Original Copy of GST AAR of M/s Toshniwal Brothers (SR) Private Limited

Original Copy of GST AAR of M/s Toshniwal Brothers (SR) Private Limited

In the GST AAR of M/s Toshniwal Brothers (SR) Private Limited. The Applicant has raised the three questions regarding the intermediary services, composite supply, and export.

ORDER UNDER SUB-SECTION (4) OF SECTION 98 OF CENTRAL GOODS AND SERVICE TAX ACT, 2017 AND UNDER SUB-SECTION (4) OF SECTION 98 OF KARNATAKA GOODS AND SERVICES TAX ACT, 2017

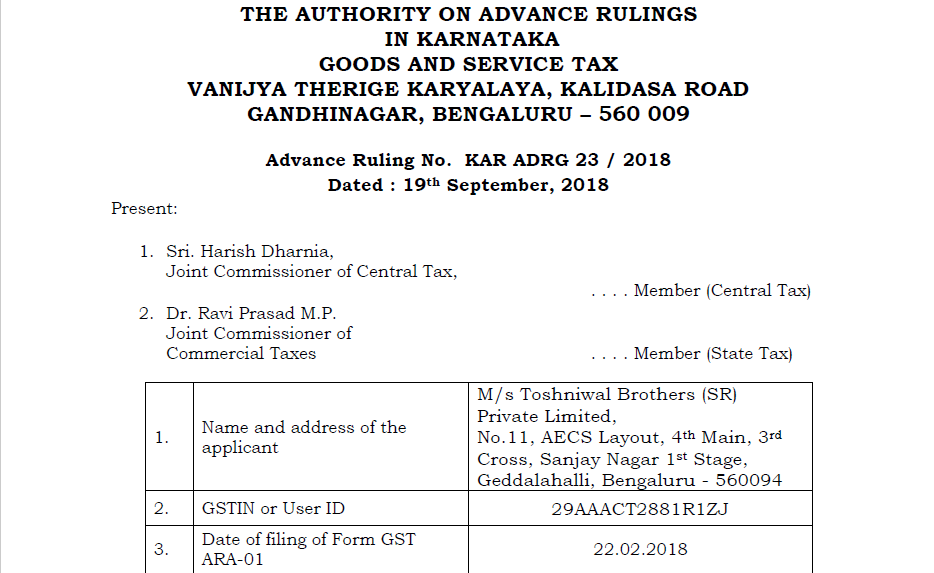

1. M/s Toshniwal Brothers (SR) Private Limited, (called as the „Applicant‟ hereinafter), No.11, AECS Layout, 4th Main, 3rd Cross, Sanjay Nagar 1st Stage, Geddalahalli, Bengaluru – 560094, having GSTIN number 29AAACT2881R1ZJ, has filed an application for Advance Ruling under Section 97 of CGST Act,2017, KGST Act, 2017 & IGST Act, 2017 read with Rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01 discharging the fee of Rs.5,000-00 each under the CGST Act and the KGST Act.

2. The Applicant is a Private Limited Company and is registered under the Goods and Services Act, 2017. The applicant has sought advance ruling in respect of the following questions:

a) Whether pure and mere promotion and marketing services will be “intermediary services” for the purposes of section 12 of the Integrated Goods and Services Tax Act, 2017 for determining the place of supply of such services?

b) If after sale support services are also provided under a composite contract, would it then be composite supply? What will be the principal supply for such contracts?

c) Whether the above contracts would qualify as exports if the client is overseas entity, in terms of clause (6) of section 2 of the Integrated Goods and Services Tax Act, 2017 and will be a zero-rated supplt as provided in section 16 of IGST Act, 2017? 3. The applicant furnishes some facts relevant to the stated activity:

Download the Original Copy of GST AAR of M/s Toshniwal Brothers (SR) Private Limited. By clicking the below image:

3. The applicant states that he is a supplier of services to overseas clients and is engaged in the business of promotion and marketing and after sale support services as a composite supply. He has entered into an agreement with their customers (Service Recipients), who are located outside India (which is a non-taxable territory in terms of clause (79) of section 2 of the CGST Act, 2017) for providing marketing, sales promotion and certain post-sales support services. Consideration for these services would be received in convertible foreign exchange. The said services are provided in respect of scientific instruments used in research and development / quality control primarily in fields of Nano Science, Material Science, Bio Pharma and Polymer Sciences.

