Original GST AAR of M/s Laurus Labs Limited

Original GST AAR of M/s Laurus Labs Limited

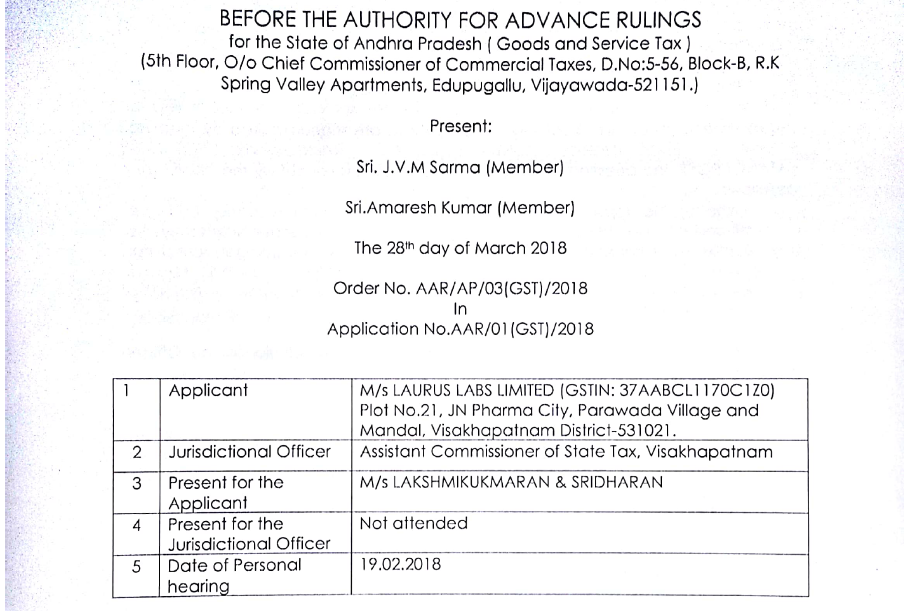

In the GST AAR of M/s Laurus Labs Limited, the applicant has raised the query regarding the claim of the benefit of the lower rate of GST (5%) on the supply made by him. Following is the GST AAR of M/s Laurus Labs Limited:

Order:

Note: Under Section 100 of the APGST Act, 2017, an appeal against this ruling lies before the appellate authority for advance ruling constituted under section 99 of APGST Act, 2017, within a period of 30 days from the date of service of this order.

M/s LAURUS LABS LIMITED, Plot No.21, JN Pharma City, Parawada Village and Mandal, Visakhapatnam District-531021, Andhra Pradesh, lndia(hereinafter also referred as applicant), having GSTIN: 37AABCL1170C1Z0 are engaged in manufacturing of pharmaceutical products (i.e. Bulk drugs and Intermediates).

2. The applicant have filed an application in Form ARA-01, dated 10.01.2018 and received by this authority on 11.01.2018, for seeking advance ruling on determination of rate of tax of the products those are manufactured by them, ie., EFAVIRENZ, EMTRICITABINE, SUNTINIB MALATE, RALTEGRAVIR POTASIUM, LATANOPROST. The question on which Advance Ruling is sought by the applicant is as follows:

Whether the applicant is eligible to claim the benefit of lower rate of GST i.e., 5% under SI. No. 180 of Schedule-I of the rate schedule under Notification No. 01/2017 Central Tax (Rate) dated 28.06.2017 read with the corrigendum dated 30.06.2017 on supply of 1. EFAVIRENZ, EMTRICITABINE, SUNTINIB MALATE, RALTEGRAVIR POTASIUM, LATANOPROST, which also falls under SI. No. 40 of Schedule III.

Copy of the said application was forwarded to the Jurisdictional Tax Officer. However, no comments/ reply were offered.

3. A personal hearing was fixed on 19.02.2018, wherein Sri. L.V.VN Satya Sai, O/o Lakshmi kumaran & Sridharan (Advocates), and authorized representative of the applicant attended. In their submissions the authorized representative requested for ruling on applicability of rate of tax on supply of

- EFAVIRENZ

- EMTRICITABINE

- SUNTINIB MALATE

- RALTEGRAVIR POTASSIUM

- LATANOPROST

In support of his contention he relied on the Notification No. 01/2017 Central Tax (Rate) dated 28.06.2017, and also various judicial pronouncings. Further the representative argued that, when a product is falling under two entries, the assesse is entitled to avail the benefit of that entry which is beneficial to him, and submitted the words used in the entry in S.No. 180 of Schedule I i.e ‘ Drugs or medicines’ , the word ‘drug’ is not qualified by any other word such as ‘bulk’ , and contended in such cases, it can be said that all forms of drugs, whether in the form of ‘bulk drugs’ or formulations, would fall under the said entry, and requested ruling accordingly.

Download the GST AAR of M/s Laurus Labs Limited by clicking the below image:

4.1. We have gone through the application filed by the applicant, written submissions given at the time of personal hearing and the oral submissions. The two entries relevant for the impugned goods are reproduced here under for the sake of clarity:

Schedule 1- 5%

| SI.No | Chapter Heading/ Sub headinq/ Tariff item | Description of Goods |

| (1) | (2) | (3) |

| 180 | 30 or any chapter | Drugs or medicines including their salts and esters and diagnostic test kits, specified in List 1 appended to this schedule |

List 1 appended to Schedule I under Notification No. 01/2017 CTR is as follows.

“List 1 (See Sl.No. 180 of the Schedule I)

(72) Efavirenz

(73) Emtricitabine

(99) Suntinib Malate

(116) Raltegravir Potassium

(26) Latanoprost”

Schedule III-18%

| SI.No | Chapter Heading/ Sub-headinq/ Tariff item | Description of Goods |

| (1) | (2) | (3) |

| 40 | 29 | All organic chemicals other than giberellic acid. |

4.2. As seen from above, the products manufactured by the applicant, even though are bulk drug gets squarely covered under List 1 of SI. No. 180 of the Schedule -I to the Notification No. 01/2017 Central Tax (Rate) dated 28.06.2017. Further as it is settled law that, the specific entry overrides the general entry, the commodities dealt by the applicant are covered by specific entries, the rate of tax applicable, is the rate specified against specific entry only.

Ruling:

Accordingly we pass the following ruling:

5. The applicant is eligible to claim the benefit of lower rate of GST i.e. 5% under SI. No. 180 of Schedule-I of the rate schedule under Notification No. 01/2017 Central Tax (Rate) dated 28.06.2017 read with the corrigendum dated 30.06. 2017 on supply of

1. EFAVIRENZ

2. EMTRICITABINE

3. SUNTINIB MALATE

4. RALTEGRAVR POTASIUM

5. LATANOPROST.

Source: http://gstcouncil.gov.in/sites/default/files/ruling-new/AP%2003-2018%2028-03-18%20LAURUS%20LABS.pdf

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.