Original GST AAR of Shri Kailash Chandra

Original GST AAR of Shri Kailash Chandra

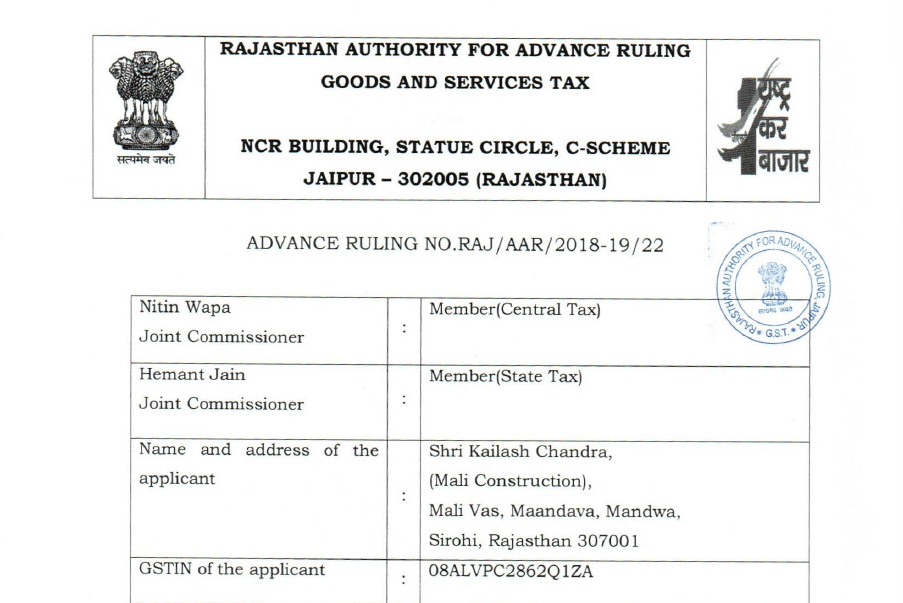

In the GST AAR of Shri Kailash Chandra, the applicant has raised the query regarding the applicability of tax rate on the composite supply provided by them. Supply involves the operations and maintenance of fluoride control project on the ESCO model. Following is the GST AAR of Shri Kailash Chandra:

Order:

Note: Under section 100 of CGST/RGST Act 2017, an appeal against this ruling lies before the Appellate Authority of Advance ruling constituted under section 99 of CGST/RGST Act 2017, within the period of 30 days from the date of service of his order.

The Issue raised by Shri Kailash Chandra, (Mali Construction), situated at Mali Vas, Maandava, Mandwa, Sirohi, Rajasthan 307001 (hereinafter the applicant) is fit to pronounce advance ruling as it falls under ambit of the Section 97(2) (a) (e) which is as given under:-

a. Classification of any goods or services or both;

e. Determination of the liability to pay tax on any goods or services or both;

Further, the applicant being a registered person, GSTIN is 08ALVPC2862Q1ZA, as per the declaration given by him in Form ARA-01, the issue raised by the applicant is neither pending for proceedings nor proceedings were passed by any authority. Based on the above observations, the application is admitted to pronounce advance ruling.

1. SUBMISSION AND INTERPRETATION OF THE APPLICANT:

a. The applicant is engaged in providing the comprehensive water services to the clients who may be both private clients as well governmental. That the currently the applicant is in the process for bidding for tender floated by the PHED, a unit of Government of Rajasthan for designing, providing, installation, commissioning, operation and maintenance of solar energy based bore well water pumping systems, Reverse osmosis plant and operation and maintenance of Fluoride Control project on ESCO and O&M contract.

b. The terms and scope of the contract combines ESCO Model and O&M work. That the activities under ESCO model and O&M contract are so closely linked in a manner that they form a single indivisible supply. The driving factors are:-

– A single tender shall be floated for Operation and Maintenance of Fluoride Control Project on ESCO Cum O&M Contract where the preamble of scope specifies that the contract combines ESCO model and O&M work.

