Original order of GST AAR of M/s Maini Precision Products Ltd.

Original order of GST AAR of M/s Maini Precision Products Ltd.

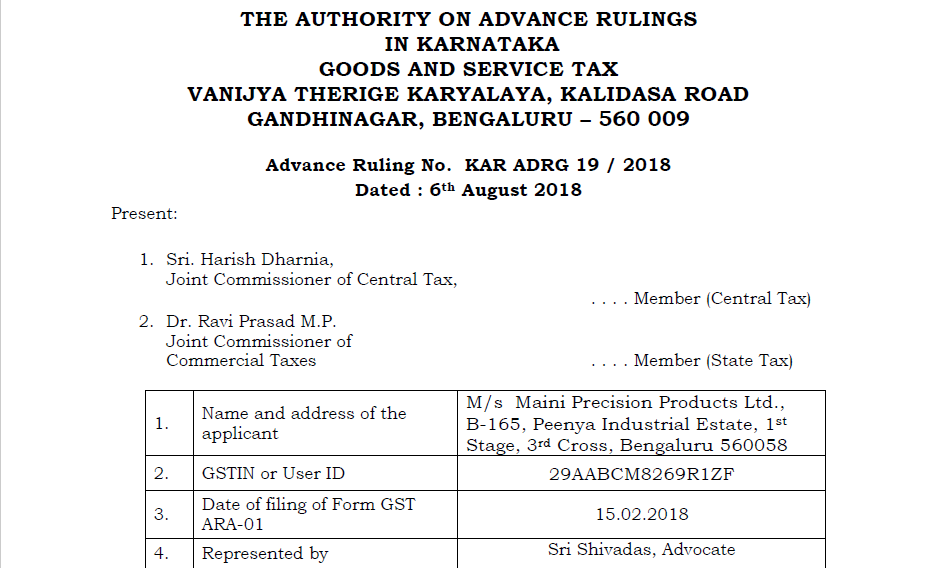

Following is the original order of GST AAR of M/s Maini Precision Products Ltd. in which the case applicability of tax rate is raised by the applicant.

ORDER UNDER SUB-SECTION (4) OF SECTION 98 OF CENTRAL GOODS AND SERVICE TAX ACT, 2017 AND UNDER SUB-SECTION (4) OF SECTION 98 OF KARNATAKA GOODS AND SERVICES TAX ACT, 2017 AND SECTION 20 OF THE INTEGRATED GOODS AND SERVICES TAX ACT, 2017

1. M/s Maini Precision Products Ltd, (called as the „Applicant‟ hereinafter), having its registered office at B-165, Peenya Industrial Estate, 1st Stage, 3rd Cross, Bengaluru 560058, having GSTIN number 29AABCM8269R1ZF, has filed an application for Advance Ruling under Section 97 of CGST Act, 2017, KGST Act, 2017 read with Rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01 discharging the fee of Rs.5,000-00 each under the CGST Act and the KGST Act.

2. The Applicant is a private limited company engaged in the manufacture and supply of High Precision Components and Assemblies, catering to a global clientele in the automotive, industrial and aerospace sectors. The applicant manufactures and supplies a wide range of products including sub-assembly products, precision machined components, industrial castings, metal forgings, vacuum formed parts, engine parts, transmission parts, parts of fuel injection pumps. The question on which advance ruling is sought is as follows:

(I) “Whether the „Parts of Fuel Injection Pumps‟ are classifiable under Tariff Heading 8413 91 90?

(II) Whether the applicable entry in Notification )1/ 2017 – Integrated Tax (Rate), is 453 of Schedule III, for parts of fuel injection pumps, attracting a levy of 18%?

3. The applicant furnishes some facts relevant to the stated activity:

a. The applicant states that he is engaged in the manufacture and supply of High Precision Components and Assemblies, catering to a global clientele in the automotive, industrial and aerospace sectors. The applicant manufactures and supplies a wide range of products including sub-assembly products, precision machined components, industrial castings, metal forgings, vacuum formed parts, engine parts, transmission parts, parts of fuel injection pumps.

b. The applicant submitted that section 97(2)(b) of the KGST Act provides that the question in respect of which Advance Ruling is sought shall be inter-alia in respect of the applicability of a notification issued under the provisions of the GST Act and in respect of determining the classification of goods to be supplied by the applicant and since the applicant is seeking to determine the applicability of Schedule I of Notification No. 01/2017- I.Tax (Rate) dated 28.06.2017 to the supplies of „parts of fuel injection pumps‟ to be made by the applicant and consequently, the rate of tax applicable on such supplies, their application is maintainable.

