Practical Suggestions on Reply to Show Cause Notice Under GST

Table of Contents

- Show Cause Notice‐ Defined

- Master Circular on SCN

- SCN cannot be vague

- Recovery without issuing Show cause notice (SCN)

- Pointers to Reply of Show Cause Notice

- Pointers to Reply of Show Cause Notice‐ Is it a Valid Notice?

- Pointers to Reply of Show Cause Notice

- Notice not to be Invalid if already acted upon

- Modes of Service of Notice‐ Sec 169

- Documentation Identification Number

- Legal Provisions under which notices can be issued

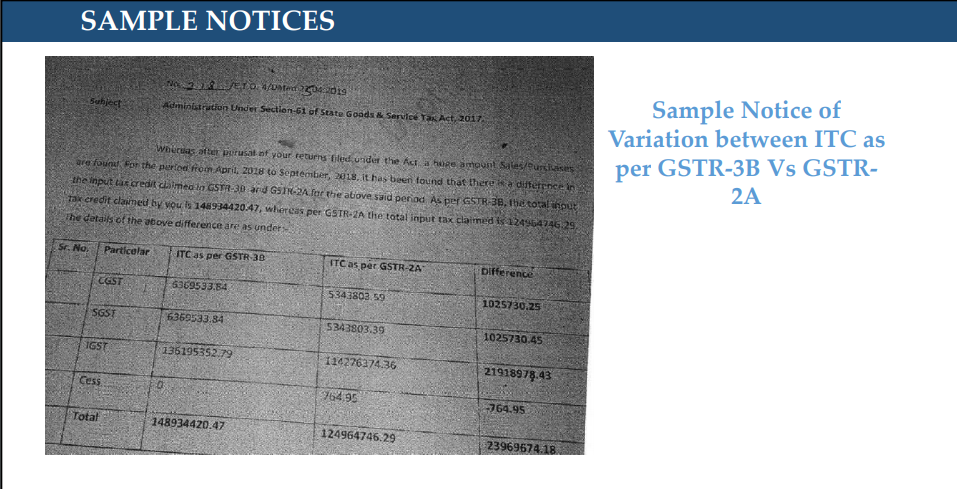

- MOST COMMON NOTICES CURRENTLY BEING ISSUES

- Notice for Recovery Interest

- SAMPLE REPLY TO NOTICES OF VARIATION BETWEEN ITC AS PER GSTR‐3B VS GSTR‐2A

- GST ON MANAGERIAL REMUNERATION?

- Undervaluation can’t be ground for detention and seizure of goods

- Can Lift installed in Building be termed as “Plant & Machinery”

- GST RELIEF MEASURES FOR COVID ‐19 PANDEMIC

- Relief for Composition Taxpayers

- Download the copy:

- Notification No 35/2020 – Central Tax‐ Non-Applicability of Extension

- Notification No 35/2020 – Central Tax‐ Non-Applicability of Extension

- Now we shall provide you with some conditions and case laws where SCN were found to be defective or the adjudicating authority exceeded its legal mandate

- Implementation of the decision to expedite pending refund claims – Instruction No. 2/1/2020‐GST dated 09‐04‐2020

Show Cause Notice‐ Defined

- In order to adhere to the principles of natural justice, before raising any tax demand,

- a notice has to be issued (generally referred to as Show Cause Notice),

- asking the person chargeable with tax to show cause as to why the specified amount of tax should not be demanded from him.

- The issuance of SCN grants an opportunity to such a person to defend himself before adjudication.

- The person to whom such notice has been issued can contest the demand by filing a reply to the show-cause notice and also by appearing before the adjudicating authority personally.

- Only after going through the submissions, Speaking Order can be issued.

Master Circular on SCN

There was a master circular issued by the CBIC dated 19.01.2017, which provided the edifice related to the drafting and necessary contents to be included in the show-cause notice. It contains adjudicating and recovery procedures, their timelines, and relevant legal and statutory provisions. Some of its important points are given below;

- Show-cause Notice (SCN) as the starting point for any legal proceeding (raising demand) against the taxpayer

According to the principles of natural justice, the issuance of show cause notice is a statutory requirement. In the legal language, it is commonly known as “Audi alteram partem,” which means that no one should be condemned unheard i.e everyone should be given an opportunity to explain his point of view. SCN is the basic document issued before taking any punitive action for contravention of Indirect tax laws, or settlement of any tax dispute. It offers the notice an opportunity to submit his oral or written submission before the Adjudicating Authority on the charges leveled against him in the SCN.

