No recovery till the GST Tribunal is formed

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

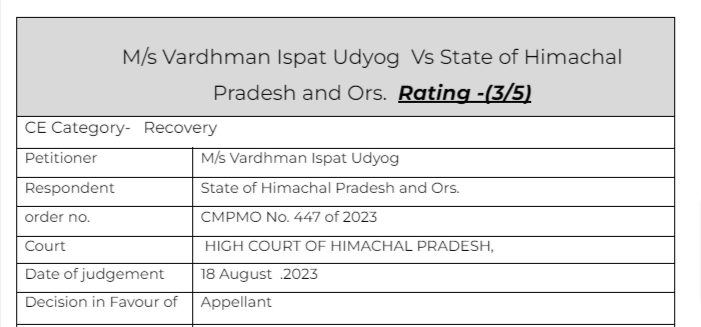

M/s Vardhman Ispat Udyog Vs State of Himachal Pradesh and Ors.

Citation:

Rochem India Pvt. Ltd. v. The Union of India

Facts of the cases:

As the appellate tribunal is not formed.The petitioner is compelled to approach this Court in the instant proceedings filed under Article 227 of the Constitution of India, praying therein to issue direction to respondent No.1 to not to act in furtherance of order dated 19.5.2023, passed by the Commissioner (Appeals) HP Goods and Service Tax-cum-Divisional Commissioner, Shimla Division, whereby appeal having been filed by the petitioner under Section 107(1) of the Act, laying therein challenge to order dated 30.8.2022, passed by the Joint Commissioner of State Taxes and Excise, Central Enforcement Zone, Una, came to be dismissed

Observation & Judgement of the Court:

Consequently, in view of the detailed discussion made herein above as well as law taken into consideration, this Court finds merit in the present petition and accordingly, same is allowed with direction to respondent No.1 to not to act in furtherance of the order dated 19.5.2023, passed by the appellate tribunal in Appeal Nos. 247 and 248 of 2022 till the time appellate tribunal in terms of Section 109 of the Act is constituted by the State of Himachal Pradesh and thereafter appeal within prescribed period of limitation as detailed in circular dated 3.12.2019 issued by the Ministry of Finance, Government of India, is filed by the petitioner in the appellate Tribunal

Read & Download the Full M/s Vardhman Ispat Udyog Vs State of Himachal Pradesh and Ors.

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.