4. The applicant provides the details of the service areas and are as follows:

a. Promotion and marketing of the products of the Service Recipients in India:

The applicant would solicit orders for the goods of the overseas customer in India by marketing and promoting the goods in India. The orders for the products would be placed directly by the prospective customers on the overseas entity. The applicant is not engaged in trading of such goods, either on his own account or on the account of the overseas client. The promotion and marketing of the products included the following activities:

i. Applicant would advertise the details of the goods to the prospective customers;

ii. Demonstration of the products to the various prospective customers located in India;

iii. Communicate and correspond about all the relevant information to the prospective customers in connection with the goods;

iv. Communication to the overseas clients about comments and queries of the prospective customers; and

v. Review the credit rating of the prospective customers of the overseas entity on regular basis;

b. After sale support services

On the basis of the order issued by the prospective customer to the overseas entity, the overseas entity supplies the products to their customer in India. The applicant shall provide the following support services:

i. Advice and assist the customers of the overseas entity in installation, initial start-up of products and demonstration of its satisfactory operation to such customers;

ii. For few product lines, provide complete installation services to the customers of the overseas entity along with necessary advisory and assistance to the customers of the overseas entity in initial start up of the products and demonstration of its satisfactory operation to such customers;

iii. Assistance in operation adjustments, on site services and general customer assistance including warranty services;

c. Submission of Reports

The Applicant shall prepare and submit regular reports within agreed time on its activities to promote and solicit orders for the products in India, to the overseas entity. These business reports would normally include:

i. Short and medium-term forecasts detailing prospective customer‟s name, order value, anticipated placement and expected delivery dates and long-term project and prospect lists;

ii. Results of regular observation of marketing conditions, information in the public domain relating to the activities of competitors; and

iii. Results of participation in trade fairs.

5. The assessee has submitted that intermediary means a person who arranges or facilitates the supply of goods or services or both, between two or more persons, but does not include a person who supplies such goods or services or both on his own account. In this regard, the following are to be considered:

a. Services provided by the applicant to overseas entity (service recipients) is on principal-to-principal basis;

b. Applicant is providing services to service recipients and not on behalf of the service recipients to any other person, say, the prospective customers in India;

c. Service recipients would be dealing with Indian customers directly and the applicant is not authorised to enter into any contract or arrangement on behalf of the service recipients;

d. Applicant is not securing any order from the customer in India, but the order would be placed directly by the customer on the Service recipients;

e. Service recipients would directly sell the products to the customers located in India;

f. The customer would import the goods, file the bill of entry and pay the applicable customs duty and GST;

g. Applicant is not engaged in arranging or facilitating the supply of goods, but is engaged for promoting and marketing the goods of the overseas entity in India;

h. The services provided to the service recipients are provided by the applicant on his own account.

In light of the above, the applicant submits that in his view the activity undertaken by him by way of promotion and marketing services is not intermediary services. The applicant refers to the Advance Ruling pronounced by the Authority on Advance Rulings under the Service Tax provisions in the case of GoDaddy India Web Services (P.) Ltd (Ruling No. AAR/ST/08/2016, Application No. AAR/44/ST/15/2014) wherein the Authority had clearly demarcated the meaning of intermediary services and ruled that pure marketing and promotion services would not be intermediary services.

6. The applicant submits that in the aforesaid Advance Ruling, it is stated as under:

“The definition of „intermediary‟ as envisaged under Rule 2 (f) of POPS doesnot include a person who provides the main service on his own account. In the present case, applicant is providing main service i.e. “business support services” to WWD US and on his own account. Therefore, applicant is not an “intermediary” and the service provided by him is not intermediary service. Further, during arguments, applicant drew our attention to one of the illustration given under paragraph 5.9.6 of the Education Guide, 2012 issued by CBEC. Relevant portion is extracted as under:

Similarly, persons such as call centres, who provide services to their clients by dealing with the customers of the client on the client‟s behalf, but actually provided these services on their own account, will not be categorized as intermediaries.

Applicant relying on above paragraph submitted that all call centres, by dealing with customers of their clients, on client‟s behalf, are providing service to their client on their own account. Similarly, applicant is providing business support service such as marketing and other allied services like oversight of quality of third party customer care centre operated in India and payment processing services, on behalf of GoDaddy US. Therefore,these services provided by the applicant to GoDaddy US cannot be categorized as intermediary or services, as intermediary services.”

The applicant submits that the facts and surrounding circumstances of the said case and the applicant‟s business are same and wholly comparable and thus, the ratio of the said Ruling should be squarely applicable to the applicant‟s case.

