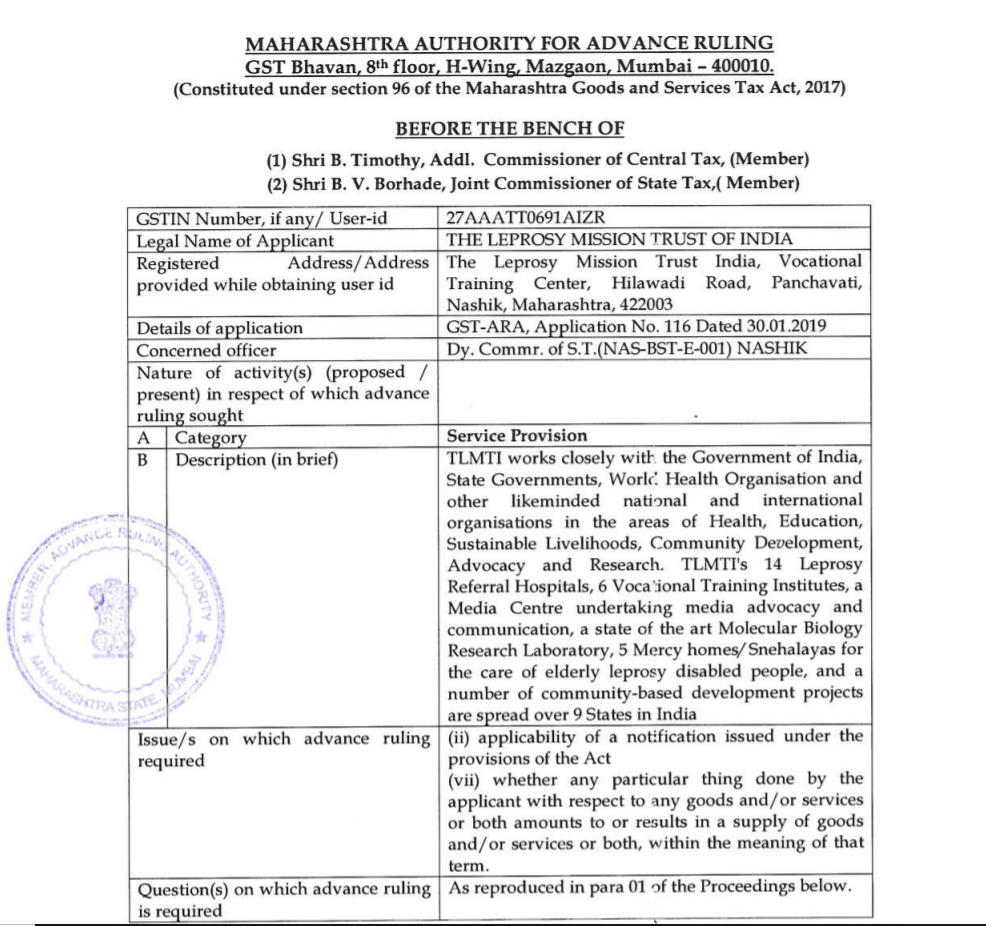

Original copy of GST AAR of The Leprosy Mission Trust of India

In the GST AAR of The Leprosy Mission Trust of India, the applicant has raised the query regarding the vocational training courses provided by them is exempted or not. Following is the GST AAR of The Leprosy Mission Trust of India:

Order:

The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act”] by THE LEPROSY MISSION TRUST OF INDIA, the applicant, seeking an advance ruling in respect of the following question.

Whether services provided under vocational training courses recognized by National Council for Vocational Training (NCVT) or Jan Shikshan Sansthan (JSS) is exempt either under Entry No 64 of exemption list of Goods and Service Tax Act 2017 or under Educational Institution defined under Notification 22/Central Tax (Rate)?

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to any dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, the expression ‘GST Act’ would mean CGST Act and MGST Act.

