Note on Recent changes in GSTR-9 & 9C

In its 4th and probably final round of extension and modification exercise in filing GSTR-9 and 9C, the Government has issued following yesterday:

1. Notification No. 56/2019-CGST dated 14th November 2019 notifying

a. various changes in formats of GSTR-9 and 9C to give effect to its applicability for F.Y 2018-19

b. changes in formats of GSTR-9 & 9C to provide substantial relief by making various mandatory fields ‘optional’ for the F.Y 2017-18 and 2018-19

2. ROD Order No. 08/2019 -CGST dated 14th November 2019 providing

a. Extension in the filing of GSTR-9 and 9C for F.Y 2017-18 for a further period of one month after the last extension. Now to be filed latest by 31st December 2019

b. Extension in filing GSTR-9 and 9C for F.Y 2018-19 for 3 months. Now to be filed latest by 31st March 2020

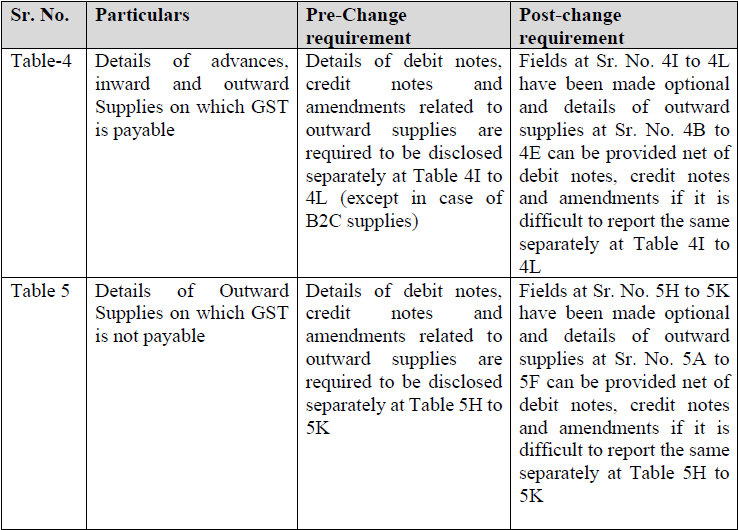