– The nature of contract is such that initial activities under ESCO model is the main service and the other services under O&M contract combined with such service are in the nature of ancillary services which help in better operation of main activities under ESCO model and make the model successful.

c. Thus, based on above facts and concept such contract shall be a single supply and cannot be treated as distinct supplies. Since all the conditions of composite supply are satisfied, it is a composite supply.

d. Further, since composite supply of works contract has been specifically classified as supply of service under Schedule II, it should be first analysed whether the contract can be classified as a works contract or not.

e. The scope of work involves Pump House/Replacement/ refurbishment/ repair/ rehabilitation of existing pump sets, switchgears, mechanical and electrical equipment, capacitor banks etc. Repair/ remodel of pump foundation according to new pump sets or as per requirement. Extension of pump house if required to remodel the configuration of pump sets or as per site condition. The supply and installation of new pumping machinery and other equipments shall be done as per best engineering practice.

f. The operation and maintenance work shall be carried out of all the electrical and mechanical instruments, pumping machinery etc.

g. The pumping station and its surrounding shall be kept clean and in dry condition, properly ventilated and illuminated. For the purpose of illumination, replacement of fitting/ fixtures shall be done by the contractor, if required.

h. The applicant shall be responsible for painting, color/ white washing, distempering etc. to the pumping station building, thrice during the entire contract period.

Transmission Pipelines

The contractor shall be responsible for Patrolling, operation and maintenance of the pipelines, repairing of leakages of pipelines, replacement of burst pipes, repairing of appurtenances of pipelines like air valves, scour valves air vessels system, intermediate OHSR (for vacuum filling system), pressure gauges, joints etc.

Switchyards

He shall be responsible for replacement of transformers if required according to year 2027 designed capacity of pump sets. He shall also be responsible for painting, color/ white washing, distempering etc. to the switchyard stuff thrice during the entire contract period.

Storage Tanks (CWR)

He shall also be responsible for painting, color/white washing, distempering etc. to the CWR, compound wall, store etc thrice during the entire contract period.

Headworks Campus

Contractor shall maintain whole campus neat and clean by removing unwanted trees, bushes, vegetation etc, pruning of trees watering to sapling and maintenance of lawn/ garden, plantation of new trees and saplings, illumination in the whole campus, maintain all internal and service roads, proper drainage system etc.

SCADA

The scope of work includes design the system based on re-engineered processes and best fit automation interventions to get transparent real time data and remote monitoring.

O&M work

The scope of work of O&M contract includes operation and maintenance of rising mains of RWSS/Clusters, OHSR and water treatment plant at Baghera.

i. It is understood based on the scope of work detailed above that ESCO model requires improvement of the whole water supply system involving pump houses, pumping stations, transmission lines, switchyards, storage tanks and headwork campus. Re-modelling of pump foundation and extension of pump house, replacement of fittings/fixtures and painting of all permanent structures like pumping station building etc. are involved in the contract.

j. Based on above facts and the intent of the proposed activity, it is implied that the given work is a contract for improvement of the pumping system under the Fluoride control project, wherein transfer of property in goods in the form of new pumping machinery and mechanical/electrical equipment shall be involved in the execution of such contract.

k. That Works contract in itself is a composite supply in which construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning etc are involved along with transfer or property in goods.

l. Now whether a supply is a works contract or not is dependent on whether the plant or device or property is a movable or immovable property. To decide whether a property is movable or immovable, the given terms have not been defined under the Act and hence the reliance needs to be placed on other laws and judicial precedents.

m. Under the General Clauses Act 1897 the term immovable property has been defined under Section 3(26) as “immovable property” shall include land, benefits to arise out of land, and things attached to the earth, or permanently fastened to anything attached to the earth:

n. As per the definition the term permanently fastened or attached to earth can be treated as immovable property. Any attachment with earth which is temporary in nature or can be shifted from part of earth to another without causing substantial damage to it cannot be treated as immovable property.

o. On the given issue, CBEC has also clarified in its circular number 58/ 1/2002-CX dated 15/ 1/2002 where in para (e) it was clarified that;-

If items assembled or erected at site and attached by foundation to earth cannot be dismantled without substantial damage to its components and thus cannot be reassembled, then the items involved not be considered as moveable and will, therefore, not be excisable goods.

p. Further, such a contract can amount to works contract in GST only if the improvement is of any immovable property. Taking references from the concepts evolved from the precedents, it is understood that the properties for which improvement works has been assigned like pump houses, storage tanks, headworks campus etc. cannot be moved from one site to another. All the components of the pumping system are erected at the prescribed location and permanently attached to the earth and they cannot be dismantled and reassembled as such dismantling may cause substantial damage to the system and its components.