02 FACTS AND CONTENTION – AS PER THE APPLICANT

The submissions, as reproduced verbatim, could be seen thus-

i. The Society, The Leprosy Mission Trust India (TLMTI), is registered under Section 12 A of the Income Tax Act 1961. The income of the Society is exempt u/s 11 of the Income Tax Act, 1961.

ii. TLMTI, established in the year 1973, is the largest Non-Governmental Organization (NGO) in India working with and for people affected by leprosy. TLMTI works closely with the Government of India, State Governments, World Health Organisation and other like-minded national and international organizations in the areas of Health, Education, Sustainable Livelihoods, Community Development, Advocacy, and Research. TLMTI’s 14 Leprosy Referral Hospitals, 6 Vocational Training Institutes, a Metlia Centre undertaking media advocacy and communication, a state of the art Jigs’ Biology Research Laboratory, 5 Mercy homes/ Snehalayas for the care of elderly leprosy disabled people, and a number of community-based development projects are spread over 9 states in India. Activities of the Society are charitable in ea nature & within the meaning of Sec. 2(15) of the Income Tax Act, 1961 undertaking Medical Relief, Relief of Poor and Education,

iii. All the twenty-two branches of The Leprosy Mission Trust India are registered under the Goods and Service Tax Act 2017.

iv. The Leprosy Mission Trust of India provides following Vocational Training Courses at Nashik.

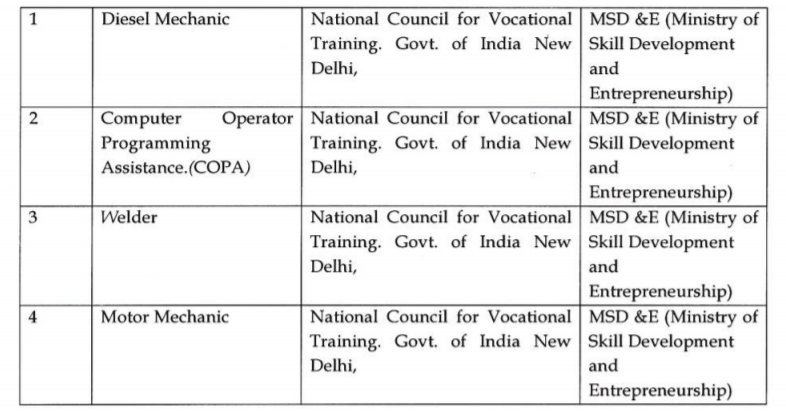

- Vocational Training Courses recognized under National Council for Vocational Training (NCVT) such as Diesel Mechanic, COPA, Welder and Motor Mechanic

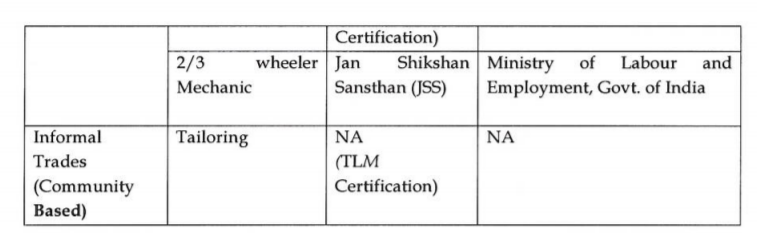

- Vocational Training Courses recognized under Jan Shikshan Sansthan (Ministry of HRD) – 2/3 wheeler Mechanic Trade

- informal trades with TLM Certification such as Offset Printing, Electrician and Tailoring

3.3 Statement containing the applicant’s interpretation of law and/or facts, as the case may be, in respect of the aforesaid question(s) (i.e. applicant’s viewpoint and submissions on issues on which the advance ruling is sought). (ref. Sl. No. 16 of GST ARA-01)

i. According to Notification 22 of Central Tax (Rate) dated 28th June 2017 Educational institution is defined as

“educational institution” means an institution providing services by way of,- (i) pre-school ‘ education and education up to higher secondary school or equivalent; (ii) education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force; (iii) education as a part of an approved vocational education course.

The Applicant Society falls under Clause (iii) as an institution providing education services,

According to Notification 22 of Central Tax (Rate) approved vocational training is defined as :

“approved vocational education course” means, – (i) a course run by an industrial training institute or an industrial training centre affiliated to the National Council for Vocational Training or State Council for Vocational Training offering courses in designated trades notified under the Apprentices Act, 1961 (52 of 1961); or (ii) a Modular Employable Skill Course, approved by the National Council of Vocational Training, run by a person registered with the Directorate General of Training, Ministry of Skill Development and Entrepreneurship.

According to Entry 64 of Exemption List under Goods and Service Tax; 2017

Services provided by training providers (Project implementation agencies) under Deen Dayal Upadhyaya Grameen Kaushalya Yojana implemented by the Ministry of Rural Development, Government of India by way of offering a skill or vocational training courses certified by the National Council for Vocational Training are exempt. Applicant Society also provides courses approved by National Council for Vocational Training.