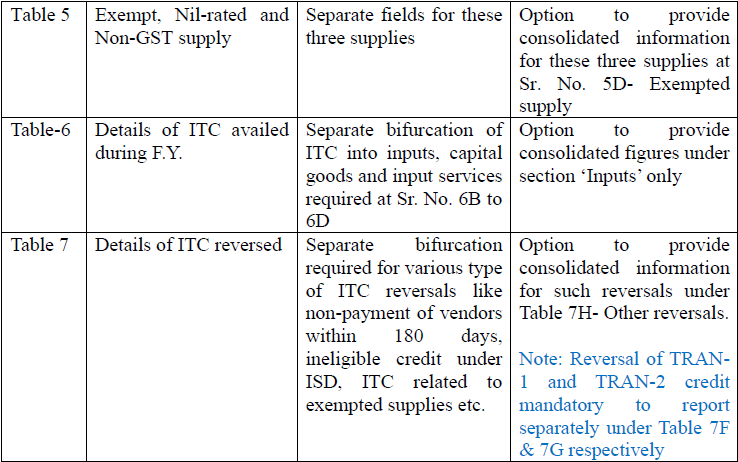

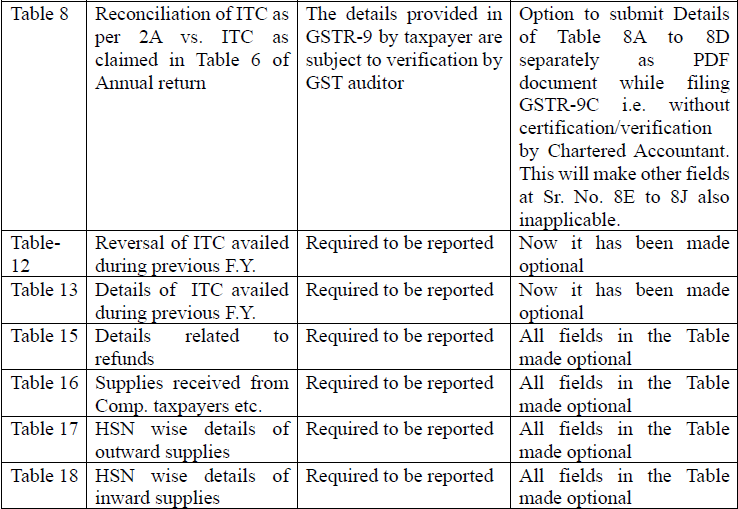

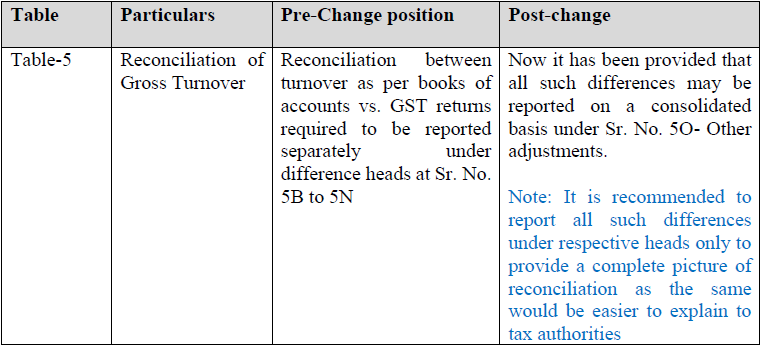

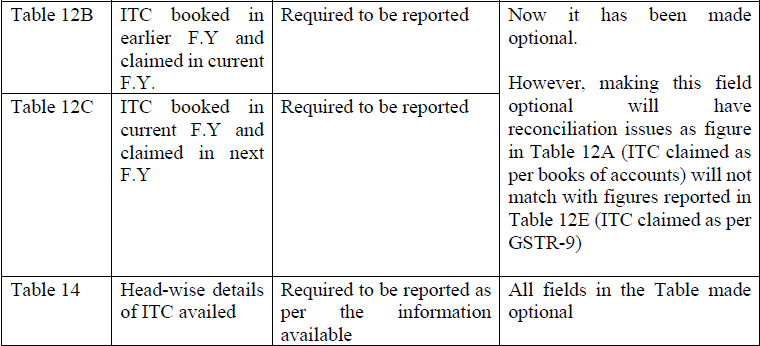

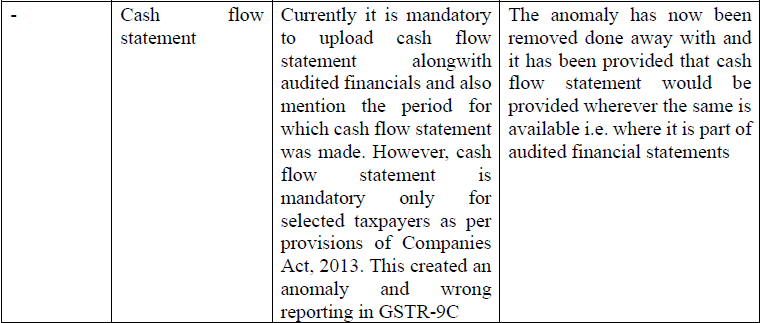

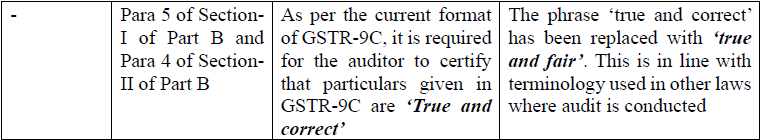

The changes made in the Form GSTR-9 and 9C are tabulated below:

A. Changes in GSTR-9 including instructions

B. Changes in GSTR-9C including instructions

Before parting…..

By this time, most of the taxpayers and professionals have already spent a lot of time and effort for compiling the details required to be reported in GSTR-9 & 9C which have now been made optional. The relaxation provided would have had a better impact if the same were notified at least 6 months well in advance.

Download the pdf on Note on Recent changes in GSTR-9 & 9C, below:

CA Nikhil M Jhanwar

CA Nikhil M Jhanwar

Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.