Related Topic:

NECESSARY INGREDIENTS & ADJUDICATION OF SHOW CAUSE NOTICE

2. Introduction to the case

The SCN must contain the name, registration number/IEC (if any), address of the person, and the manner in which the said person has been identified in the later text of the notice. It should also contain a brief background/ reasons for starting such proceedings against the notices. Further, the details of verification/investigation conducted/ carried out and the summary of the verification may also be discussed in it.

3. Discussion, facts, and legal framework

The authority issuing the SCN should cogently lay down the legal provisions in respect of which the person has been sent a notice. The provisions listed should be accurate, specific, and clearly articulate the contraventions averred in the SCN. The present facts and evidence related to the notice should be discussed against the backdrop of the legal framework set out in the notice. The show-cause notice should spell out the reasons so as to arrive at the charges of omission and commission against the notice separately.

4. Factual statement and appreciation of evidence

The SCN should state the facts relating to acting of omission and commission pertinent to the initiation of the proceedings against the notice in a most objective and precise manner. All evidence available in form of documents, statements, and material evidence accumulated during the course of inquiry/investigation should be organized serially in a manner so as to establish the charges against the notice. The SCN should contain the grain, not the chaff.

- Quantification of Demand

It is in the interest of both the department and the notice, that the proposed demand is quantified in the SCN. Although there may be cases where it is not possible to quantify the demand at the time of issue of SCN. It will not render the SCN invalid but it would still be desirable that the principles and manner of computing the amounts due from the notice are clearly laid down in this part of the SCN. It is open to the petitioner to seek further clarifications and particulars if the show cause notice seems to be deficient in the same. It provides a benchmark for both the department and the notice, to ascertain the energy level and time to be deployed in the further proceedings and develop a future strategy.

6. Statement of charges

The SCN should have the list of all charges alleged against the notice in a summarized form. The notice should pose the question of why action as provided in law, should not be taken against him.

7. Authority to adjudicate and to issue SCN

The SCN must categorically state the authority to whom the reply to the show-cause notice is required to be answered. In circumstances where seizure of goods is involved, the issue of show cause notice is mandatory before any order for confiscation of goods is passed. The authority to issue SCN and the adjudicating authority is mostly the same. The quantity of the alleged amount to be recovered from the notice is the deciding factor of the adjudicating and SCN issuing authority.

- Show Cause Notice and the Relied Upon Documents to be served

A how-cause notice along with the documents relied upon in the Show Cause Notice has to be served on the assessee for initiation of the adjudication proceedings. Those documents/records which are not relevant in framing charges in the Show Cause Notice are returned under proper receipt to the persons from whom they are seized.

- Settlement of Cases through Settlement Commission

Every show cause notice should have the option that the party can approach the Settlement Commission for the settlement of the case through it.

- Filing of Written submissions

Normally a time limit of thirty days for submission of written reply is provided to the noticee, however, the time limit may be extended by the adjudicating authority on the written request of the assessee.

- Personal hearing

After giving ample opportunity to the notice for replying to the SCN, the adjudicating authority may fix a date and time for a personal hearing in the case and request the assessee to appear before him. The assessee can appear himself or through an authorized representative. At least three opportunities of personal hearing should be given with sufficient interval of time so that the notice may avail a chance of being heard.

- Adjudication order

The adjudication order must be a speaking (self-explanatory) order. The hallmark of a good adjudication order is its capacity, caliber, and astuteness to withstand the test of legality, fairness, and reason at other higher appellate forums. Such an order should contain all the details of the matter, evidence, findings, their implication on the collection of tax, and a well-reasoned unambiguous order.