Thus, according to applicant the property of improvement is an immovable property and thus the given work should be treated as works contract.

Download the GST AAR of Shri Kailash Chandra by clicking the below image:

2. QUESTIONS ON WHICH THE ADVANCE RULING IS SOUGHT

Whether the activity of O & M of Fluoride control project on ESCO Model and O & M work supply of goods or supply of services and what shall be the rate of GST on it?

3. PERSONAL HEARING (PH)

The PH was held on 22.10.2018 at Room No. 2.22, NCRB, Statue Circle, Jaipur. The applicant in his original application has submitted request for advance ruling on three questions. The applicant has submitted a letter in PH requesting to withdraw the question 1 and 2 due to mutually exclusive and independent nature of all three questions. Accordingly, this advance ruling is solely for question number 3.

4. FINDINGS, ANALYSIS & CONCLUSION:

1. We find that, scope of work in ESCO model requires improvement of the whole water supply system involving pump houses, pumping stations, transmission lines, switchyards, storage tanks and headwork campus. Remodelling of pump foundation and extension of pump house, replacement of fittings/fixtures and painting of all permanent structures like pumping station building etc. are involved in the contract.

2. The given activities undertaken by the applicant are culminating into works contract services. Now works contract service in itself is a composite supply. The same has been defined under Schedule-II under Entry 6 which is read under:-

“6. Composite supply

The following composite supplies shall be treated as a supply of services, namely:

(a) works contract as defined in clause (119) of section 2; and

If items assembled or erected at site and attached by foundation to earth cannot be dismantled without substantial damage to its components and thus cannot be reassembled, then the items involved not be considered as moveable and will, therefore, not be excisable goods.

p. Further, such a contract can amount to works contract in GST only if the improvement is of any immovable property. Taking references from the concepts evolved from the precedents, it is understood that the properties for which improvement works has been assigned like pump houses, storage tanks, headworks campus etc. cannot be moved from one site to another. All the components of the pumping system are erected at the prescribed location and permanently attached to the earth and they cannot be dismantled and reassembled as such dismantling may cause substantial damage to the system and its components.

Thus, according to applicant the property of improvement is an immovable property and thus the given work should be treated as works contract.

2. QUESTIONS ON WHICH THE ADVANCE RULING IS SOUGHT

Whether the activity of O & M of Fluoride control project on ESCO Model and O & M work supply of goods or supply of services and what shall be the rate of GST on it?

3. PERSONAL HEARING (PH)

The PH was held on 22.10.2018 at Room No. 2.22, NCRB, Statue Circle, Jaipur. The applicant in his original application has submitted request for advance ruling on three questions. The applicant has submitted a letter in PH requesting to withdraw the question 1 and 2 due to mutually exclusive and independent nature of all three questions. Accordingly, this advance ruling is solely for question number 3.

4. FINDINGS, ANALYSIS & CONCLUSION:

1. We find that, scope of work in ESCO model requires improvement of the whole water supply system involving pump houses, pumping stations, transmission lines, switchyards, storage tanks and headwork campus. Remodelling of pump foundation and extension of pump house, replacement of fittings/fixtures and painting of all permanent structures like pumping station building etc. are involved in the contract.

2. The given activities undertaken by the applicant are culminating into works contract services. Now works contract service in itself is a composite supply. The same has been defined under Schedule-II under Entry 6 which is read under:-

“6. Composite supply

The following composite supplies shall be treated as a supply of services, namely:

(a) works contract as defined in clause (119) of section 2; and

(b) supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration.”

3. The terms and scope of the contract combines ESCO Model and O&M work. That the activities under ESCO model and O&M contract are so closely linked in a manner that they form a single indivisible supply. The driving factors are:-

– A single tender is being floated for Operation and Maintenance of Fluoride Control Project on ESCO Cum O&M Contract in which preamble of scope specifies that the contract combines ESCO model and O&M work.

– The nature of contract is such that initial activities under ESCO model is the main service and the other services under O&M contract combined with such service are in the nature of ancillary services which help in better operation of main activities under ESCO model and make the model successful.

4. Further, since composite supply of works contract has been specifically classified as supply of service under Schedule II, it should be first analysed whether the contract can be classified as a works contract or not.-

a. The scope of work under the contract has been carefully examined to derive that it involves Pump House/Replacement/ refurbishment/ repair / rehabilitation of existing pump sets, switchgears, mechanical and electrical equipment, capacitor banks etc. Repair/ remodel of pump foundation according to new pump sets or as per requirement. Extension of pump house if required to remodel the configuration of pump sets or as per site condition. The supply and installation of new pumping machinery and other equipments shall be done as per best engineering practice.

b. The operation and maintenance work shall be carried out of all the electrical and mechanical instruments, pumping machinery etc.

c. The pumping station and its surrounding shall be kept clean and in dry condition, properly ventilated and illuminated. For the purpose of illumination, replacement of fitting/ fixtures shall be done by the contractor, if required.

d. He shall be responsible for painting, color/ white washing, distempering etc. to the pumping station building, thrice during the entire contract period.

e. Transmission Pipelines

The contractor shall be responsible for Patrolling, operation and maintenance of the pipelines, repairing of leakages of pipelines, replacement of burst pipes, repairing of appurtenances of pipelines like air valves, scour valves air vessels system, intermediate OHSR (for vacuum filling system), pressure gauges, joints etc.

Switchyards

He shall be responsible for replacement of transformers if required according to year 2027 designed capacity of pump sets. He shall also be responsible for painting, color/ white washing, distempering etc. to the switchyard stuff thrice during the entire contract period.

Storage Tanks (CWR)

He shall also be responsible for painting, color/white washing, distempering etc. to the CWR, compound wall, store etc thrice during the entire contract period.

Headwork Campus

Contractor shall maintain whole campus neat and clean by removing unwanted trees, bushes, vegetation etc, pruning of trees watering to sapling and maintenance of lawn/ garden, plantation of new trees and saplings, illumination in the whole campus, maintain all internal and service roads, proper drainage system etc.

SCADA

The scope of work includes design the system based on re-engineered processes and best fit automation interventions to get transparent real time data and remote monitoring.

O&M work

The scope of work of O&M contract includes operation and maintenance of rising mains of RWSS/Clusters, OHSR and water treatment plant at Baghera.

5. It is understood based on the scope of work detailed above that ESCO model requires improvement of the whole water supply system involving pump houses, pumping stations, transmission lines, switchyards, storage tanks and headwork campus. Re-modelling of pump foundation and extension of pump house, replacement of fittings/fixtures and painting of all permanent structures like pumping station building etc. are involved in the contract.

6. Based on above facts and the intent of the proposed activity, it is implied that the given work is a contract for improvement of the pumping system under the Fluoride control project, wherein transfer of property in goods in the form of new pumping machinery and mechanical /electrical equipment shall be involved in the execution of such contract.

7. That Works contract in itself is a composite supply in which construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning etc are involved along with transfer or property in goods.

8. Now whether a supply is a works contract or not is dependent on whether the plant or device or property is a movable or immovable property. To decide whether a property is movable or immovable, the given terms have not been defined under the Act and hence the reliance needs to be placed on other laws and judicial precedents.

9. Under the General Clauses Act 1897 the term immovable property has been defined under Section 3(26) as “immovable property” shall include land, benefits to arise out of land, and things attached to the earth, or permanently fastened to anything attached to the earth:

10. As per the definition the term permanently fastened or attached to earth can be treated as immovable property. Any attachment with earth which is temporary in nature or can be shifted from part of earth to another without causing substantial damage to it cannot be treated as immovable property.

11. On the given issue, CBEC has also clarified in its circular number 58/1/2002-CX dated 15/ 1/2002 where in para (e) it was clarified that;-

If items assembled or erected at site and attached by foundation to earth cannot be dismantled without substantial damage to its components and thus cannot be reassembled, then the items involved not be considered as moveable and will, therefore, not be excisable goods.

12. According to definition of works contract under GST regime, the supply of goods and services are done by the supplier simultaneously which is for immovable property. Hence in works contract supply of goods and services together is compulsory.

Thus, based on above facts and concept we find that the contract shall be a single supply and cannot be treated as distinct supplies. Since all the conditions of composite supply are satisfied, it is a composite supply.

