ppt on the Audit, Annual Return & Reconciliations under GST

Ppt on the Audit, Annual Return & Reconciliations under GST

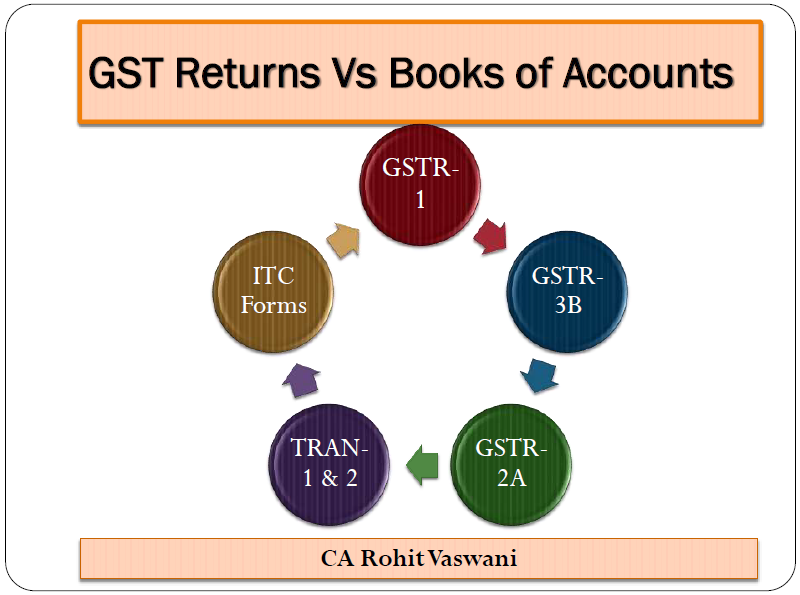

After the format is issued of the Annual return and Audit under GST. There are various discussions going on regarding the reconciliation and representation of the data in these formats. It will make easy for the Audit, Annual Return & Reconciliations under GST. Because these three things are the major factors to determine the scrutiny of the tax returns under GST. So, let us understand the Audit, Annual Return & Reconciliations under GST with the help of the ppt.

The content of the ppt on the Audit, Annual Return & Reconciliations under GST:

“Place of business” as per section 2(85) of the CGST Act,

“place of business” includes-

(a) a place from where the business is ordinarily carried on and includes a warehouse, a godown or any

other places where a taxable person stores his goods, supplies or receives goods or services or both; or

(b) a place where a taxable person maintains his books of account; or

(c) a place where a taxable person is engaged in business through an agent, by whatever name called

“Principal place of business” as per section 2(85) of the CGST Act,

“principal place of business” means the place of business specified as the principal place of business in the certificate of registration;

Download the ppt on the Audit, Annual Return & Reconciliations under GST, by clicking the below image:

Reconciliation of Output Tax & ITC Reflection in Balance Sheet:

| Liabilities | Assets |

| ITC Reversible (Non-eligible ITC claimed or excess ITC claimed up to 31st March) | Input Tax Credit (E-Credit Ledger as per PMT-2 of GSTN Portal) |

| GST Payable (GST due but not paid as per returns filed up to 31st March) | ITC Claimable (Eligible credit is not claimed up to 31st March) |

| Excess GST Payable (GST due but not paid up to 31st March) | Excess GST Paid (Output Tax paid up to 31st March) |

| GST E-Cash Ledger (As per PMT-5 of GST Portal) |