Original order of GST AAR of M/s. Modern Food Enterprise Pvt. Ltd.

Original order of GST AAR of M/s. Modern Food Enterprise Pvt. Ltd.

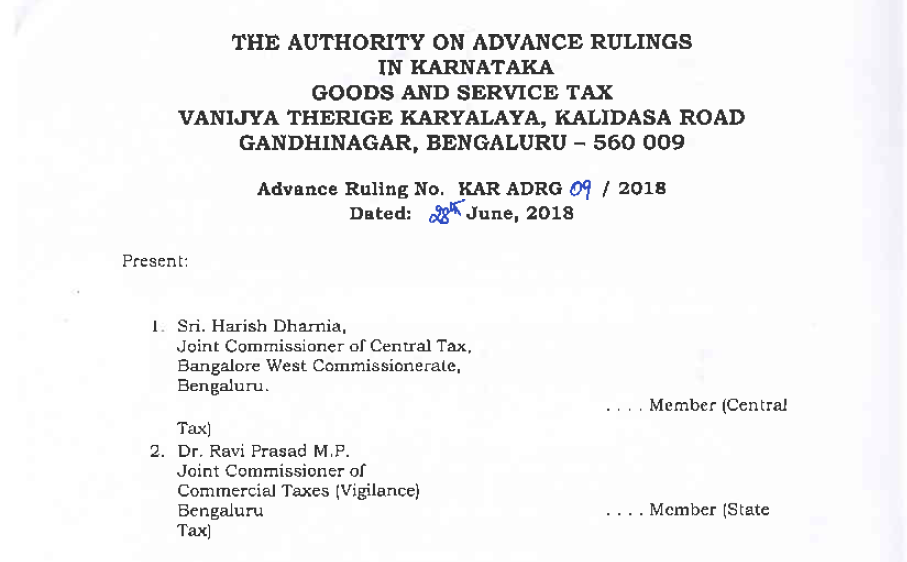

In the GST AAR of M/s. Modern Food Enterprise Pvt. Ltd. The applicant M/s. Modern Food Enterprise Pvt. Ltd. has raised the question regarding the classification and applicability under GST. Following is the order:

Applicant is a manufacturer of ‘Classic Malabar Parota’ & ‘Whole Wheat Malabar Parota’. The major ingredients are wheat atta, Edible vegetable oil, Milk solids, Sugar, Salt, Yeast etc. According to them, these products qualify as bread classifiable under Heading 1905 and eligible for GST exemption. Hence the applicant requested advance ruling on the following:-

i) Classification of ‘Classic Malabar Parota’ and ‘Whole Wheat Malabar Parota’.

ii) Eligibility of exemption from GST vide Notification No.2/2017 – Central Tax / SRO No.361/2017.

The authorized representative was heard It is stated that ‘Parotta’ is a food product made with maida (fine wheat flour). This literally means layers of cooked dough. Concise Oxford English Dictionary define paratha as a flat, thick piece of unleavened bread fried on a griddle. Since it is an unleavened flat bread prepared by frying, parota is a flatbread. Parotta is a wheat flour based, circular, layered and creamy white traditional bread. Bread is a product prepared by cooking of dough made from flour of any grain, water and salt. The explanatory note to Heading 1905 gives a very wide description of the term ‘bread’ and provides an illustrative list of various kinds of bread included within the scope.

The process of preparation of parotta involved mixing and kneading the dough. The dough prepared is covered with a wet cloth for resting the dough for fermentation. Then dough is divided into small balls and sheeting the small dough and baking the sheeted dough. Half cooked goods cooled to room temperature and packed.

The goods prepared from wheat flour, Edible vegetable oil, Milk solids, Sugar, Salt are in the nature of Parotta. ‘Classic Malabar Parota’ is unleavened, ‘Whole Wheat Malabar Parota’ is leavened with yeast. The impugned goods being in the nature of parotta qualify as flatbread, sold in packed form. In Kayani & Company v. CST [AIR1953 Hyd 252] Karnataka High Court observed that, term ‘bread’ includes all forms of bread which are prepared by moistening, kneading, baking, frying or roasting meal or flour, with or without addition of yeast. Therefore parotta is a variant of bread squarely covered under entry 97 of Notification No.2/2017 – Central Tax / SRO. No.361/2017. Moreover the FSSAI certification classified these items as bread. It is also stated that bread is a general entry which forms a genus, comprising of various species within its ambit. Therefore parotta is a species of bread and the same is eligible for exemption.

The authority examined the case meticulously. Bread is a staple food prepared by cooking dough of flour, water and yeast. Whereas parotta’is prepared by using ghee or oil. The dough is rolled out and brushed with ghee or oil then folded again, brushed with more ghee and folded again. This is then rolled out to a circle and cooked on a buttered griddle. The heat makes the layers of dough puff up slightly, resulting in a more flaky texture.

Download the original copy of GST AAR of M/s. Modern Food Enterprise Pvt. Ltd. By clicking the below image:

As per entry 97 of Notification No.2/2017 – Central Tax / SRO. No.361/2017, only specific commodity ‘Bread branded or otherwise’ covered under HSN 1905 is eligible for exemption. When we apply “commercial parlance test” and in fact ask someone to bring the bread from the market, he will never bring parotta. There is an open market of the commodity where the commodity is commonly traded and the common man who knows the goods according to the meaning given to them in normal usage. As there is substantial distinction between bread and parotta, in preparation, use, taste, digestion, even though both of them are used as food. Therefore the exemption given to the specific commodity under GST tariff ‘Bread branded or otherwise’ is eo nomine exclusively covered under HSN 1905. It has no wider scope to incorporate different food stuff prepared using wheat flour.

As per Schedule III of GST Laws, vide Heading 2106 ‘Food preparations not elsewhere specified or included’ is taxable @18% GST. There is specific exclusions from this heading, for ‘Khakhra, Plain Chapatti or Roti, Idli / Dosa batter, and included under 5% category. Even though ‘Chapati’ is unleavened flatbread prepared from whole wheat flour or maida, it is specifically included under heading 2106 and reduced the tax rate from 18% to 5%.Therefore the word ‘Food Preparations’ connotes preparations for use, either directly or after processing such as cooking for human consumption. Therefore all food preparations which are not specifically mentioned in any other entry squarely comes under Heading 2106. The plain language used in the heading does not need an interpreter, absolute sententia expositore non indiget.

The case pointed out by the petitioner ie, Kayani & Company v. CST [AIR1953 Hyd 252] the appellant requested to direct the sales tax commissioner not to collect tax on ‘double roti, Parata and shirmal’ and while giving verdict Hon’ble Court excluded ‘Parata’ and gave exemption from tax only to double roti and shirmal only. There is no doubt that Parata comes under the category of ‘Food preparations not elsewhere specified or included’.

In view of the observations stated above, the following rulings are issued:-

i) ‘Classic Malabar Parota’ and ‘Whole Wheat Malabar Parota’ classified under Schedule III of GST Laws, vide Heading 2106 ‘Food preparations not elsewhere specified or included’ and is taxable @18% GST.

ii) Eligibility of exemption from GST vide Notification No.2/2017 – Central Tax / SRO No.361/2017 is applicable only for specific commodity ‘Bread branded or otherwise’ covered under HSN 1905.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.