c. The applicant submits that Explanation (iii) of Notification No.01/2017- IGST (Rate) provides that “Tariff item”, “sub-heading”, “heading” and “Chapter” shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975. Further, Explanation (iv) provides that the rules for interpretation of the First Schedule to the Customs Tariff Act, 1975 including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this Notification.

d. The applicant submits that the application is preferred for the purpose of adoption of the appropriate rate of tax as different goods falling under Heading 8413 have been placed under various Schedules Sl. No. 231 of Schedule I, Sl. No. 192 of Schedule II or Sl. No. 317A of Schedule III and Sl. No. 117 of Schedule IV of Notification No. 1/ 2017 – Integrated Tax (Rate). Further Sl. No. 453 of Schedule III covers goods falling under any Chapter which are not covered by any of the entries in Schedule I, II, IV, V and VI also becomes relevant for the Heading 8413.

e. The applicant submits that „parts of the fuel injection pumps for diesel engines‟ shall fall under Tariff Entry 8413 91 90. He has reproduced the entries pertaining to the Heading 8413 in the Customs Tariff Import Schedule for reference. The applicant claims that it becomes evident that the said parts of the „fuel injection pumps for diesel engines‟ shall fall under the head 8413 91 which deals with “parts” of pumps. Under the head, the „parts of the fuel injection pumps for diesel engines‟ shall fall under entry 8413 91 90 as „Other‟ because it is not classifiable under any other sub-headings.

Download the copy of the order by clicking the below Image for the case of AAR, Karnataka: M/s Maini Precision Products Ltd.:

f. The applicant submits that the product proposed to be supplied shall undisputedly be covered under Tariff Heading 8413 91 under Section XVI of the Customs Tariff Act, 1975, which deals with „Parts of Pumps‟ and specific Tariff Item numbers are provided for parts of Reciprocating Pumps, Centrifugal Pumps, Deep well turbine pumps and of other rotary pumps, Hand pumps for handling water. Tariff Heading 8413 91 90 pertains to „Other‟ sub-classification of „parts of Pumps”.

g. The applicant states that it is understood that the fuel injection pumps are classifiable under Tariff Heading 8413 30 10, which are not being manufactured by the applicant. The applicant states that he specifically manufactures „parts of fuel injection pumps‟, not covered in the entry of tariff heading 8413 30 10.

h. Schedule I of the Notification No.1/ 2017 – Integrated Tax (Rate) provides for the list of goods that attract IGST at the rate of 5%. Entry 231 of the Notification reads as below:

| 231. | 8413, 8413 91 | Hand Pumps and parts thereof |

The parts supplied in the instant case are not parts of Hand Pumps and hence this entry is prima facie inapplicable although it deals with “parts of pumps”.

i. Schedule II consists of goods attracting IGST @ 12% and includes the following

| 192. | 8413 | Power driven pumps primarily designed for handling water, namely, centrifugal pumps (horizontal and vertical), deep tube-well turbine pumps, submersible pumps, axial flow and mixed flow vertical pumps. |

The above entry in Schedule II covers certain pumps falling under 8413, but does not include the parts of such pumps.

j. Schedule IV of the Notification provides the list of goods that attract IGST at the rate of 28%. Entry 117 of the Notification reads as below

| 117. | 8413 | Pumps for dispensing fuel or lubricants of the type used in filling stations or garages [8413 11], Fuel, lubricating or cooling medium pumps for internal combustion piston engines [8413 30] |

The applicant submits that while the above entry does pertain to „fuel injection pumps‟, this entry does not pertain to „parts of such fuel injection pumps‟. Hence the entry shall be rendered inapplicable.

k. Sl. No. 317A was inserted in Schedule III (which pertains to goods attracting 18% IGST) by Notification No. 43/ 2017 – Integrated Tax (Rate) dated 14.11.2017 and reads as under:

| 317A. | 8413 | Concrete pumps [8413 40 00], other rotary positive displacement pumps [8413 60] |

The above entry also does not cover „pumps‟ falling under 8413 91.

l. In furtherance to the discussion of inapplicability of the above entries in Schedules I, II, III and IV, the applicant submits that „parts of pumps‟ falling under 8413 91 do not find specific mention in any other the Schedules of the Notification No. 1 / 2017 – Integrated tax (Rate). However, for those goods which are not specified in Schedule I, II, IV, V or VI, Entry 453 of Schedule III of the Notification reads as below

| 453. | Any Chapter | Goods which are not specified in Schedule I, II, IV, V or VI |

The applicant submits that the „parts of the fuel injection pumps for diesel engines‟, not being specifically classified elsewhere would therefore fall within the ambit of Entry 453 of Schedule III and supply of „parts of the fuel injection pumps for diesel engines‟ attracts a levy of 18% GST.

