One Page Summary For Relaxed Due Dates For GSTR 3B

Table of Contents

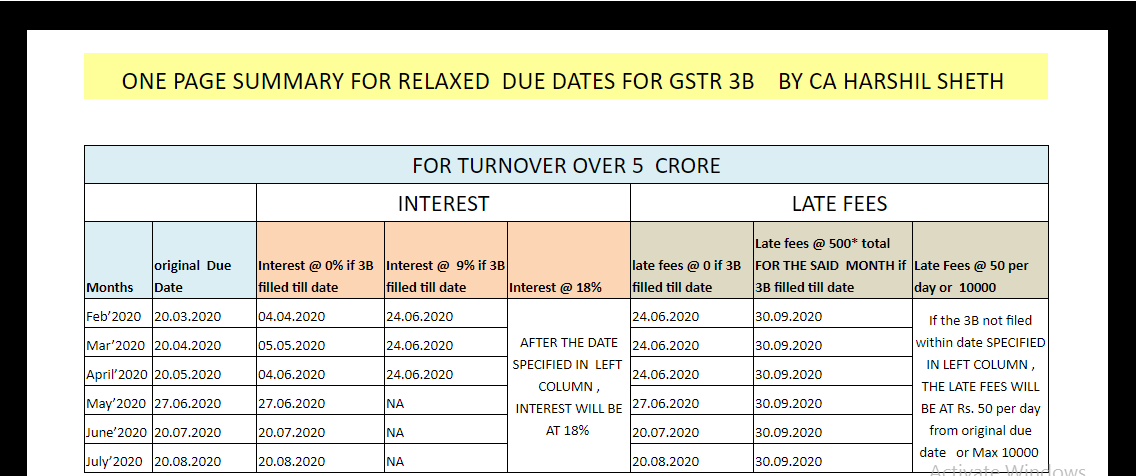

One Page Summary For Relaxed Due Dates For GSTR 3B

|

FOR TURNOVER OVER 5 CRORE |

|||||||

|

INTEREST |

LATE FEES |

||||||

|

original Due Date |

Interest @ 0% if 3B filled till date |

Interest @ 9% if 3B filled till date |

Interest @ 18% |

late fees @ 0 if 3B filled till date |

Late fees @ 500* total FOR THE SAID MONTH if 3B filled till date |

Late Fees @ 50 per day or 10000 |

|

|

Feb’2020 |

20.03.2020 |

04.04.2020 |

24.06.2020 |

AFTER THE DATE SPECIFIED IN LEFT COLUMN, INTEREST WILL BE AT 18% |

24.06.2020 |

30.09.2020 |

If the 3B not filed within date SPECIFIED IN LEFT COLUMN, THE LATE FEES WILL BE AT Rs. 50 per day from the original due date or Max 10000 |

|

Mar’2020 |

20.04.2020 |

05.05.2020 |

24.06.2020 |

24.06.2020 |

30.09.2020 |

||

|

April’2020 |

20.05.2020 |

04.06.2020 |

24.06.2020 |

24.06.2020 |

30.09.2020 |

||

|

May’2020 |

27.06.2020 |

27.06.2020 |

NA |

27.06.2020 |

30.09.2020 |

||

|

June’2020 |

20.07.2020 |

20.07.2020 |

NA |

20.07.2020 |

30.09.2020 |

||

|

July’2020 |

20.08.2020 |

20.08.2020 |

NA |

20.08.2020 |

30.09.2020 |

||

|

|

|||||||

|

FOR TURNOVER BELOW 5 CRORE – category 1 states |

|||||||

|

|

INTEREST |

LATE FEES |

|||||

|

Months |

original Due Date |

Interest @ 0% if 3B filled till date |

Interest @ 9% if 3B filled till date |

Interest @ 18% |

late fees @ 0 if 3B filled till date |

Late fees @ 500* total FOR THE SAID MONTH if 3B filled till date |

Late Fees @ 50 per day or 10000 |

|

Feb’2020 |

22.03.2020 |

30.06.2020 |

30.09.2020 |

AFTER THE DATE SPECIFIED IN LEFT COLUMN, INTEREST WILL BE AT 18% |

30.06.2020 |

30.09.2020 |

If the 3B not filed within date SPECIFIED IN LEFT COLUMN, THE LATE FEES WILL BE AT Rs. 50 per day from original due date or Max 10000 |

|

Mar’2020 |

22.04.2020 |

03.07.2020 |

30.09.2020 |

03.07.2020 |

30.09.2020 |

||

|

April’2020 |

22.05.2020 |

06.07.2020 |

30.09.2020 |

06.07.2020 |

30.09.2020 |

||

|

May’2020 |

12.07.2020 |

12.09.2020 |

30.09.2020 |

12.09.2020 |

30.09.2020 |

||

|

June’2020 |

24.07.2020 |

23.09.2020 |

30.09.2020 |

23.09.2020 |

30.09.2020 |

||

|

July’2020 |

24.08.2020 |

27.09.2020 |

30.09.2020 |

27.09.2020 |

30.09.2020 |

||

|

Aug’2020 |

01.10.2020 |

01.10.2020 |

NA |

01.10.2020 |

NA |

||

|

|

|||||||

|

FOR TURNOVER BELOW 5 CRORE – category 2 states |

|||||||

|

|

INTEREST |

LATE FEES |

|||||

|

Months |

original Due Date |

Interest @ 0% if 3B filled till date |

Interest @ 9% if 3B filled till date |

Interest @ 18% |

late fees @ 0 if 3B filled till date |

Late fees @ 500* total FOR THE SAID MONTH if 3B filled till date |

Late Fees @ 50 per day or 10000 |

|

Feb’2020 |

24.03.2020 |

30.06.2020 |

30.09.2020 |

AFTER THE DATE SPECIFIED IN LEFT COLUMN, INTEREST WILL BE AT 18% |

30.06.2020 |

30.09.2020 |

If the 3B not filed within date SPECIFIED IN LEFT COLUMN, THE LATE FEES WILL BE AT Rs. 50 per day from the original due date or Max 10000 |

|

Mar’2020 |

24.04.2020 |

05.07.2020 |

30.09.2020 |

05.07.2020 |

30.09.2020 |

||

|

April’2020 |

24.05.2020 |

09.07.2020 |

30.09.2020 |

09.07.2020 |

30.09.2020 |

||

|

May’2020 |

14.07.2020 |

15.09.2020 |

30.09.2020 |

15.09.2020 |

30.09.2020 |

||

|

June’2020 |

24.07.2020 |

25.09.2020 |

30.09.2020 |

25.09.2020 |

30.09.2020 |

||

|

July’2020 |

24.08.2020 |

29.09.2020 |

30.09.2020 |

29.09.2020 |

30.09.2020 |

||

|

Aug’2020 |

03.10.2020 |

03.10.2020 |

NA |

03.10.2020 |

NA |

||

|

* No late fees for Nil 3B |

|||||||

Reduced Late Fee – A Relaxation – For Those Having Pending Returns Since JULY 2017 TO JAN 2020

here comes great news for those having pending return to file from July 2017 to January 2020, i.e. since the inception of GST.

Taxpayers who must file a nil GSTR-3B for any of the months within the period mentioned above do not have to pay any late fee. Whereas, those taxpayers who are having some tax liability during these months can get a reduction in the maximum cap of late fee. Such taxpayers must pay a late fee of Rs 50 per day for every day’s delay starting from the original due dates, up to a maximum of Rs 500 per return. The earlier figures.

Read & download the copy: