Original order:AAR Golden Vacations Tours and Travels

WEST BENGAL AUTHORITY FOR ADVANCE RULING GOODS AND SERVICES TAX

14 Beliaghata Road, Kolkata – 700015

(Constituted under section 96 of the West Bengal Goods and Services Act, 2017)

BENCH

Ms Susmita Bhattacharya, Joint Commissioner, CGST & CX Mr Parthasarathi Dey, Senior Joint Commissioner, SGST

Preamble

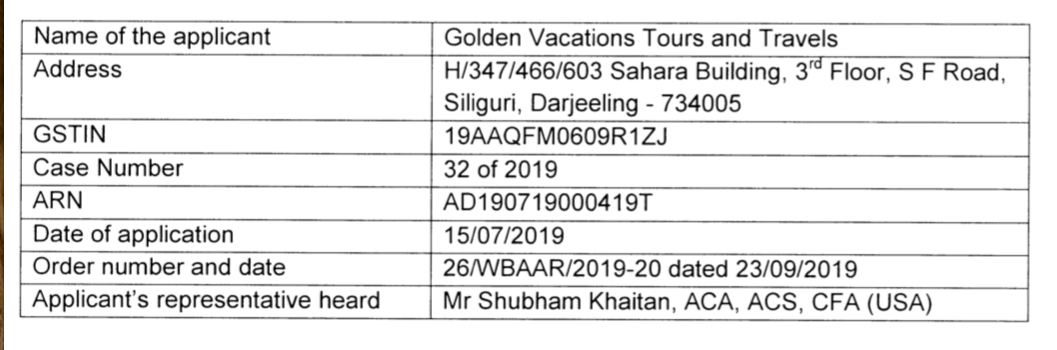

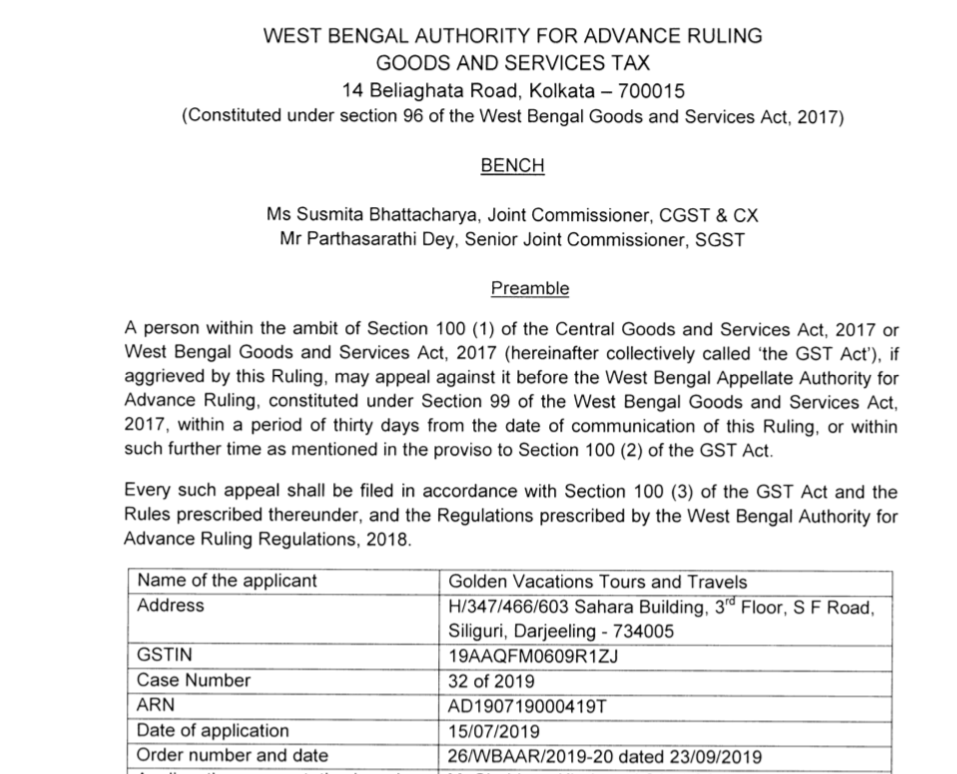

A person within the ambit of Section 100 (1) of the Central Goods and Services Act, 2017 or West Bengal Goods and Services Act, 2017 (hereinafter collectively called ‘the GST Act’), if aggrieved by this Ruling, may appeal against it before the West BengalAppellate Authority for Advance Ruling, constituted under Section 99 of the West Bengal Goods and Services Act, 2017, within a period of thirty days from the date of communication of this Ruling, or within such further time as mentioned in the proviso to Section 100 (2) of the GST Act.

Every such appeal shall be filed in accordance with Section 100 (3) of the GST Act and the Rules prescribed thereunder, and the Regulations prescribed by the West Bengal Authority for Advance Ruling Regulations, 2018.

