No recovery from the Directors

Case Covered:

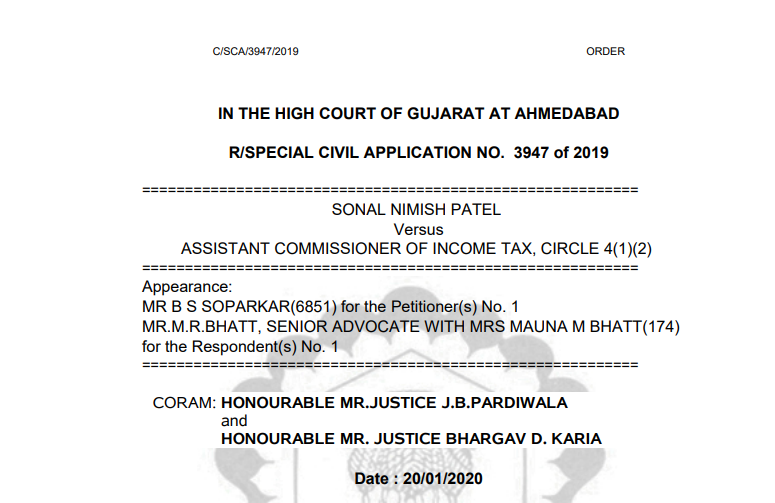

SONAL NIMISH PATEL

Versus

ASSISTANT COMMISSIONER OF INCOME TAX

Read the full text of the case here.

Facts of the case:

At the relevant point of time, the directors of the assessee company were Smt. Sonal Nimish Patel and Smt. Ashita Nilesh Patel. Further, it is noticed from the records of the company that there are no recoverable assets in the name of assessee company. In such circumstances, proceedings under Section 179 of the I.T.Act were initiated on 02.11.2017 by way of issuing of notice to the then Directors and all the directors were requested to show cause vide notice u/s 179 of the Act as to why they should not be treated as jointly and severally liable for the payment of such tax and why an order u/s 179 of the Income Act,1961 should not be passed against them. In terms of the said notice, the directors were to attend the office of the undersigned on 10.11.2017 with the explanation. But no compliance was made in response to the said notice. It is noticed that neither the Directors or any of their authorized representatives attended nor any written submission was furnished.

Observations of the court:

In view of the above, this writapplication is partly allowed. The impugned notice, as well as the order, is hereby quashed and set aside. It shall be open for the respondent to issue fresh showcause notice for the purpose of proceeding against the writapplicant under Section 179 of the Act, 1961. We would like to give a time-bound program so that the proceedings may not go on for an indefinite period. We are also issuing such direction because of the statement being made that the writapplicant will not operate the bank account until the fresh proceedings are initiated and completed. In such circumstances, we grant two months’ time from the date of receipt of the writ of this order to the Department to initiate fresh proceedings and pass appropriate orders in accordance with the law. Till the final order is passed, the writ applicant shall not operate the bank account concerned.

In view of the above, two notices under Section 226(3) of the Act,1961, i.e. one, to the Kalupur Commercial Cooperative Bank Limited, and another, to the HDFC Bank Limited, are also quashed and set aside.

With the above, this writapplication stands disposed of.

One copy of this order shall be furnished to Mrs.Bhatt, the learned standing counsel for the respondent for its onward communication.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.