Notification No. 49/2018 – Central Tax

Notification No. 49/2018 – Central Tax

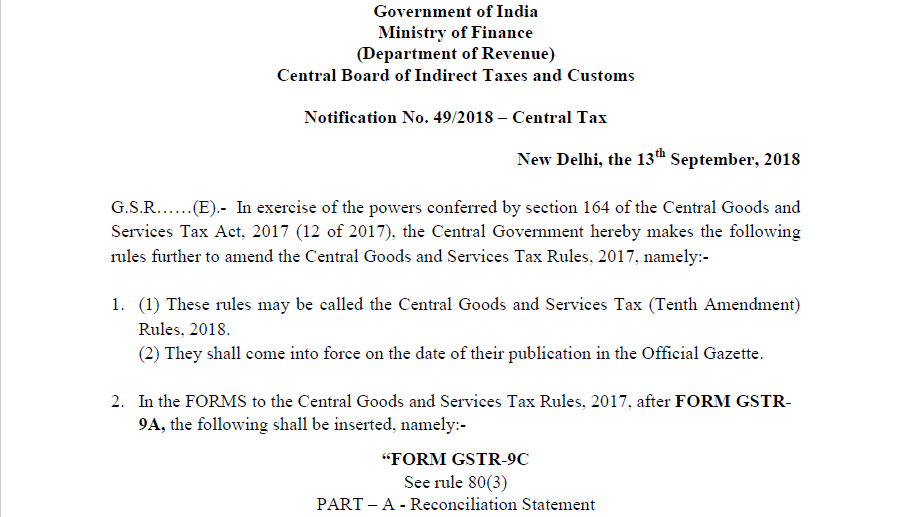

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 49/2018 – Central Tax

New Delhi, the 13th September 2018

G.S.R……(E).- In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

1. (1) These rules may be called the Central Goods and Services Tax (Tenth Amendment) Rules, 2018.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the FORMS to the Central Goods and Services Tax Rules, 2017, after FORM GSTR-9A, the following shall be inserted, namely:-

Download the full Notification No. 49/2018 – Central Tax by clicking the below Image:

Instructions: –

1. Terms used:

(a) GSTIN: Goods and Services Tax Identification Number

2. The details for the period between July 2017 to March 2018 are to be provided in this statement for the financial year 2017-18. The reconciliation statement is to be filed for every GSTIN separately.

3. The reference to the current financial year in this statement is the financial year for which the reconciliation statement is being filed for.

Source: CBIC, CGST Notifications

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.