1. Admissibilitv of the Application

1 .1 The Applicant is stated to be a tour operator. lt seeks a ruling on the classification of the service it provides when it arranges the client’s accommodation in hotels. lt further wants to know whether the GST the hotels charge on it can be claimed as an input tax credit. The questions raised are admissible for advance ruling under section 97(2)(a) &(d) of the GST Act.

1.2 lhe Applicant declares that the issues raised in the Application are not pending nor decided in any proceedings under any provisions of the GST Act. The concerned officer from the Revenue has not objected to the admission of the application. The Application is, therefore, admitted.

2. Submissions of the Applicant

2.1 The Applicant submits that it books rooms in hotels and provides them for accommodation as asked by the customers.

2.2|n the Applicant’s opinion, it is notto be classified as tour operating service. According to Explanation to Sl No. 23(i) of Notification No. 1112017 – CT (Rate) dated 2810612017 (State Notification No. 1135 – FT dated 2810612017), as amended from time to time (hereinafter collectively called the Rate Notification), the “tour operator” means any person engaged in the business of planning, scheduling, organizing, arranging tours (which may include arrangements for accommodation, sightseeing or other similar services) by any mode of transport, and includes any person engaged in the business of operating tours. Furthermore, SL No. 23(i) applies provided inter alia the bill issued for supply of the service indicates it is inclusive of charges of accommodation and transportation required for such a tour. As the

Applicant seeks the ruling for cases where it provides the client accommodation only, Sl No. 23(i) of the Rate Notification should not be applicable.

2.3 The Applicant argues that accommodation service is classified under SAC 996311 and covered under several clauses of Sl No. 7 of the Rate Notification. Although SAC 996311 is limited to the accommodation service provided by the hotels, guest house etc., the narration under Sl No. 7 of the Rate Notification keeps scope for the suppliers like the Applicant who arrange such accommodation in hotels.

2.4 The Applicant further argues that support services covered under Sl No. 23(iii) of the Rate Notification include services classified under SAC 998552. Services covered under SAC 998552 includes arranging reservations for accommodation services for domestic accommodation, accommodation abroad etc. The Applicant’s service may be classified under the above SAC also.

2.5 Finally, the Applicant states that if not elsewhere classified, SAC 9997 under Sl No. 35 of the Rate Notification can be used for classification of such services.

3. Submissions of the Revenue

3.1 The concerned officer from the Revenue is of the view that the Applicant’s service as above is classifiable under SAC 9985 as tour operating service procured from another tour operator. The bills issued indicate that the Applicant charges inclusive of accommodation and transportation required for such tours.

4. Observations and findinqs of the Authoritv

4.1 The Applicant is admittedly a tour operator. But the question on which the advance ruling is sought is whether it should continue to be classified as a tour operator when it merely arranges the client’s accommodation in hotels. lt is not unusual for tour operators to bulk book rooms in hotels and release a few of them to clients who either do not book for the tour or prefer to reach by own arrangement and pay only for the accommodation. Arranging accommodation may also be a standalone business. Such a service cannot be classified as tour operating. According to Explanation to Sl No. 23(i) of the Rate Notification, tour operator means any person engaged in the planning, scheduling, organising, and arranging tours by any mode of transport. Arranging accommodation might be provided as add-ons, but that is not the essence of the tour operating service. The Applicant’s service under focus in the Application is not, therefore, to be treated as that of a tour operator.

4.2 Neither is it the accommodation service as classified under SAC 996311. Accommodation service under SAC 996311 is limited to the one provided by the hotels, guest house etc. Sl No. 7 of the Rate Notification refers to the accommodation service as classified under SAC 99631 1, and, therefore, leaves no room for the suppliers like the Applicant who arrange such accommodation in hotels.

4.3 The support services covered under Sl No. 23(iii) of the Rate Notification include services classified under SAC 998552. Services covered under SAC 998552 include arranging reservations for accommodation services for domestic accommodation, accommodation abroad etc. The Applicant’s supply is specifically covered and, therefore, classifiable under SAC 998552. lt is, therefore, taxable under Sl No. 23(iii) of the Rate Notification, and the Applicant is eligible to claim the input tax credit as admissible under the law.

4.4 Since the Applicant’s supply is specifically covered under SAC 998552, we find no need to discuss on SAC 9997.

Based on the above discussion, we rule as under.

RULING

The Applicant, if arranges for clients only accommodation in hotels, is supplying a service classifiable under SAC 998552. lt is taxable under Sl No. 23(iii) of the Rate Notification, and the Applicant is eligible to claim the input tax credit as admissible under the law.

This Ruling is valid subject to Ire provisions under Section 103until and unless declared void under Section 104(1 ) of the GST Act.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.