Original GST AAR of M/s Fairmacs Ship Stores Private Limited

Original GST AAR of M/s Fairmacs Ship Stores Private Limited

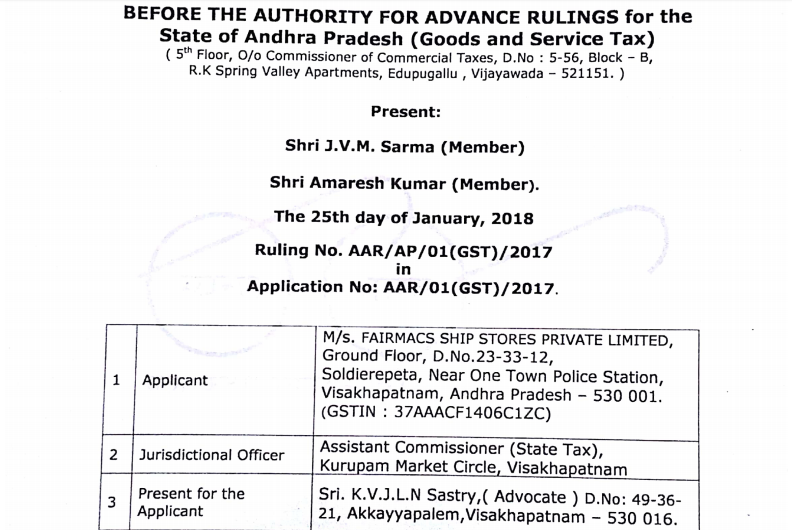

In the GST AAR of M/s Fairmacs Ship Stores Private Limited. The applicant has raised the query regarding the Tax liability on the outward supplies made by them to the ocean-going merchant vessels on the foreign run, Indian Naval Ships, and Indian Coast Guard Ships. Following is the GST AAR of M/s Fairmacs Ship Stores Private Limited:

Order:

NOTE: Under Section 100 of the APGST Act, 2017, an appeal against this ruling lies before the appellate authority for advance ruling constituted under section 99 of APGST Act, 2017, within a period of 30 days from the date of service of this order

M/S FAIRMACS SHIP STORES PRIVATE LIMITED (hereinafter also referred as an applicant), having GSTIN 37AAACF1406C1ZC are holders of Special Warehouse License No. 14/2016, issued under Section 58 (A) of The Customs Act, 1962 for storage of duty free ship stores imported without payment of duty for supply to Indian Naval / Coast Guard ships and Ocean going merchant ships.

2. The applicant seeks Advance Ruling under Section 104 of CGST & SGST Acts’ 2017 for the following questions:-

i. Whether they are exempted from tax under GST on their outward supplies made to ocean-going merchant vessels on foreign run, Indian Naval Ships and Indian Coast Guard Ships or not?

ii. If at all they are liable for GST on their outward supplies whether they can collect the GST from the recipient for the goods namely:-

♦ Ocean going merchant vessels on foreign run.

♦ Indian Naval Ships

♦ Indian Coast Guard Ships or from their authorized agents.

3. The Jurisdictional officer, i.e. the Assistant Commissioner, Kurupam market Circle, Visakhapatnam offered comments on the subject application wherein he stated that:-

♦ No proceedings were pending against the applicant on the issue raised by him.

♦ No final orders passed in the issue raised by the said applicant.

♦ No other remarks offered.

Accordingly the application for advance ruling was admitted, and a personal hearing conducted on 10th January 2018. At the time of personal hearing the authorized representative presented the documentary evidences for the following:-

> Customs Special ware house license issued by Visakhapatnam customs house.

> Import Export Code Certificate issued by the DGFT

> Circular F.No. 21/31/63-CUS.IV, Dated: 17.08.1966, regarding concessions in respect of imported stores for Indian navy.

> Notification 123/93- Customs, Dated.14.05.1993 regarding concessions in respect of imported stores for Indian Coast Guard.

