Original copy of GST AAAR of M/s Kundan Misthan Bhandar

Original copy of GST AAAR of M/s Kundan Misthan Bhandar:

Original copy of GST AAAR of M/s Kundan Misthan Bhandar observed by Uttarakhand APPELLATE AUTHORITY FOR ADVANCE RULING.Analysis of its observation is provided in our article.

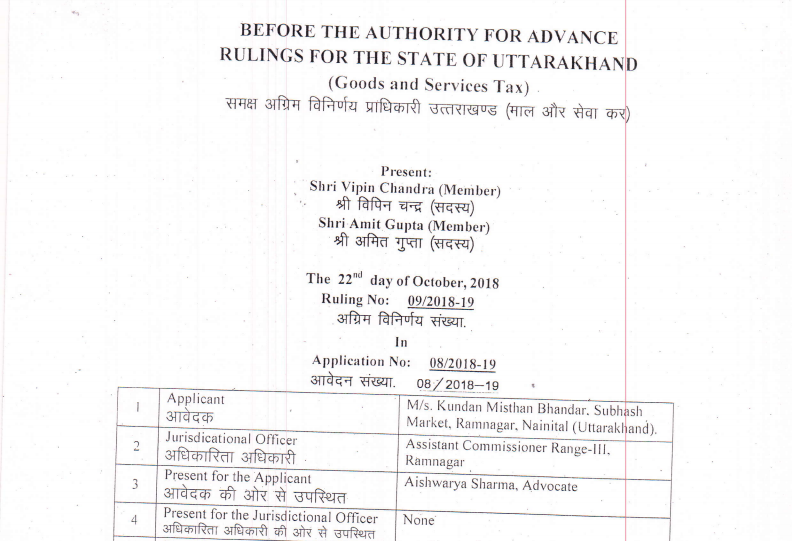

IN RE: M/S. KUNDAN MISTHAN BHANDAR

AAR Ruling No. 09/2018-19 in Application No. 08/2018-19

Dated: – 22 October 2018

Judgment / Order

SHRI VIPIN CHANDRA AND SHRI AMIT GUPTA MEMBER

Present for the Applicant: Shri Aishwarya Sharma, Advocate

Present for the Concerned Officer: None

RULING

Under Section 100(1) of the Uttarakhand Goods and Services Act, 2017, an appeal against this ruling lies before the appellate authority for advance ruling constituted under Section 99 of the Uttarakhand Goods and Services Tax Act, 2017, within a period of 30 days from the date of service of this order.

1. This is an application under Sub-Section (1) of Section 97 of the CGST/SGST Act, 2017 (herein after referred to as Act) and the rules made thereunder filed by M/s. Kundan Misthan Bhandar, Subhash Market, Ramnagar (Nainital) Uttarakhand, primarily engaged in the business of supplying goods & services both and seeks an advance ruling on the question, details of which given below as:

(a) whether supply of pure food items such as sweetmeats, namkeens, cold drink and other edible items from sweetshop which also runs a restaurant is a transaction of supply of goods or a supply of service;

(b) what is the nature and rate of tax applicable to the following items supplied from ground floor of a sweetshop in which restaurant is also located on the first floor and whether the applicant is entitled to claim benefit of input tax credit with respect to the same:

(i) Sweetmeats, namkeens, Dhokla etc commonly known as snacks, cold drinks, ice creams and other edible items;

(ii) Ready to eat (partially or fully pre-cooked/ packed) items supplied from live counters such as jalebi, chola bhatura and other edible items;

(iii) Takeaway order of sweetmeats or namkeens by a person sitting in the restaurant of a sweetshop when such products are not consumed within the premises of the applicant but are takeaway.

2. Advance Ruling under GST means a decision provided by the authority or the appellate authority to an applicant on matters or on questions specified in sub section (2) of section 97 or sub section (1) of section 100 in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant.

3. In the present case applicant has sought advance ruling whether the activity of the applicant is supply of goods or supply of services, nature & rate of tax on items and input tax credit. Therefore, in terms of said Section 97 (2) (d), (e) & (g) of Act, the present application is hereby admitted for the questions supra in terms of Section 97 (2) of Act. The provisions of said section are reproduced below:

(2) The question on which the advance ruling is sought under this Act, shall be in respect of,–– (a) classification of any goods or services or both;

(b) applicability of a notification issued under the provisions of this Act;

(c) determination of time and value of supply of goods or services or both;

(d) admissibility of input tax credit of tax paid or deemed to have been paid; (e) determination of the liability to pay tax on any goods or services or both; (f) whether applicant is required to be registered;

(g) whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term.

4. Accordingly opportunity of personal hearing was granted to the applicant on 05.09.2018. Shri Aishwarya Sharma (Advocate) appeared for personal hearing on 05.09.2018 and submitted documents describing therein exact nature of work being undertaken. Nobody appeared from the side of Revenue for the hearing.

