Park Remission of duty and Warning to Commissioner

Table of Contents

Case Covered:

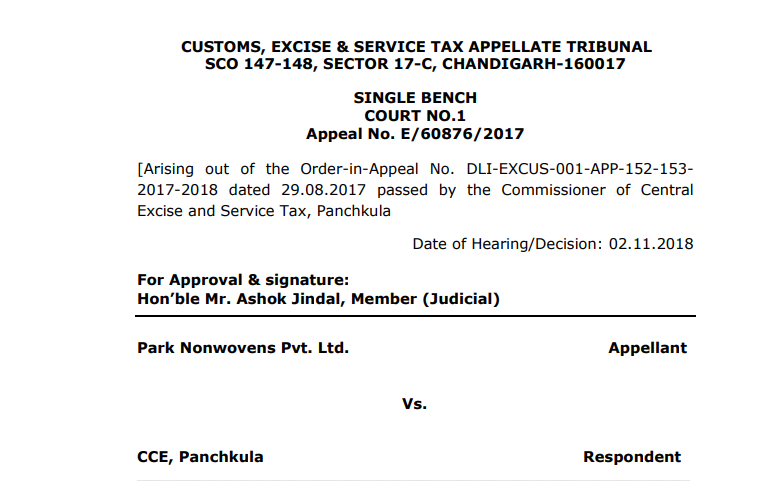

Park Nonwovens Pvt. Ltd.

Versus

CCE, Panchkula

Read the full text of the case here.

Introduction:

The above cited case which was argued by me relates to remission of duty on final products,semi-finished goods and work-in-progress due to fire in the factory due to a natural cause beyond the control of the assessee. Remission was rejected by the jurisdictional Commissioner and the same was allowed by the Hon’ble CESTAT. Another SCN for reversal of input Cenvat on remitted goods issued by Jurisdictional ADC which were against the assessee and filed the appeal before the Hon’ble Comm. (A).In the meantime hearing of Hon’ble CESTAT come argued by me and allow the appeal for both remission of duty and no reversal required as per cited judgement. Intimation of order given to Com(A) for allow the appeal by Hon’ble CESTAT ,Com(A) dismissed the appeal and confirm for reversal of Input Cenvat. Again filed an appeal before Hon’ble CESTAT and allow the appeal with a warning to Com(A) do not against the order of the superior court.

Facts of the case:

The appellant is in appeal against the impugned order wherein cenvat credit sought to be reversed on inputs contained in work in progress by way of impugned order.

The brief facts of the case are that on 31.05.2013 fire took place in the factory premises of the appellant wherein, certain inputs issued for work in progress, semi finished goods and finished goods were destroyed. The appellant filed claim of remission of duty under Rule 21 of the Central Excise Rules, 2002, for semi finished goods and finished goods lost in fire. The ld. Commissioner (A) rejected their claim of remission of duty but on appeal before this Tribunal, this Tribunal allowed the remission of claim of duty. Later on, a show cause notice was issued to the appellant for recovery of cenvat credit on inputs contained in semi finished goods and finished goods which lost in fire. The matter was adjudicated and cenvat credit on inputs sought to be recovered in semi finished goods lost in fire by way of impugned order. Against the said order, the appellant is before me.

Observations of the court:

Considering the fact that the said issue has already been settled by this Tribunal in appellant’s own case while entertaining the claim of remission of duty by this Tribunal vide Final Order No. A/60318/2017- SM(BR) dated 01.03.2017 wherein it has been held that the appellant is not required to reverse the cenvat credit contained in work in progress finished goods and semi finished goods. Taking note that the said order which has been accepted by the Revenue, the ld. Commissioner (A) was not required to pass the impugned order for recovery of cenvat credit on inputs contained in work in progress of semi finished goods which shows that the ld. Commissioner (A) have no regard to the order passed by this Tribunal, I find that recently the Hon’ble High Court of Karnataka in the case of Excel Health Corporation India Pvt. Ltd. vs UOI in writ Petition No. 37514/2017 dated 22.10.2018 observed that the ld. Commissioner (A) has not given any regard to the Tribunal’s orders imposed a fine of Rs. 1 Lac on the Ld. Commissioner (A). In that circumstances, the Commissioner (A) has not respected the order of this Tribunal required to be penalized. Therefore, the ld. Commissioner (A) is directed to take care in future to avoid any penal action from this Tribunal.

Download the copy:

Advocate Dinesh Verma

Advocate Dinesh Verma