Order rejecting the GST refund for amount not paid by client on account of insolvency set aside.

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

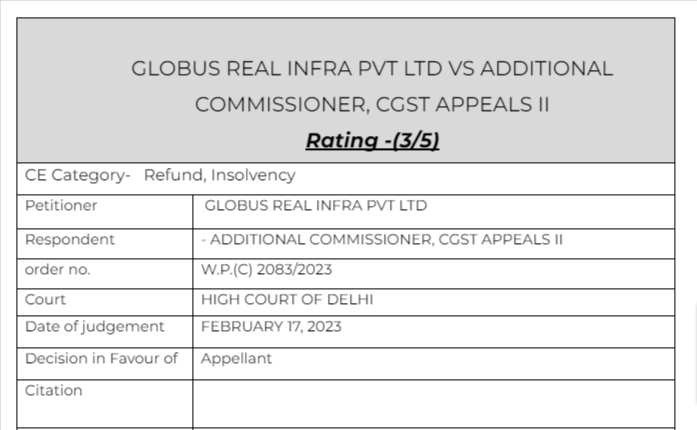

GLOBUS REAL INFRA PVT LTD VS ADDITIONAL COMMISSIONER, CGST APPEALS II

Facts of the cases:

On 18.11.2020, the petitioner filed a Refund Application under Section 54 of the CGST Act (ARN No. AA07112009694H) before the Assistant Commissioner, Central Goods and Services Tax, Commissionerate, South Delhi (hereafter ‘the Adjudicating Authority’) seeking refund of GST paid on lease rentals “on account of assessment/provisional assessment/appeal/any other order” for the period of 01.07.2017 to 30.07.2018.

The key question to be addressed is whether the petitioner was liable to pay GST in respect of the lease of the property in view of the resolution plan terminating all agreements/arrangements between BSL and other related parties. Clause 10.1.6 of the resolution plan is relevant and set out below:

Observation & Judgement of the Court:

There is no dispute that the resolution plan was sanctioned by the National Company Law Tribunal and is binding. It is the petitioner’s contention that, in terms of the sanctioned plan, the ‘Memorandum of Agreement for Lease’ dated 01.04.2015 was terminated without any liability on the part of BSL to pay or make any payment.

In the circumstances, we consider it apposite to set aside the impugned order and remand the matter to the Appellate Authority to consider the aforesaid contention and pass a speaking order after affording the petitioner a reasonable opportunity to be heard.

Read & Download the Full GLOBUS REAL INFRA PVT LTD VS ADDITIONAL COMMISSIONER, CGST APPEALS II

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.