PMT 09 effective from 21-4-2020

PMT 09 effective from 21-4-2020

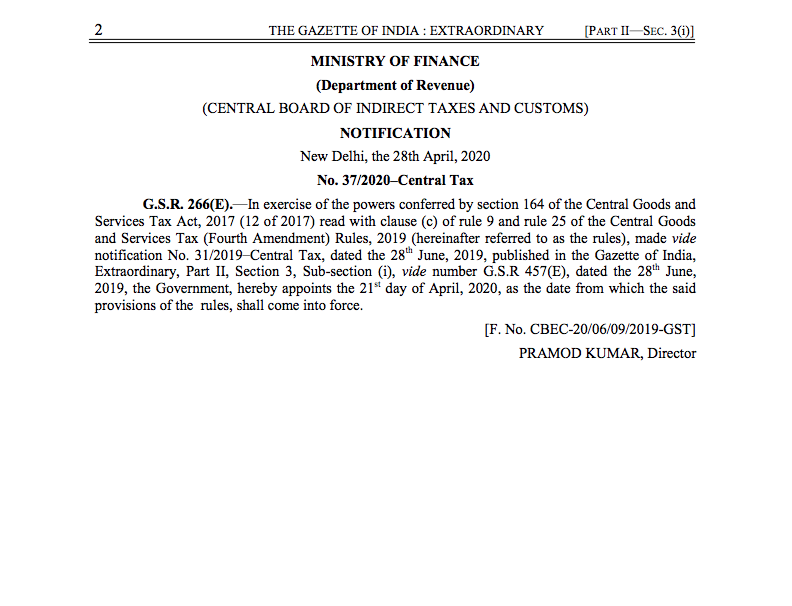

The forms to shift the tax deposited in one head to other is made effective. PMT 09 effective from 21-4-2020.

The day when it was made effective on the portal. You can shift wrongly paid tax using it. Remember if the return is filed wrongly and tax is appropriated towards it, PMT 09 will not be helpful. It cant shift an adjusted tax. You will have to adjust your wrongly adjusted tax via GSTR 3b only.

E.g. Let us say that for the month of March 2019, the interstate sales were Rs 20 lac with IGTS of Rs. 3,60000. Now at the time of filing of return of the month. The sale was booked under the intrastate sales and tax was deposited and adjusted as CGST and SGST. Now you cant change this transaction via PMT 09. If you just deposited the tax in CGST and SGST and now want to shift it to IGST, you can do it by PMT 09. Errors of GSTR 3b will be resolved by using GSTR 3b only.

The problem it was supposed to solve will still be there. This can be corrected by adjusting it by the turnover of the coming months. Like if there is intrastate sales of Rs 200000 in next month, It can be shown Zero and a turnover in IGST can be shown for an equal amount. Now suppose there are no intrastate turnover for the taxpayer. He will never ever be able to correct it.

You can use it to shift the wrongly deposited amount. Like if a tax is deposited in penalty. You can shift it to tax from penalty.

Read the manner of shifting the various amount here.

You can also watch the live demo of this form here.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.