> Text of Customs Act’ 1962 for section 87,88 and 69

> Supply details for the Ship stores exported to Ocean going merchant ships on foreign run under section 88(a)

> Supply details for the ship stores exported to Indian naval vessels under section 69 read with 87.

> Supply details for the ship stores exported to Indian Coast Guard Ships under section 69 read with 87.

> Import particulars including bill of entry and Re-warehousing certificate for the ship stores warehoused into customs special warehouse.

4. The relevant statutory provisions are reproduced hereunder for our examination of the issue:

As per Section 2 (11) of the Customs Act, 1962

“Customs area” means the area of a customs station or a warehouse and includes any area in which imported goods or export goods are ordinarily kept before clearance by Customs Authorities

As per Section 88 (a) of the Customs Act, 1962

The provisions of section 69 and Chapter X shall apply to stores (other than those to which section 90 applies) as they apply to other goods, subject to the modifications that

(a) for the words “exported to any place outside India” or the word “exported”, wherever they occur, the words “taken on board any foreign-going vessel or aircraft as stores” shall be substituted;

As per Section 2 (5) of the Integrated Goods and Service Tax Act, 2017

“Export of goods” with its grammatical variations and cognate expressions, means taking goods out of India to a place outside India.

As per Section 2 (56) of the Central Goods and Services Tax Act, 2017

“India” means the territory of India as referred to in article 1 of the constitution, its territorial waters, seabed and sub-soil underlying such waters, continental shelf, exclusive economic zone or any other maritime zone as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976, and the airspace above its territory and territorial waters.

As per Section 2 (47) of the Central Goods and Service Tax Act, 2017

“exempt supply” means the supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply;

As per Section 7 (2) of the Integrated Goods and Service Tax Act, 2017

Supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-State trade or commerce.

Download the GST AAR of M/s Fairmacs Ship Stores Private Limited by clicking the below image:

5. We have examined the facts of the case as submitted by the applicant. It is observed that the goods which are received by the applicant are within the Customs area as defined under Section 2 (11) of the Customs Act, 1962. Accordingly, goods cleared/supplied by the applicant is to be treated as a supply of goods in the course of inter-State trade. Furthermore, the goods supplied by the applicant is also not an exempt supply as per the definition under Section 2 (47) of the Central Goods and Service Tax Act, 2017 as it is neither nil rated or being exempt by any Notification.

5.1 We have observed that, at best, some of the supplies of applicant may fall under the definition of “exports” which is considered a zero rated supply. However, the same is not within the prerogative of present application.

5.3 The Central Board of Excise and Customs, on a related matter has Issued Circular No 46/2017-Customs, dated 24th November 2017. The relevant para is reproduced here under:

However, the transaction of sale / transfer etc. of the warehoused goods between the importer and any other person may be at a price higher than the assessable value of such goods. Such a transaction squarely falls within the definition of “supply” as per section 7 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as, “CGST Act”) and shall be taxable in terms of section 9 of the CGST Act read with section 20 of the Integrated Goods and Services Tax Act, 2017 (hereinafter referred to as, “IGST Act”). It may be noted that as per sub-section (2) of section 7 of the IGST Act, any supply of imported goods which takes place before they cross the customs frontiers of India, shall be treated as an inter-State supply. Thus, such a transaction of sale/transfer will be subject to IGST under the IGST Act. The value of such supply shall be determined in terms of section 15 of the CGST Act read with section 20 of the IGST Act and the rules made thereunder, without prejudice to the fact that customs duty (which includes BCD and applicable IGST payable under the Customs Tariff Act) will be levied and collected at the ex-bond stage

RULING:

6. Having given careful consideration, we rule on the aforementioned question as under:

(i) The applicant is not exempted from tax under GST on their outward supplies made to ocean-going merchant vessels on the foreign run, Indian Naval Ships and Indian Coast Guard Ships

(ii) The applicant can collect the applicable GST from their customers, in case it is not exports. However, in case of exports the option lies with the applicant based on manner of exports i.e. whether they intend to export under bond or on payment of tax.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.