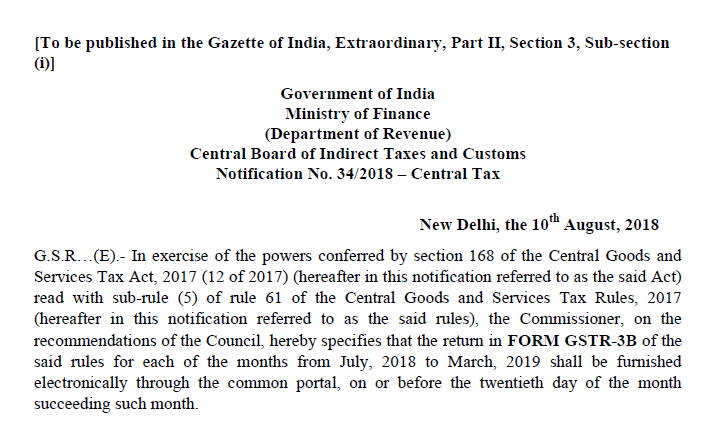

Notification No. 34/2018 – Central Tax

Notification No. 34/2018 – Central Tax

Government of India

Ministry of Finance

(Department of Revenue)

0Central Board of Indirect Taxes and Customs

Notification No. 34/2018 – Central Tax

New Delhi, the 10th August 2018

G.S.R…(E).- In exercise of the powers conferred by section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said Act) read with sub-rule (5) of rule 61 of the Central Goods and Services Tax Rules, 2017 (hereafter in this notification referred to as the said rules), the Commissioner, on the recommendations of the Council, hereby specifies that the return in FORM GSTR-3B of the said rules for each of the months from July 2018 to March 2019 shall be furnished electronically through the common portal, on or before the twentieth day of the month succeeding such month.

Download the Notification No. 34/2018 – Central Tax by Clicking the below Image:

2. Payment of taxes for the discharge of tax liability as per FORM GSTR-3B.– Every registered person furnishing the return in FORM GSTR-3B of the said rules shall, subject to the provisions of section 49 of the said Act, discharge his liability towards tax, interest, penalty, fees or any other amount payable under the said Act by debiting the electronic cash ledger or electronic credit ledger, as the case may be, not later than the last date, as specified in the first paragraph, on which he is required to furnish the said return.

[F. No. 349/58/2017-GST (Pt.)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.