Petition in SC against the composition of GST appellate Tribunal (Pdf Attach)

Cases Covered:

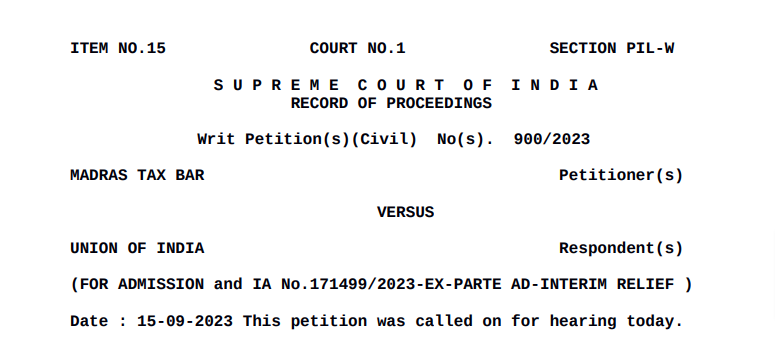

Madras tax bar VS Union of India

Madras tax bar association has challenged the composition of GSTAT

The Madras tax bar association challenged the constitutional validity of section 149 and 150 of FA 2023. These two sections amended section 109 and 110 of CGST Act.

[pdf_attachment file=”1″ name=”optional file name”]

Senior advocate Arvind Datar appeared for the petitioner.

These section belongs to the appointment of members of tribunal.

As per this amendment the advocates are not eligible to apply as judicial members of the tribunal. All over the country advocates are appointed as the members of tribunal to ensure the justice. This is against the constitution.

It is against article 14,19 and 21 read with article 50 of constitution of India. Yesterday only the government released the list of GST tribunals for state. This amendment was suddenly inserted into the Finance Act.

As apparent GST is 6 years old but still government is failed to make the GST tribunals.

They dont want any independent member in Tribunal. Many times its composition is challanged.

Supreme court has already struck down the composition of Tribunals given by the government and asked them to include the advocates with 10 years of practice to be included as the members.(In case of Madras bar association Vs Union of India.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.