- Analysis of issues

The Adjudicating Authority has to examine all available evidence, issues, and material on record, and analyze them in the context of alleged charges in the show cause notice. He has also to examine each of the points raised in the reply to the SCN by the notice and accept or reject them with cogent reasoning. After due analysis of facts and law, previous case laws, the generally accepted principles in the trade, adjudicating authority is expected to record his observations and findings in the adjudication order.

- Quantification of demand:

The confirmed amount that is finally demanded from the notice should be clearly quantified and the order portion must contain the provisions of law under which such demand is confirmed and a penalty is imposed. The said amount cannot exceed the earlier amount proposed in the Show Cause Notice.

SCN cannot be vague

- In the case of M/s Brindavan Beverages (P) Ltd [2007(213) ELT487(SC), Hon’ble SC observed that;

- “The show-cause notice is the foundation on which the department has to build up its case. If the allegations in the show cause notice are not specific and are on the contrary vague, lack details, and/or unintelligible that is sufficient to hold that the notice was not given proper opportunity to meet the allegations indicated in the show cause notice.”

Recovery without issuing Show cause notice (SCN)

- M/s. LC Infra Projects Pvt. Ltd. [2019 (8) TMI 84] ‐ Karnataka High Court observed and held that

- The issuance of Show Cause Notice is the sine qua non to proceed with the recovery of interest payable thereon under Section 50 and penalty leviable under the provisions of the Act or the Rules.

- Undisputedly, the interest payable under Section 50 has been determined by the Authority without issuing a Show Cause Notice, which is in breach of principles of natural justice. It is a settled principle of law that any order passed by the quasi‐judicial authorities in contravention of the principles of natural justice, cannot be sustained.

- Thus, it is apparent that the action of the third respondent is perverse and illegal and the same deserves to be set aside.

Related Topic:

GST Show cause notice – 20+ cases covered in one article

Pointers to Reply of Show Cause Notice

- Acknowledging the Receipt of SCN

- While acknowledging the SCN, always remember to put date and time over the acknowledgment copy.

- Donʹt avoid the receipt of SCN

- If an SCN is being served, there is no point in avoiding receiving it. It has to be received and then contested/ replied to. Non-receipt is sometimes considered a service.

- Contemplating any SCN and feeling that GST has to be paid it would be advisable to pay GST before SCN is issued. SCN cannot be issued for the amounts already paid.

Related Topic:

Show cause notice (SCN) in GST

Pointers to Reply of Show Cause Notice‐ Is it a Valid Notice?

- To read the show cause notice thoroughly

- If you have not understood any point mentioned in the notice please read it again and again till you understand.

- Preliminary objections to be raised first with justifications

- Jurisdiction‐Centre/ State, Proper Officer [Ref CBIC Circular No. 3/3/2017 ‐ GST dated 5th July 2017, Circular No. 31/05/2018‐GST dated 09th February 2018]

- Time-Barred: If the service of notice is time-barred, it could be suitably replied with substantiating evidence

- Section 73: Notice to be issued within 2 years and 9 months from the due date of filing annual return

- Section 74: Notice to be issued within 4 years and 6 months from the due date of filing annual return

- invoking extended period of limitation

- If the SCN is beyond 3 years, it will have to be proved that there was no suppression, etc. on the assesseeʹs part so that department cannot invoke the provision of five years.

- The opportunity of Being Heard

- Whenever SCN is intended to enhance the liability of the assessee or reduce the amount of refund, an opportunity of being heard is necessary and it can not be denied by the revenue

- Computation of Demand

- At times the computation of the amount demanded is not available. This can also be requested to be able to reply effectively and also as a process of natural justice.

- Department to adjudicate only on the issue mentioned in the SCN

- Department cannot go beyond what is mentioned in SCN and adjudicate an issue that is not a subject matter of SCN.

Related Topic:

Draft reply to sec 50, interest notices

Pointers to Reply of Show Cause Notice

- Format to Reply

- If Form is prescribed for reply

- If no form is prescribed for filing a reply

- Point‐wise Reply

- Try to provide a reply or explanation to all points covered in SCN and wherever necessary, substantiate the reply with documentary evidence.

- A detailed reply may be submitted along with earlier decided case laws.