In view of the above, we seek your ruling whether vocational training courses (under NCVT, JSS, and Others) conducted by The Leprosy Mission Trust of India, Vocational Training Centre, Nashik, as listed in Annexure 1 are exempt under either educational service or vide entry 64 of Exemption list.

3.4 Additional submission on 03.04.2019

1) The Leprosy Mission was founded in 1874 as ‘The Mission to Lepers’ in Ambala, India, Subsequently in 1973, The Leprosy Mission Trust India (hereinafter referred to as applicant society trust) was registered as a Society under the Societies Registration Act of 1860. TLMTI is the largest leprosy-focused non-governmental organization in India and is headquartered in New Delhi, India and works with people affected by leprosy and other neglected tropical diseases (NTDs), people with disabilities, and marginalized communities, especially women. TLMTI has a diverse set of programmes – Healthcare, Sustainable Livelihood, Community Empowerment, Advocacy, and Research and Training, implemented through 14 hospitals, and two clinics, six vocational training centers, five residential care homes for elderly persons affected by leprosy, community empowerment projects, and a research laboratory, spread across 10 states of India.

2) The applicant society trust is also registered under Section 12AA of the Income Tax Act, 1961. The activities of the social trust are charitable in nature within the meaning of section 2(15) of the Income Tax Act, 1961 accordingly Surplus/Income of the Society is exempt as per the provisions of section 11 of the Income Tax Act, 1961.

3) ‘The applicant society trust has twenty-two branches in India and out of it twenty-one branches are registered under Goods and Service Tax Act 2017.

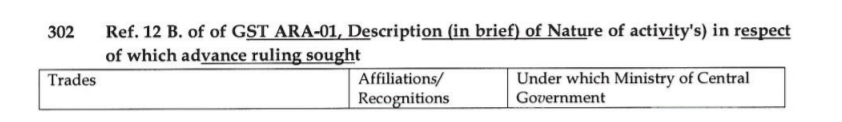

4) Applicant society trust is providing following Vocational Training Courses mainly to leprosy-affected person(s) or members of Leprosy affected family for their day to day survival,

5.)Applicability of relevant notification: – Notification No. 12/2017 – Central Tax (Rate) dated 28th June 2017 (Reliance placed on serial no. 66, 69 or 71 as the case may be)

5.1 Relevant Para of serial no. 66 of Notification No. 12/2017 is reproduced herewith for your kind perusal- Services provided- (a) by an educational institution to its students, faculty, and staff.

“educational institution” means an institution providing services by way of, (i) pre-school education and education up to higher secondary school or equivalent; (ii) education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force; (iii) education as a part of an approved vocational education course. The applicant society trust may fall under Clause (iii).

“approved vocational education course” means, – (i) a course run by an industrial training institute or an industrial training center affiliated to the National Council for Vocational training or state council for vocational training offering course is designated trades notified under the Apprentices Act, 1961 (52 of 1961); or (ii) a Modular Employable Skill Course, approved by the National Council of Vocational Training, run by a person / registered with the Directorate General of Training, Ministry of Skill Development and Entrepreneurship.

6 It is submitted herewith that the additional requirements for applicant annexed with Preliminary hearing notice dated 06.02.2019 is not applicable in respect of point no. (1) to (9) in the instant case.

PRAYER: –

In view of the submissions made above; it is most humbly prayed that honorable authorities may kindly pass a ruling to clarify Whether, on facts and circumstances of the case, aforesaid vocational training courses conducted by the applicant society trust are exempt under Notification No. 12/2017.

04. CONTENTION – AS PER THE CONCERNED OFFICER

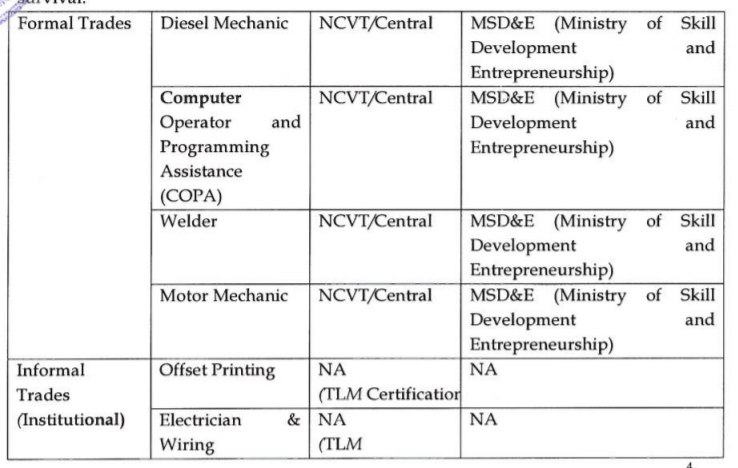

The submission, as reproduced verbatim, could be seen thus- The applicant provides vocational training for formal trades and informal trades. But as on details submitted by the dealer, he has applied for advance ruling for formal trades only. Under formal trades, the applicant society trust is providing following Vocational Training Courses mainly to Leprosy affected person(s) or members of Leprosy affected family for their day to day survival.