7. The applicant submitted that clause (30) of section 2 of the CGST Act, 2017, provides the meaning of composite supply which reads as under:

“Composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.”

In this case where after-sale support services are also provided along with the promotion and marketing services under a composite contract, it will be in the nature of composite supply because of the following reasons:

(i) Two taxable supplies of services is being made under a single service agreement;

(ii) There is a single price for both the services;

(iii) The different elements of the services are not available separately;

(iv) The different elements are integral to one overall supply – if one or more is removed, the nature of supply would be affected;

(v) These services are naturally bundled and supplied in conjunction with each other in the ordinary course of business;

(vi) These services are naturally bundled because:

a. After sale support services can be provided only when product is sold to the customer;

b. Customer would place order to the service recipients on the basis of promotion and marketing services provided by the applicant;

c. Post purchase, customer would be able to use the products only when after-sale support services are provided;

d. Since all these activities are inter-linked with each other, it is naturally bundled in the ordinary course of business.

8. The applicant submits where after-sale support services are also provided along with promotion and marketing services and being a composite supply, one should be the principal supply. The applicant submits that the principal supply would be the promotion and marketing services because of the following reasons:

a. Marketing activities is the first step in the complete process;

b. After-sale support services can be given only once the product is sold;

c. Customer will place order to the service recipients on the basis of promotion and marketing services provided by the applicant – it is only after the products are sold that after-sale services arises;

d. The supply of the product by the overseas entity to the customer in India embeds within itself, the provision of after-sale support;

e. Marketing determines the very sale of the product and as a complete offering, post-sales support is ancillary and incidental to the sale;

f. The essential characteristic of the services provided by the applicant are marketing, sales promotion and brand building; co-ordination and providing all other support once the product is sold are by-products of the sale of the product;

g. In terms of service agreement, promotion and marketing services is the predominant component while installation and warranty services are ancillary to such promotion and marketing services.

9. The applicant submits that the clause (6) of section 2 of the IGST Act defines the meaning of “export of services” which reads as under:

“Export of services” means the supply of any service when, –

(i) The supplier of service in located in India;

(ii) The recipient of service is located outside India;

(iii) The place of supply of service is outside India;

(iv) The payment for such service has been received by the supplier of service in convertible foreign exchange; and

(v) The supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 of section 8 of IGST Act.”

The applicant submits that recipient has been defined in clause (93) of section 2 of the CGST Act, 2017, which reads as under:

“Recipient” of supply of goods or services or both means –

(a) Where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) Where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) Where no consideration is payable for the supply of services, the person to whom the service is rendered,

And any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied.”

In the present case, the consideration is payable for the supply of such services and the overseas entity is liable to pay that consideration for both promotion and marketing services and after-sale support services. So the recipient of both the services will be the overseas entity, which is located outside India.

10. The applicant submits that the place of supply shall be determined as provided in section 13 of the IGST Act, 2017 because the location of the supplier is in India and the location of the recipient is outside India.

The applicant submits that as explained in the earlier paragraphs, services provided by him is not intermediary services and hence the place of supply shall not be determined by section 13(8) of IGST Act, 2017 but in terms of section 13(2) of IGST Act, 2017, which is general clause.

As per section 13(2) of IGST Act, 2017, the place of supply of services shall be the location of the recipient of services and since the location of the recipient of services is a place outside India, the place of supply for promotion and marketing services would be the place outside India.

11. The applicant submits that the services as a whole, would be the export of services provided in clause (6) of section 2 of the IGST Act because:

(a) The supplier of services, i.e. the applicant, is located in India;

(b) The recipient of services, i.e. the overseas entity, is located outside India;

(c) The place of supply of service is outside India

(d) The payment of such service would be received by the supplier of services in convertible foreign exchange; and

(e) The supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8 of IGST Act, 2017.

Thus the supply of said services is “export of services” and consequently will become a zero-rated supply as provided in section 16 of IGST Act, 2017.

12. The applicant has made additional submissions and the same as under

12.1 The activities of the applicant are limited to functioning as an agent of the overseas principals and the applicant does not and is not engaged in the business of buying and selling of the products. In this regard, the following are important to note:

(a) Majority of the customers are research institutes or R&D centres. Under the Customs Law, they are eligible for exemptions / concessions with respect to custom duties on import of goods. Accordingly, they would always directly import the said goods and would not procure (such imported goods) from any supplier in India (who has imported the same earlier). Such a proposition would disentitle them from availing the customs duty exemptions or concessions.