5. In the present application, applicant has requested for advance ruling on different issues which are now discuss as under:

5.1 Whether supply of pure food items such as sweetmeats, namkeens, cold drink and other edible items from a sweetshop which also runs a restaurant is a transaction of supply of goods or a supply of service:

A. Before coming to any conclusion, first we have to go through the relevant provisions of law and the same are covered under section 2 of the Act ibid. The relevant portion of the same extracted an read as under:

(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business one of which is a principal supply;

(52) “goods” means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply;

(74) “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply;

(90) “principal supply” means the supply of goods or services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary;

(102) “services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged;

B. On going through the submissions made by the applicant we find that applicant has a sweetshop in the ground floor and a restaurant in the first floor of the same building. We observe that if we look at the market strategy today, we will notice very often, two or more goods, or a combination of goods and services, are supplied together. This could be due to either of the following reasons:

(i) A sales strategy – to attract more customers

(ii) The nature or type of goods or services, which requires them to be bundled or supplied together

Under Service Tax, this mechanism is called Bundled Service – which is the rendering of a service or services with another element of service of services. The service tax law was dealing with pure services and not with goods per se. Now the concept introduced is for goods also and is linked with the concept of Principal Supply. Under GST law, supplies which are bundled with two or more supplies of goods or services or combination of goods and services are classified, with distinct characteristics, as:

(i) Composite Supply

(ii) Mixed Supply

If we look at the definitions (supra), Composite supply is one where two or more goods or services or both are supplied together, in a natural bundle and in a normal course of business, provided one of which is a principal supply. However, principal supply will be that supply which is predominant over other supplies. This means that the goods and services are bundled owing to natural necessities. The composite supply is taxed at the rate applicable to the principal supply whereas a Mixed supply means two or more individual supplies of goods or service, or any combination thereof; made in conjunction with each other by taxable person for a single price where such supply does not constitute a composite supply. It means each of these items can be supplied separately and is not dependent on any other. In Mixed Supply, the combination of goods, and/or services is not bundled due to natural necessities, and they can be supplied individually in the ordinary course of business.

In order to identify if the particular supply is a Mixed Supply, the first requisite is to rule out that the supply is a composite supply. A supply can be a mixed supply only if it is not a composite supply, As a corollary it can be said that if the transaction consists of supplies not naturally bundled in the ordinary course of business then it would be a Mixed Supply. Once the amenability of the transaction as a composite supply is ruled out, it would be a mixed supply, classified in terms of a supply of goods or services attracting highest rate of tax.

C. From the discussion supra and submission made by the applicant we find that in the case of sweet shop cum restaurant, the services from the restaurant is a principle supply which provides a bundled supply of preparation & sale of food and serving the same and therefore it constitutes a composite supply. It further satisfied the following conditions of a composite supply:

(i) Supply of two or more goods or services or both together

(ii) Goods or services or both are usually provided together in the normal course of business.

Download the GST AAAR of M/s Kundan Misthan Bhandar by clicking the below image:

In the instant case the nature of restaurant services is such that it may be treated as the main supply and the other supplies combined with such main supply are in the nature of incidental or ancillary services. Thus restaurant services get the character of predominant supply over other supplies. Therefore in the present case the supply shall be treated as supply of service and the sweet shop shall be treated as extension of the restaurant in as much as the said activity cove ed under Schedule II of the Act ibid and the relevant portion of the same read as under:

SCHEDULE II

[See section 7]

ACTIVITIES TO BE TREATED AS SUPPLY OF GOODS OR SUPPLY OF SERVICES

6. Composite supply

The following composite supplies shall be treated as a supply of services, namely:-

(a) …………………………….

(b) supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration.

5.2 Now we come to issue of applicability of GST rate. Since we already held above that the activity of the applicant come under the purview of “restaurant services”, the same falls under Heading 9963 of GST rates on services under Notification No. 11/2017-Central Rate (Tax) dated 28.06.2017 (as amended time to time) and the relevant port on of the same is reproduce as under:

| Sl.No. | Chapter, Section, heading | Description of service | Rate (in%) | Condition |

| 1 | 2 | 3 | 4 | 5 |

| 7 |

Heading |

Supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or drink, where such supply or service is for cash, deferred payment or other valuable consideration, provided by a restaurant, eating joint including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied, other than those located in the premises of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes having declared tariff of any unit of accommodation of seven thousand five hundred rupees and above per unit per day or equivalent.

Explanation.- “declared tariff” includes charges for all amenities provided in the unit of accommodation (given on rent for stay) like furniture, air conditioner, refrigerators or any other amenities, but without excluding any discount offered on the published charges for such unit. |

2.5% | Provided that credit of input tax charged on goods and services used in supplying the service has not been taken |

Thus the rate of GST on aforesaid activity shall be 5% as on date. As regard to the issue of admissibility of ITC credit, we find that the applicant cannot avail credit on the GST paid on the goods and services used in their Said activity in terms of aforesaid notification.

6. In view of the above, we order as under:

(i) The supply shall be treated as supply of service and sweet shop shall be treated as extension of restaurant;

(ii) The rate of GST on aforesaid activity will be 5% as on date, on the condition that credit of input tax charged on goods and services used in supplying the said service has not been taken;

(iii) All the items including takeaway items from the said premises shall attract GST of 5% as on date subject to the condition of non availment of credit of input tax charged on goods and services used in supplying the said service.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.