It is seen that the said organization is nothing but works as under the Ministry of Skilled Development and Entrepreneurship, Govt. of India with National Council for vocational training “which offers a skill or vocational training courses certified by National Trade Certificate i.e. National council for vocational training,

Dealer has not produced any evidences whether the vocational courses conducted by the dealer are under Din Dayal Upadhyay Gramin Kaushalya Yojana under the Ministry of Rural Development by offering a skill or vocational training courses certified by National Council for Vocdtitrtal training.

WhileZoin g through the submission given by the Leprosy Mission it is observed as under

1) Déaler provides approved vocational Training courses.

2) It is an Educational Institution.

3) This Institution has affiliation from Central Govt. in respect of National for Vocational Training, which offering courses in designated trades notified under the Apprentices Act, 1961. Copies of Affiliation certificates are produced by the dealer. Hence as on the facts produced by the dealer and the notification No 12/2017 regarding exemption of intrastate supply of services, it is seen that dealer fulfills the conditions of the entry No 66 of the said notification.

Hence, an exemption may be granted to the services of vocational training courses to the extent of strength sanctioned to the courses by DGET. Further, you may pls take a call regarding the continuity of affiliations or whether those affiliations are valid as on today or not?

04. HEARING

Preliminary Hearing in the matter was held on 26.02.2019. Sh. Ajay Singh, C.A. appeared and requested for admission of application as per’ contentions made in their application. Jurisdictional Officer Sh. Vijay Aher, State Tax Officer, Nasik Division, Nasik also appeared. The application was admitted and called for a final hearing on 03.04.2019. Sh. Ajay Singh, C.A., appeared, made oral and written submissions. Jurisdictional Officer Sh, Vijay Aher, State Tax Officer, Nasik Division, Nasik also appeared and made written submissions.

05.OBSERVATIONS

We have gone through the facts of the case, documents on record and submissions made by both, the applicant as well as the jurisdictional office.

The applicant society, a Non-Governmental Organization (NGO) registered under Section 12 A of the Income Tax Act 1961 and having Leprosy Referral Hospitals, Vocational Training Institutes, Research Laboratory, homes for the care of elderly leprosy disabled people, etc, works in the areas of Health, Education, Sustainable Livelihoods, Community Development, Advocacy and Research. They have submitted that their activities are charitable in nature and within the meaning of section 2(15) of the Income Tax Act, 1961. The vocational training provided by them, in respect of which their query is raised, are mentioned in their submissions in the form of a table which mention both, Formal Trades and Informal Trades. Formal trades viz. Diesel Mechanic, Computer Operator, and Programming Assistance (COPA), Welder and Motor Mechanic are Affiliated/ Recognized by the National Council for Vocational Training (NCVT)/ Ministry of HRD. These are under the MSD&E (Ministry of Skill Development and Entrepreneurship). They also have vocational training for 2/3 wheeler Mechanic, a training course recognized by Jan Shikshan Sansthan (JSS) under the Ministry of Labour and Employment, Govt. of India. Other informal courses i.e. Offset Printing, Tailoring and electrician & Wiring are non-recognized courses. Hence our discussions will be only in respect of recognized courses.

The applicant in their application dated 30.01.2019 has raised the primary question whether their training courses recognized by National Council for Vocational Training (NCVT) or Jan Shikshan Sansthan (JSS) are exempt either under Entry No 64 of exemption list of Goods and Service Tax Act 2017 or under Educational Institution defined under Notification 22/Central Tax (Rate).

Entry 64 of Notification 12/2017 CT (Rate) dated 28.06.2017 deals with “services provided by the Central/State Government, Union Territory or a local authority by way of assignment of the right to use any natural resource where such right to use was assigned by the Central/State Government, Union Territory or local authority…… Provided that… “ The applicant is not a Central/State Government, Union Territory or local authority and therefore Entry No. 64 is not applicable to them.