- A list of evidence on which you are relying must also be submitted.

- Reply within the stipulated time

- SCN is required to be replied to within the stipulated time mentioned in the notice and must be replied to accordingly

- Adjournment: While efforts must be made to comply within the stipulated time, it would be advisable to seek an extension of time or adjournment which is normally granted.

- Submission of Reply

- the reply may be submitted in person before the authority and get acknowledgment from them or maybe sent by registered post/speed post;

- If it is sent by registered post/speed post it is better to take the delivery report by tracking the same in the post office website;

- Uploaded on Portal‐ Note the Acknowledgement no

- Proper reply forms a foundation for future litigation

- SCNs have to be properly defended and argued for this stage builds the foundation for further actions.

- Assistance of Professional

- If you are not in a position to represent your case personally, better hire a professional to assist you in drafting a reply to SCN and represent your case at the adjudication stage.

Related Topic:

Service of GST notice via email, Valid or not

Notice not to be Invalid if already acted upon

As per section 160(2),

- the service of any notice, order, or communication

- shall not be called in question,

- if the notice, order, or communication, as the case may be,

- has already been acted upon by the person to whom it is issued or

- where such service has not been called in question at or

- in the earlier proceedings commenced, continued, or finalized pursuant to such notice, order, or communication

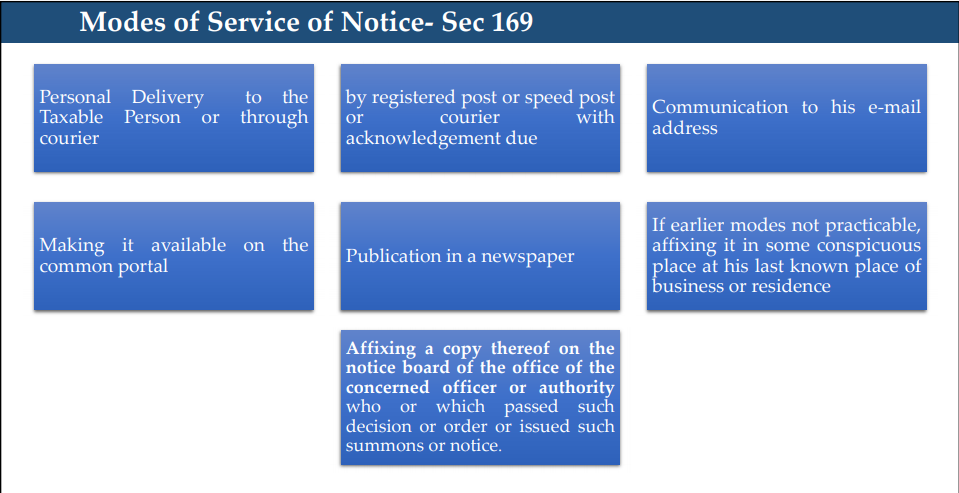

Modes of Service of Notice‐ Sec 169

In the case of Kashi Bartan Bhandar [2018 (11) TMI 556] – Allahabad High Court observed and held as under:

- the Assistant Commissioner could not come to any conclusion that all previous modes as prescribed under Section 169 are not practicable for the service of notice and

- has directly resorted to service by affixation.

- In such a situation, service if any by affixation cannot be regarded as a proper service. Moreover, nothing on record has been brought to establish the time, date, and place and the manner in which service by affixation was resorted to.

- It has been stated that the show cause notice was sent at the e‐mail address of the petitioner on 18.01.2018 but again there is no material to support the said contention and the sending and receiving of any such email has been categorically denied by the petitioner.

- Thus, the petitioner was not served any SCN ‐ the impugned order dated 27.01.2018 is not at all sustainable.

Documentation Identification Number

- CBIC has issued Circular No. 128/47/2019‐GST dated 23‐12‐2019 regarding the generation and quoting of Document Identification Number (DIN)

- Mandatory Generation of DIN: With effect from 24‐12‐2019, the electronic generation and quoting of Document Identification Number (DIN) shall be done in respect of all communications (including e‐mails) sent to taxpayers and other concerned persons by any office of CBIC across the country.

