Note on Refund Under GST

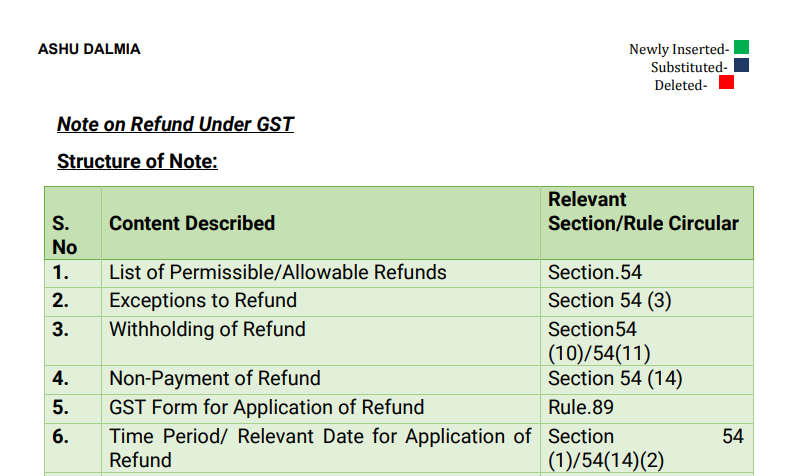

Table of Contents

- Note on Refund Under GST

- List of Permissible/Allowable Refunds

- The exception to Refund –

- Withholding of Refund –

- Non-Payment of Refund

- Time Period and Relevant Date for Application of Refund

- Time Period and GST Form for application of refund by the person (UNO etc.) notified under section 55.

- Read & Download the full copy in pdf:

Note on Refund Under GST

List of Permissible/Allowable Refunds

- Refund of unutilized input tax credit (ITC) on account of exports without payment of tax;

- Refund of tax paid on export of services with payment of tax.

- Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax.

- Refund of tax paid on supplies made to SEZ Unit/SEZ Developer with payment of tax.

- Refund of unutilized ITC on account of accumulation due to an inverted tax structure.

- Refund to the supplier of tax paid on deemed export supplies.

- Refund to the recipient of tax paid on deemed export supplies.

- Refund of excess balance in the electronic cash ledger.

- Refund of excess payment of tax.

- Refund of tax paid on an intra-State supply which is subsequently held to be inter-State supply and vice versa.

- Refund on account of assessment/provisional assessment/appeal/any other order.

- Refund on account of “any other” ground or reason; and

- Refund, as per section 54 (2) of the CGST Act of tax paid on inward supplies of goods or services or both by UNO, etc. notified under section 55.

- Refund by shops on Airports beyond custom immigration in the designated area

The exception to Refund –

According to provisos to Sec.54(3), CGST Act

- No refund of the unutilized input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty:

- No refund of the input tax credit shall be allowed, if the supplier of goods or services or both avails of drawback in respect of central tax or claims refund of the integrated tax paid on such supplies

Related Topic:

Uploading supporting documents with the GST refund application

Withholding of Refund –

According to provisos to Sec.54(10), CGST Act

- Defaulted in furnishing any return.

- Defaulted in payment of any tax, interest or penalty and

- The Proper Officer is authorized to deduct from the refund due, any tax, interest, penalty, fee or any other amount which the taxable person is liable to pay but which remains unpaid under this Act or under the existing law

According to provisos to Sec.54(11), CGST Act

- Where an order giving rise to a refund is the subject matter of an appeal or further proceedings or where any other proceedings under this Act are pending and the Commissioner is of the opinion that grant of such refund is likely to adversely affect the revenue in the said appeal or other proceedings on account of malfeasance or fraud committed, he may, after giving the taxable person an opportunity of being heard, withhold the refund till such time as he may determine.

According to provisos to Sec.54(13), CGST Act

- The amount of advance tax deposited by a casual taxable person or a non-resident taxable person under sub-section (2) of section 27, shall not be refunded unless such person has, in respect of the entire period for which the certificate of registration granted to him had remained in force, furnished all the returns required under section 39.

Non-Payment of Refund

According to Sec.54(14), CGST Act

- No refund under Sec.54 (5)/(6) about the Application of claiming Refund shall be paid to an applicant if the amount is less than Rs.1000.

- It is clarified vide circular 125/44/2019 that the limit of Rs.1000 shall be applied for each tax head separately and not cumulatively.

Related Topic:

Documents for refund application in GST

Time Period and Relevant Date for Application of Refund

Refund Application can be filed before the expiry of 2 years from the “Relevant date”

According to Sec.54(14) Explanation:2 Relevant Date means:

(a) in the case of goods exported out of India where a refund of tax paid is available in respect of goods themselves or, as the case may be, the inputs or input services used in such goods,—

(i) if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India; or

(ii) if the goods are exported by land, the date on which such goods pass the frontier; or

(iii) if the goods are exported by post, the date of dispatch of goods by the Post Office concerned to a place outside India;

(b) in the case of a supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods, the date on which the return relating to such deemed exports is furnished.

(c) in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of—

(i) receipt of payment in convertible foreign exchange [or in Indian rupees wherever permitted by the Reserve Bank of India], where the supply of services had been completed prior to the receipt of such payment; or

(ii) issue of invoice, where payment for the services had been received in advance prior to the date of issue of the invoice;

(d) in the case where the tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court, the date of communication of such judgment, decree, order or direction;

(e) in the case of a refund of unutilized input tax credit under clause (ii) of the first proviso to sub-section (3) ( accumulation of tax due to inverted tax structure ), the due date for furnishing of return under section 39 for the period in which such claim for refund arises;

(f) in the case where tax is paid provisionally under this Act or the rules made thereunder, the date of adjustment of tax after the final assessment thereof;

(g) in the case of a person, other than the supplier, the date of receipt of goods or services or both by such person; and

(h) in any other case, the date of payment of tax.

Related Topic:

Important issues in GST refund resolved

Time Period and GST Form for application of refund by the person (UNO etc.) notified under section 55.

According to Section 54 (2) of the CGST Act, the person ( UNO, etc. ) notified under section 55 shall apply for the refund through GST Form GST RFD-10 before the expiry of six months from the last day of the quarter in which such supply was received. Such supply means an inward supply on which the tax has been paid.

Read & Download the full copy in pdf:

Ashu Dalmia

Ashu Dalmia

New Delhi, India

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.