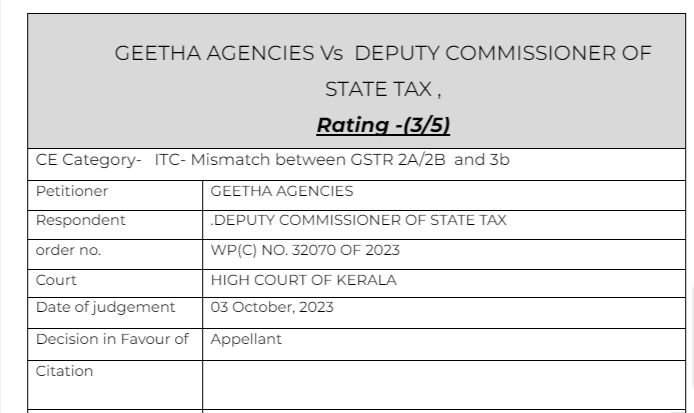

GEETHA AGENCIES Vs DEPUTY COMMISSIONER OF STATE TAX ,

Facts of the cases:

The petitioner’s input tax credit for an amount of Rs.1,10769/- (SGST + CGST), has been denied on the ground that there is mismatch in GSTR 2A and GSTR 3B.

writ petitioner/assessee had submitted that the petitioner had claimed the input tax as specified in GSTR-3B, based on valid invoices available with them. Petitioner also submitted that certain suppliers while uploading the data in GSTR-1, due to certain technical problem in the website, the data was uploaded as ‘0’ tax items.

His reply was not considered convincing DRC 01A was issued.

Later on recovery proceedings were also started.

Observation & Judgement of the Court:

To prove his case, one opportunity is granted to the petitioner to appear before the Assessing authority, within seven days from today with all relevant documents. The present writ petition is allowed. Impugned order Exhibit P1 and notice Exhibit P2 are set aside. Petitioner is directed to appear before the assessing authority within seven days from today with all relevant documents and on examination of the documents, if the assessing authority is satisfied that the petitioner’s claim for input tax credit denied by Exhibit P1 order, is bonafied, he be granted the said benefit and a revised order be issued.

Comment:

Benefit was given where the difference was there in GSTR 2A and 3b.

Read & Download the Full GEETHA AGENCIES Vs DEPUTY COMMISSIONER OF STATE TAX ,

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.