4. FINDINGS & DISCUSSION:

(a) The contention of the applicant is examined. The goods dealt by the applicant are „parts of the fuel injection pumps for diesel engines‟. The parts of pumps for liquids, whether or not fitted with a measuring device‟ are covered under the heading 8413 91.

(b) The goods covered under heading 8413 91 are verified and found the sub-heading 8413 91 covers the following goods

| 8413 91 | Parts of pumps |

| 8413 91 10 | Parts of reciprocating pumps |

| 8413 91 20 | Parts of Centrifugal pumps |

| 8413 91 30 | Parts of deep well turbine pumps and of other rotary pumps |

| 8413 91 40 | Parts of hand pump for handling water |

| 8413 91 90 | Other |

Since parts of fuel injection pumps for diesel engines are parts of pumps, but are neither covered under HS Codes 8413 91 10 or 8413 91 20 or 8413 91 30 or 8413 91 40, they have to be covered under the residual entry 8413 91 90. Hence “Parts of Fuel injection pumps for diesel engines” are covered under HS Code 8413 91 90.

(c) Fuel injection pumps for diesel engines are covered under the HS Code 8413 30 10. These pumps are covered under Schedule IV attracting a tax of 28% and the entry reads as under:

| 117. | 8413 | Pumps for dispensing fuel or lubricants of the type used in filling stations or garages [8413 11], Fuel, lubricating or cooling medium pumps for internal combustion piston engines [8413 30], concrete pumps [8413 40 00], other rotary positive displacement pumps [8413 60], [other than hand pumps falling under tariff item 8413 11 10] |

It is seen from the contentions of the applicant that what is supplied is not the fuel injection pumps, but parts of the same and since parts are not covered under this entry, the same cannot be covered under this entry.

(d) Since the goods supplied by the applicant is neither a hand pump or a part of it, the same cannot be covered under entry 231 of Schedule I of the Notification No.1/ 2017 – Integrated tax (Rate) dated 28.06.2017 attracting 5% IGST. Further, since the goods supplied is not Power driven pumps primarily designed for handling water, the same cannot be covered under entry 192 of Schedule II of the Notification No.1/ 2017 – Integrated tax (Rate) dated 28.06.2017 attracting 12% IGST.

(e) The Schedules of the Notification No.1/ 2017 – Integrated tax (Rate) dated 28.06.2017 were verified and found that there is no other entry in Schedule I or II or IV or V or VI which covers the entry 8413 91 90.

(f) Sl. No. 317A was inserted in Schedule III (which pertains to goods attracting 18% IGST) by Notification No. 43/ 2017 – Integrated Tax (Rate) dated 14.11.2017 and reads as under:

| 317A. | 8413 | Concrete pumps [8413 40 00], other rotary positive displacement pumps [8413 60] |

The above entry also does not cover „part of pumps‟ falling under 8413 91.

(g) The entry no. 453 of the Schedule III of Notification No.1/ 2017 – Integrated tax (Rate) dated 28.06.2017 reads as under:

| 453. | Any Chapter | Goods which are not specified in Schedule I, II, IV, V or VI |

Since the goods “Parts of fuel injection pumps” are not covered under any of the entries in Schedule I or Schedule II or Schedule IV or Schedule V or Schedule VI, and also under any other entries of Schedule III, the same needs to be covered under this entry 453 of Schedule III of Notification No.1/ 2017 – Integrated tax (Rate) dated 28.06.2017 and all goods covered under Schedule III of the aforesaid Notification attracts IGST at the rate of 18%.

Ruling:

1. The “Parts of Fuel Injection Pumps for diesel engines” are classifiable under Tariff Heading 8413 91 90 as per the Customs Tariff Act, 1975.

2. The “Parts of Fuel Injection Pumps for diesel engines” are covered under the entry no. 453 of Schedule III of Notification No.1/ 2017 – Integrated tax (Rate) dated 28.06.2017 and hence liable to tax at 18% under the Integrated Goods and Services Tax Act, 2017.

Source: Karnataka GST

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.