(b) The activities of the applicant is always limited to functioning as an agent promoting the goods od the overseas principals. This is evident from:

a. The fact that the order for such goods are placed by the companies or institutes etc. in India directly on the overseas suppliers;

b. The bill of entry at the time of import is filed by such companies or institutes and the payment is also made directly by such importersto the overseas suppliers and it is not routed through the applicant;

c. Such importers are always the owners of the equipment at all times; the applicant never holds ownership or title to such equipment in any circumstances.

13. The applicant also submitted that as a practice in the industry, the marketing services and the post-sale support (installation and warranty support) are normally undertaken as a bundle of services. The principals, i.e. overseas clients do not have any presence in India and the applicant is the sole representative in the Indian territory for the contracted products.

13.1 On the question as to why in certain cases, only marketing services are undertaken and the post-sale support services are not provided, the applicant submitted that the equipment that are manufactured by the applicant‟s principals and marketed by him in India are specialized equipment. Most of the equipment would need installation support. The applicant confirms in all such cases, he is the one providing the same and nevertheless, there could be certain equipment:

- Which do not need any installation: they are typically in the nature of plug and play;

- Which are installed more appropriately termed as „configured‟ remotely through computer or online networks or which requires specialized knowledge, in which cases, the same are undertaken by the manufacturers themselves;

In such cases, the applicant states that the question of providing any installation support does not arise;

14. The applicant also refers to the e-Flyers published by the CBIT on 15.03.2018 on Composite supplies wherein they have given a list of certain indicators for determining when a bundle of supplies should be treated as naturally bundled in the ordinary course of business and consequently as „composite supplies‟. The extract relevant are as under:

“Whether the services are bundled in the ordinary course of business would depend upon the normal or frequent practices followed in the area of business to which services relate. Such normal and frequent practices adopted in a business can be ascertained from several indicators, some of which are listed below:

- The perception of the consumer or the service receiver – If large numner of service receivers of such bundle of services reasonably expect such services to be provided as a package, then such a package could be treated as naturally bundled in the ordinary course of business

- Majority of service providers in a particular area of business provide similar bundle of services

- The nature of the various services in a bundle of services will also help in determining whether the services are bundled in the ordinary course of business. If the nature of services in such that one of the services is the main service and the other services combined with such service are in the nature of incidental or ancillary services which help in better enjoyment of a main service

- Other illustrative indicators, not determinative but indicative of bundling of services in ordinary course of business are –

o There is a single price or the customer pays the same amount, no matter how much of the package they actually receive or use;

o The elements are normally advertised as a package;

o The different elements are not available separately;

o The different elements are integral to one overall supply – if one or more is removed, the nature of the supply would be affected.”

The applicant submits that above analogy further substantiates the submissions earlier made and squarely applies to the present case and claims that the combination of pre-sales and installation support is a naturally bundled supply in the ordinary course of business and consequently qualifies as „composite supply‟.

15. Regarding the import of spares by the applicant, he submits that the applicant enters into agreements with the companies or institutes in India (customers) for maintenance of such equipments. This is dehors of and disconnected from the marketing activities that the applicant undertakes. The maintenance of such machinery or equipment is another business activity undertaken by the applicant if desired by the importers and the privity of such contract is only between the applicant and the owners of such equipment.

15.1 The maintenance of such machinery / equipment could involve replacement of spares, if need be. In this regard, the same being specialized equipment, the spares also would have to be procured from the suppliers of equipment itself. It is in this context, that the agreement with the principals contains clauses with respect to discount that would be offered for purchase of spares from them. The applicant reiterates that the import of spares is not in connection with the marketing activities.

16. FINDINGS & DISCUSSION:

16.1 The applicant has provided a copy of the agency contract and the following are noted from the contract:

(a) In clause II relating to the Duties of the Agent, in paragraph 1, the applicant is referred to as “Agent” – shall be act as “intermediary” on behalf of principal in negotiating business transactions with prospective customers in his territory, but the applicant shall not be entitled to conclude contracts on behalf of the principal. It is also seen that the applicant acting as an “Agent” shall take care of the interests of the principal and regularly visit the customers and prospective customers in his territory. Further, in the Clause III – relating to the “Duties of the Principal” – it is clearly stated that the Principal shall be free to conclude or to refuse the conclusion of a contract negotiated by the Agent and it is binding on the Principal to inform the applicant who is acting as “Agent” on acceptance, rejection, non-performance or different performance of a contract and shall state the decisive reasons underlying his decision, unless prejudicial to his own essential interests.

