Two major amendments in GST audit -Notification No. 29/2021 – Central Tax

This notification has notified two important sections of FA 2021. Section 110 and 111 of FA 2021 are applicable from 1st August 2021. Section 110 of Finance Act 2021 omitted section 35(5) of the CGST Act. This section was about the GST audit. From now on there is no GST audit. The self-certification will replace the GST audit with a CA or CWA.

The other major amendment is replacing the text of section 44 of the CGST Act. The requirement of submission of CA /CWA certified reconciliation statement is removed. In place of it, a self-certified statement is required.

Related Topic:

Notification No. 01/2021 – Central Tax

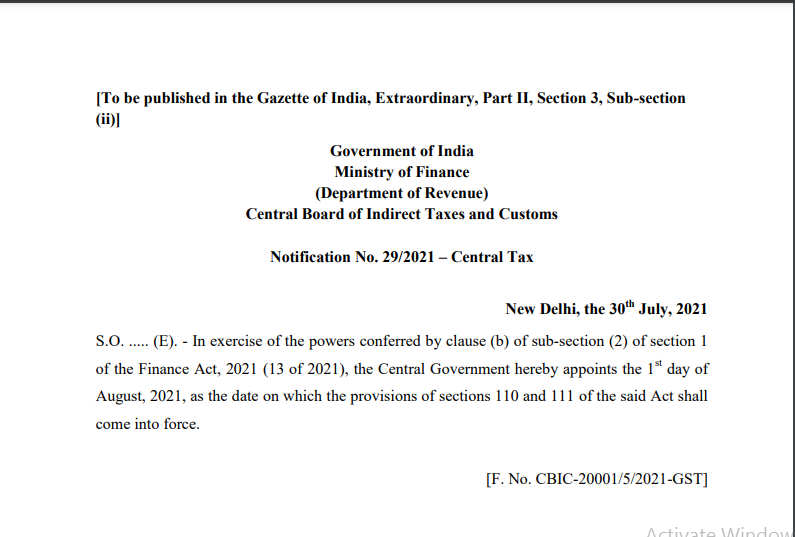

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (ii)]

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 29/2021 – Central Tax

New Delhi, the 30th July 2021

S.O. ….. (E). – In exercise of the powers conferred by clause (b) of sub-section (2) of section 1 of the Finance Act, 2021 (13 of 2021), the Central Government hereby appoints the 1st day of August 2021, as the date on which the provisions of sections 110 and 111 of the said Act shall come into force.

Related Topic:

Notification No. 30/2021 – Central Tax

[F. No. CBIC-20001/5/2021-GST]

(Rajeev Ranjan)

Under Secretary to the Government of India

Related Topic:

Notification No. 31/2021 – Central Tax

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.