In their additional submissions dated 03.04.2019, they have raised the question whether they are eligible under the entry at serial number 66 of the Notification 12/2017 CT (Rate) dated 28.06.2017. Accordingly, we take up the question of whether they are eligible for exemption under the entry 66 ibid.

The entry at Sr. No. 66 of Notification No. 12/2017 CT (Rate) as reproduced as under:-

Services Provided

(a) by an educational institution to its students, faculty, and staff;

(b) to an educational institution, by way of, –

i. transportation of students, faculty, and staff;

ii. catering, including any mid-day meals scheme sponsored by the Central Government, State Government or Union territory;

iii.security or cleaning or housekeeping services performed in such educational institution;

iv. Services relating to admission to, or conduct of examination by, such institution; (**”)

v. supply of online educational journals or periodicals:]

Provided that nothing contained in (sub-items (i), (i) and (iii) of item (b)|Jshall apply to an educational institution other than an institution providing services by way of pre-school education and education up to higher secondary school or equivalent.

Now we reproduce the definition of an ‘Educational Institution’ as defined in 2(y) of notification 12/2017 CT (Rate) dated 26.06.2019 which is as follows:

educational institution means an institution providing service by way of,-

i) Pre-school education and education up to higher secondary school or equivalent;

ii) education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force; and

iii) education as a part of an approved vocational education course.

The applicant has admitted that they do not fall under clause 2(y) (i) & (ii) mentioned above but that they fall under Clause (iii). For their services to fall under clause (iii), they have to be seen providing education as a part of an approved vocational education course. Hence we now refer to the definition of an ‘approved vocational education course’ as in clause 2 (h):-

“approved vocational education course” means, –

i) a course run by an industrial training institute or an industrial training center affiliated to the National Council for Vocational Training or State Council for Vocational Training offering courses in designated trades notified under the Apprentices Act, 1961 (52 of 1961); or

ii) a Modular Employable Skill Course, approved by the National Council of Vocational Training, run by a person registered with the Directorate General of Training, Ministry of Skill Development and Entrepreneurship.

From the documents submitted by the applicant, we find that they have been granted affiliation by the National Council for Vocational Training (NCVT) in respect of vocational skills pertaining to (i) Diesel Mechanic, (ii) Computer Operator and Programming Assistance (COPA), (iii) Welder and (iv) Motor Mechanic. These courses are vocational courses and are approved by NCVT. The definition of an ‘approved vocational education course’ has been reproduced above and it is seen to be a course run by an industrial training institute or an industrial training center affiliated to the NCVT or State Council for Vocational Training offering courses in designated trades notified under the Apprentices Act, 1961 (52 of 1961). The vocational education courses pertaining to (i) Diesel Mechanic, (ii) Computer Operator and Programming Assistance (COPA), (iii) Welder and (iv) Motor Mechanic are carried out by the applicant who are affiliated to the NCVT and therefore such services provided by them are attracting NIL rate of tax under GST. (Sr.No. 66 of Notification No. 12/2017 CT (Rate) dated 28.06.2019.

In respect of the Informal Trades like Tailoring, Offset Printing, Electrician and Wiring, the applicant have themselves submitted that these courses i.e. Offset Printing, Tailoring, and Electrician & Wiring are non-recognized courses and that they are inclined only to discuss recognized courses. Further, they also have vocational training for 2/3 wheeler Mechanic, __which they have submitted is a training course recognized by Jan Shikshan Sansthan (JSS) under the ministry of labour and employment Govt. of India. However, they not produced any evidence to support their submissions on this count.

05. In view of the extensive deliberations as held hereinabove, we pass an order as follows :

ORDER

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

For reasons as discussed in the body of the order, the questions are answered thus –

Question 1:- Whether services provided under vocational training courses recognized by National Council for Vocational Training (NCVT) or Jan Shikshan Sansthan (JSS) is exempt either under Entry No 64 of exemption list of Goods and Service Tax Act 2017 or under Educational Institution defined under Notification 22/Central Tax (Rate)?

Answer: Answered in the negative.

Question 2 ( Raised in the additional submissions dated 03.04.2019 ) :- Whether services provided under vocational training courses provided by the applicant are exempt under Entry No 66 of the Notification 22/2017 – Central Tax (Rate)?

Answer :- In view of the discussions made above, only the vocational training courses pertaining to (i) Diesel Mechanic, (ii) Computer Operator and Programming Assistance (COPA), (iii) Welder and (iv) Motor Mechanic are exempted under the Sr. No. 66 (a) of Notification No.12/2017 CT (Rate) dated 28.06.2017 as amended.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.