16.2 In Clause IV of the agreement relating to the Agent‟s right to a Commission, it is clearly stated as under:

“On all contracts for the sale of goods which the Principal enters into with customers residing in the Agent‟s territory, the Agent shall receive a commission of 12% on the value of goods as far as sales contracts are concerned that have been negotiated by the Agent and a commission of 6% for all other sale contracts.”

In Clause VI of the contract, it is seen that the commission is calculated on the basis of the amount invoiced for the business transaction, free of VAT and rebates are deductible. Additional costs such as freight, cartage, packing insurance, custom duties, and all other charges and dues, costs for installation, expenses resulting from putting into operation and similar services which are essentially work and labour shall be deducted, even if they are not invoiced separately, shall also be deducted. It is also stated in the contract, where the agent orders goods from the principal at his own expense, the commission due can be deducted directly from the value of goods. Further, it is also stated that any expenses and spendings of the Agent resulting from his activities (regardless of whether they arise generally or in connection with a particular business transaction) shall be regarded as covered by commission that the Agent is entitled to, and such expenses excludes travelling expenses. It is also stated that for spare parts, the commission would be paid for values equal or superior to € 250 and repairs are not subject to commission.

In sub-clause 6 of Clause IV, it is seen that the consideration is payable for the services which include pre-sales, marketing, sales, installation and warranty period services and the commission payable is for the complete bundle of services. The agreement quotes the principal as declaring to the agent as under

“From our experience for business in your territory it would be commensurate to allocate 25% of total commission earned in each fill system case to address installation and warranty period services which are provided by your company on our behalf to the end customers”.

All the above show that the applicant has been offered commission on the amount of goods sold and this is the method adopted for calculating the consideration.

16.3 Further, on the question as to whether the services provided by the applicant is an intermediary service or not, Sub-section (13) of section 2 of the IGST Act, 2017 defines an “intermediary” as under:

“(13) “intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account.”

The agreement copy provided by the applicant shows clearly that the price is negotiated by the applicant for the machinery or equipments and intimated to the overseas supplier. It is also seen that the Principal who is the overseas supplier reserves the right to conclude or reject or change the contract, but he shall inform the decisive reasons to the applicant. Also the commission payable to the applicant is tied to the amount of sales that the applicant solicits and is typically an agency transaction. Even the agreement entered by the applicant with the Principal, call the applicant an agent and since he is facilitating the supply of goods between the overseas supplier who is the principal, and the customer, by soliciting the customers and also by negotiating the prices, terms etc., the predominant nature of the transaction is of “intermediary” nature.

16.4 Further, on the question of whether the contract is a composite supply or not is to be seen from the nature of the contract. When the applicant solicits the prospective purchaser, he is not aware of whether the transaction would ultimately result in a supply of goods. The terms of the contract also makes it very clear that the amount of consideration towards after-sale services and warranty services would not cross 25% of the value and hence there is an element of classification of the value of marketing “intermediary” services and the “after-sale and warranty services”. The incidence of after-sale and warranty services is contingent upon the successful supply of materials and is not contingent upon the marketing “intermediary” services provided by the applicant to the principal and hence cannot be called as a naturally bundled services. Hence this does not amount to a composite supply and the same are treated as two supplies independent of each other and the valuation of each has to be computed as per Section 15 of the Central Goods and Services Tax Act. Both these independent supplies are only linked to the supply of goods from the ultimate supplier to the consumer and till that happens the transaction of after-sales supplies do not come into existence at all. But the supply of services in the form of intermediary services is related to the supply of goods, as no consideration flows to the applicant without a supply being effected by the Principal and hence it is tightly bound to supply of goods to the Principal.

16.5 The question relating to the whether the above contracts would amount to export of services has to be decided on the basis of the place of supply applicable to each of the transaction. This Authority is not competent to decide on this issue of determination of place of supply and hence does not answer this question.

RULING

1. The contract of services supplied are not pure and mere promotion and marketing services and the services provided is of the nature of facilitating the supply of goods, and hence would amount to “intermediary services” for the reasons enumerated in the aforesaid paragraphs for the purposes of determination of place of supply of such services.

2. The after-sale services provided are not in the nature of a composite contract and they are independent from the services provided in paragraph 1 above and hence there is no question of determination of what will the principal supply.

3. The third question cannot be answered as it is not in the purview of jurisdiction of this Authority as it amounts to determination of the place of supply.

Source: GST Karnataka.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.