- Document not containing DIN invalid: The CBIC directed that any specified communication which does not bear the electronically generated DIN, shall be treated as invalid and shall be deemed to have never been issued.

- Exceptions:

- In exceptional circumstances communications may be issued without an auto-generated DIN;

- Only after recording the reasons in writing in the concerned file.

- Also, such communication shall expressly state that it has been issued without a DIN.

- Exceptional Circumstances:

- (i) when there are technical difficulties in generating the electronic DIN, or

- (ii) when communication regarding investigation/inquiry, verification, etc. is required to issue at short notice or in urgent situations and the authorized officer is outside the office in the discharge of his official duties.

- Communication issued to be regularized within 15 days

- Any communication issued without an electronically generated DIN in the exigencies mentioned shall be regularized within 15 working days of its issuance, by:

- (i) obtaining the post-facto approval of the immediate superior officer as regards the justification of issuing the communication without the electronically generated DIN;

- (ii) mandatorily electronically generating the DIN after post facto approval; and

- (iii) printing the electronically generated Pro-forma bearing the DIN and filing it in the concerned file.

Related Topic:

Draft reply on 36(4) notices: Download PDF

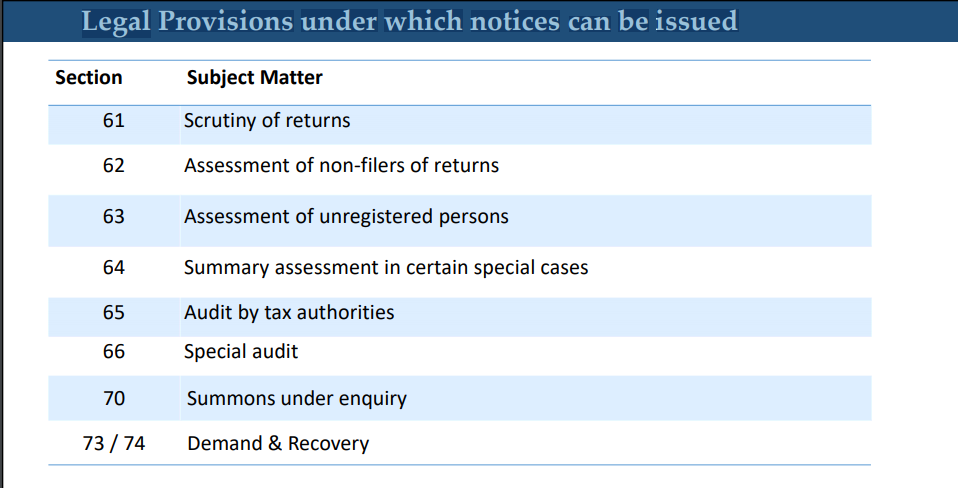

Legal Provisions under which notices can be issued

MOST COMMON NOTICES CURRENTLY BEING ISSUES

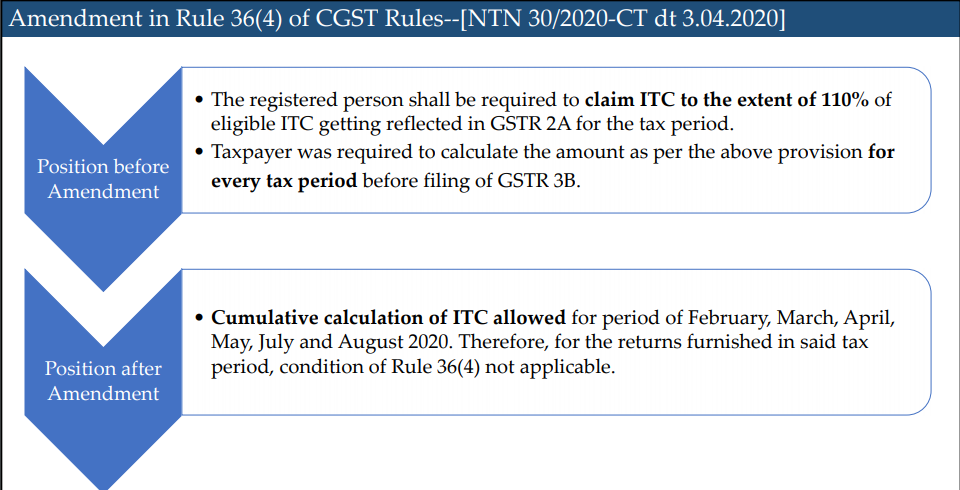

- Mismatch in GSTR‐2A vs ITC claimed in GSTR‐3B‐ Non-Compliance of Rule 36(4)

