Opportunity of being heard is right of taxpayer even if they chose no for it

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

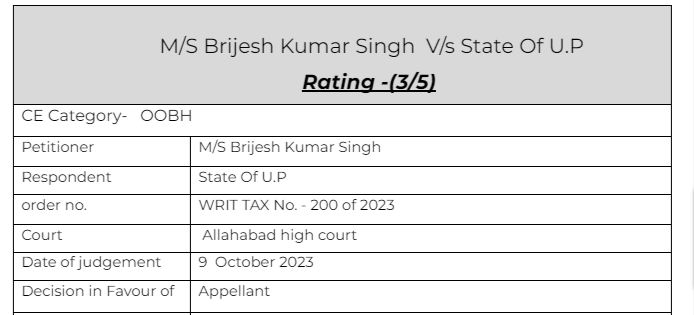

M/S Brijesh Kumar Singh V/s State Of U.P

Citations:

Bharat Mint & Allied Chemicals Vs. Commissioner Commerical Tax & 2 Or

Hitech Sweet Water Technologies Pvt. Ltd. Vs. State of Gujarat,

Facts of the cases:

Solitary ground being pressed in the present petition is, the only notice in the proceedings was issued to the petitioner on 28.09.2022 seeking his reply within 30 days. Referring to item no. 3 of the table appended to that notice, it has been pointed out, the Assessing Authority had at that stage itself chosen to not give any opportunity of hearing to the petitioner by mentioning “NA” against column description “Date of personal hearing”. Similar endorsements were made against the columns for “Time of personal hearing” and “Venue where personal hearing will be held”. Thus, it is the objection of learned counsel for the petitioner, the petitioner was completely denied opportunity of oral hearing before the Assessing Authority

Observation & Judgement of the Court:

Even otherwise in the context of an assessment order creating heavy civil liability, observing such minimal opportunity of hearing is a must. Principle of natural justice would commend to this Court to bind the authorities to always ensure to provide such opportunity of hearing. It has to be ensured that such opportunity is granted in real terms. Here, we note, the impugned order itself has been passed on 06.12.2022. The stand of the assessee may remain unclear unless minimal opportunity of hearing is first granted. Only thereafter, the explanation furnished may be rejected and demand created.

Not only such opportunity would ensure observance of rules of natural of justice but it would allow the authority to pass appropriate and reasoned order as may serve the interest of justice and allow a better appreciation to arise at the next/appeal stage, if required.

Accordingly, the present writ petition is allowed. The impugned order dated 06.12.2022 is set aside. The matter is remitted to the respondent no.2/Deputy Commissioner, State Tax, Sector-1, Raebareli to issue a fresh notice to the petitioner within a period of two weeks from today. The petitioner undertakes to appear before that authority on the next date fixed such that proceedings may be concluded, as expeditiously as possible.

comment:

The opportunity of being heard is required to be provided to every taxpayer. But in this case the appellant has chosen.

Read & Download the Full M/S Brijesh Kumar Singh V/s State Of U.P

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.