13. Now, under Notification No 12/2017-CT (Rate) dated 28.06.2018, under entry number 3A, an exemption from GST has been provided for composite supplies which is reproduced as under:-

| 3A | Chapter 99 | Composite supply of goods and services in which the value of supply of goods constitutes not more than 25 per cent, of the value of the said composite supply provided to the Central Government, State Government or Union territory or local authority or a Governmental authority or a Government Entity by way of any activity in relation to any function entrusted to a Panchayat under article 243 G of the Constitution or in relation to any function entrusted to a Municipality under article 243W of the Constitution. | Nil | Nil |

Thus according to said entry in the notification, in case of composite supply of goods or services if the value of supply of goods does not exceeds 25% of the total value of supply and service if provided to State Government or a local authority and the supply is by way of an activity in relation to functions entrusted to Municipality under Article 243W of the Constitution then no GST is applicable.

14. The activities entrusted to the Municipality under Article 243W of the Constitution of India and listed under Twelfth Schedule are enumerated as under;-

[Article 243-W]

1. Urban planning including town planning.

2. Regulation of land use and construction of buildings.

3. Planning for economic and social development.

4. Roads and bridges.

5. Water supply for domestic, industrial and commercial purposes.

6. Public health, sanitation conservancy and solid waste management.

7. Fire services.

8. Urban forestry, protection of the environment and promotion of ecological aspects.

9. Safeguarding the interests of weaker sections of society, including the handicapped and mentally retarded.

10. Slum improvement and up gradation.

11. Urban poverty alleviation.

12. Provision of urban amenities and facilities such as parks, gardens, playgrounds.

13. Promotion of cultural, educational and aesthetic aspects.

14. Burials and burial grounds; cremations, cremation grounds and electric crematoriums.

15. Cattle ponds; prevention of cruelty to animals.

16. Vital statistics including registration of births and deaths.

1 7. Public amenities including street lighting, parking lots, bus stops and public conveniences.

18. Regulation of slaughter houses and tanneries.

On perusal of said Schedule it is evident that under point number 5, the water supply for domestic, industrial and commercial purposes is responsibility of Municipality. It is pertinent to note that given activity of ESCO plant redevelopment is in relation to clean drinking water facility to the citizens. Thus, it is easily ascertained that the applicant is engaged in a Work Contract (Composite supply) to a Governmental Authority.

15. The rate of tax in given service shall be determined in accordance with the Notification No 11/2017-CT (Rate) dated 28.06.2017, as amended from time to time.

On perusal of said Notification under S. No. 3(iii), for schedule of rate of Tax on works contract Services, following is mentioned: –

| Heading 9954 (Constrction services) | CGST Rate % | SGST Rate % | IGST Rate % | Remarks | |

| (iii) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, supplied to the Central Government, State Government, Union territory, a local authority, a Governmental Authority or a Government Entity by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of,-(a) a historical monument, archaeological site or remains of national importance, archaeological excavation, or antiquity specified under the Ancient Monuments and Archaeological Sites and Remains Act, 1958 (24 of 1958);

(b) canal, dam or other irrigation works; (c) pipeline, conduit or plant for (i) water supply (ii) water treatment, or (iii) sewerage treatment or disposal. |

6 |

6 |

12 |

Provided that where the services are supplied to a Government Entity, they should have been procured by the said entity in relation to a work entrusted to it by the Central Government, State Government, Union territory or local authority, as the case may be; |

7. In the given contract if the value of supplied goods is below 25% of the total value of the composite supply, then the rate of tax would be Nil as per entry number 3A of Notification No 12/2017-CT (Rate) dated 28.06.2018. Further, if in the duration of the contract the applicant crosses the benchmark of 25% value of goods then the rate of tax will shift from Nil to 12% as per Notification No 11/2017-CT (Rate) dated 28.06.2017 as amended from time to time.

Ruling:

5. Based on above facts along with the provision of law the ruling is as follows

In the given contract, the activity of O & M of Fluoride Control Project on ESCO Model and O &M work by the applicant is being undertaken for a Government Department. If the value of supplied goods under this contract is below 25% of the total value of the composite supply, then the rate of tax would be Nil. Further, if in the duration of the contract the applicant crosses the benchmark of 25% value of goods then the rate of tax will shift from Nil to 12%.

Source: http://gstcouncil.gov.in/sites/default/files/ruling-new/Raj.22.2018-19%20-KC.pdf

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.