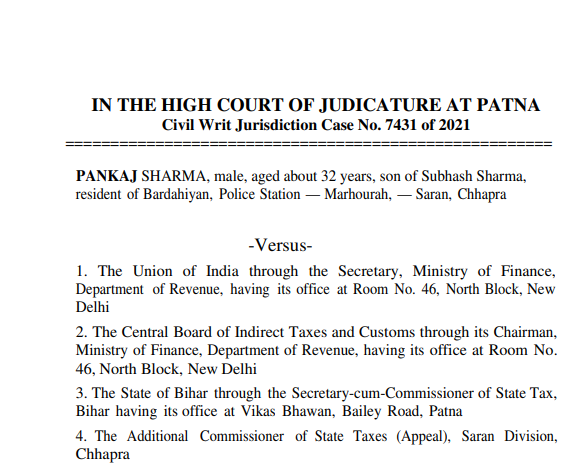

Patna HC in the case of Pankaj Sharma V/s UOI

Case Covered:

Pankaj Sharma

Versus

Union of India

Order of the Hon’ble Court:

Learned counsel for the parties desire the matter be taken up today Petitioner has prayed for the following relief(s):

“(i) For issuance of a writ in the nature of Certiorari or any other appropriate writ or order for quashing of order-in-appeal dated 28/01/2021 passed by the respondent no. 4, the Additional Commissioner of State Taxes (Appeal), Saran Division, Chhapra whereby the appeal of the petitioner was dismissed only on the ground that the appellant has not submitted

the certified copy of the impugned order in time, and further be pleased to quash the assessment order-in- original contained in Ref. No. ZAl003200086l3H dated 06/03/2020 passed under the signature of respondent no. 5 and the consequential demand notice contained in Form GST DRC-07 dated 06/03/2020 levying tax amounting to Rs. 17,11, 111.19/- (Rs. Seventeen lacs, eleven thousand, one hundred and eleven and nineteen parse only) along with interest of Rs. 93,540.67/- (Rs. Ninety-three thousand, five hundred and forty and sixty-seven paise only) and penalty of Rs. 1,76,879.28/- (Rs. One lacs and seventy-six thousand eight hundred and seventy-nine and twenty-eight parse only), totaling Rs. 19,81,531/- (Rs. Nineteen lacs, eighty one thousand, five hundred and thirty one only) for the period April 2018 to March 2019 — Financial Year 2018-19.

(ii) For issuance of an appropriate writ, order, or direction for holding and declaring Section 16(4) of the Central / Bihar Goods and Service Act, 2017 as ultra vires the provisions of Article 14, 19(1)(g) and 300A of the Constitution of India and also being violative of Section 16(1) and (2) and the basic structure of CGST/BGST Act, 2017.

(iii) For issuance of an appropriate writ, order, or direction for holding and declaring the Rule 61(5) of the Central / Bihar Goods and Service Rules, 2017 as amended by notification no. 49/2019 with the retrospective date of 01.07.2017, as ultra vires the provisions of Article 14, 19(1)(g) and 300A of the Constitution of India and also being violative of Section 16(1) and (2) and the basic structure of CGST/BGST Act, 2017.

(iv) In alternate be pleased to hold and declare that Section 16(4) of the CGST/BGST Act, 2017 and amended Rule 61(5) of the CGST/BGST Rules, 2017 are not applicable in the case of the petitioner.

(v) Be pleased to stay the operation of the demand notice contained in Form GST DRC-07 dated 06/03/2020 levying tax amounting to Rs. 17,1l,1ll.19/- (Rs. Seventeen lacs, eleven thousand, one hundred and eleven and nineteen paise only) along with interest of Rs. 93,540.67/- (Rs. Ninety-three thousand, five hundred and forty and sixty-seven paise only) and penalty of Rs. 1,76,879.28/- (Rs. One lacs and seventy-six thousand eight hundred and seventy-nine and twenty-eight paise only), totaling to Rs. 19,81,531/- (Rs. Nineteen lacs, eighty one thousand, five hundred and thirty one only) for the period April 2018 to March 2019 — Financial Year 2018-19, during the pendency of the present writ application.

(vi) For issuance of a writ in the nature of certiorari for quashing of the attachment order dated 12/02/2021 (Annexure-II) issued by respondent no. 5 as being without competence and jurisdiction and violative of mandate of Section 83 of GST Act, and further be pleased to issue the writ of mandamus, or any other appropriate writ or direction, commanding the respondents to withdraw the attachment orders and unfreeze the following bank accounts of the petitioner (1) Bank account no. 60220844946 in the name of Jagdamba hardware, (2) Bank account no. 60332637456 and (3) Bank account no. 60175677940 both in the name of the petitioner Pankaj Sharma, all three bank accounts are with the Bank of Maharashtra, Chhapra branch, and further be pleased to restrain the respondents from taking any coercive action against the petitioner.

(vii) For issuance of any other appropriate writ, order or direction which Your Lordships may deem fit and proper in the facts and circumstances of the case.”

We notice that the impugned order dated 28/01/2021 passed by respondent no. 4, the Additional Commissioner of State Taxes (Appeal), Saran Division, Chhapra, cryptic in nature, needs to be set aside only on the ground that it does not even contain the reasons necessarily required for making the order self explainable and/or comprehensible. The Appellate Authority summarily dismissed the appeal without assigning any cogent reason, thus, seriously prejudicing the petitioner’s cause and case.

It is stated before this Court that the petitioner has already deposited 100 percent of the amount making the appeal mature to be heard on merits.

On the other hand, Shri Vikash Kumar, learned Standing Counsel No. 11, states that he has no objection with the matter being remanded to the appellate authority for consideration of the petitioner’s case on its own merit in accordance with the law.

In view of the same, the petition stands disposed of in the following mutually agreeable terms:-

(a) Impugned order dated 28/01/2021 passed by the respondent no. 4, the Additional Commissioner of State Taxes (Appeal), Saran Division, Chhapra stands set aside;

(b) Petitioner shall appear before the appropriate authority on 16th of June, 2021 at 10:30 A.M., if possible through digital mode;

(c) Opportunity shall be granted to the parties to place on record all essential documents and materials if so required and desired;

(d) Petitioner through learned counsel undertakes to fully cooperate in such proceedings and not take unnecessary adjournment;

(e) The appellate authority shall decide the appeal on merits expeditiously, preferably within a period of two months from the date of appearance of the petitioner, in compliance of the principles of natural justice;

(f) Equally, liberty reserved to the parties to take recourse to such other remedies as are otherwise available in accordance with law;

(g) We are hopeful that as and when petitioner takes recourse to such remedies, as are otherwise available in law, before the appropriate forum, the same shall be dealt with, in accordance with law and with reasonable dispatch.

(h) We have not expressed any opinion on merits and all issues are left open;

(i) If possible, proceedings during the time of current Pandemic [Covid-19] would be conducted through digital mode;

(j) Liberty reserved to the petitioner to challenge the order if required and desired.

The instant petition stands disposed of in the aforesaid terms.

Interlocutory Application(s), if any, also stands disposed of.

Learned counsel for the respondents undertakes to communicate the order to the appropriate authority through electronic mode.

Read & Download the Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.