- Mismatch in GSTR‐1 vs GSTR‐3B

- GST audit to be conducted by GST Department u/s 65

- Notice for recovery of Interest on delayed payment of tax

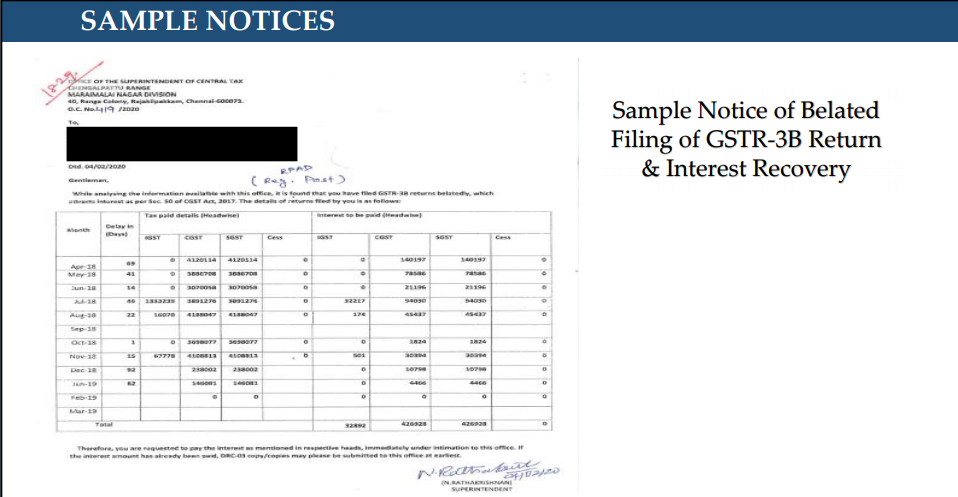

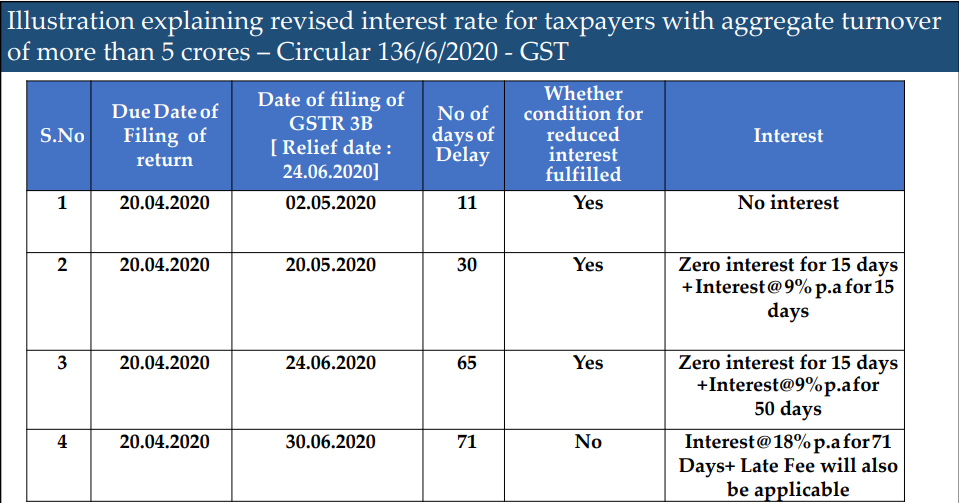

Notice for Recovery Interest

- Earlier, different opinions on whether interest would be charged on gross or net tax liability

- Judgment of Telangana & Andhra Pradesh High Court

- M/s Megha Engineering and Infrastructures Ltd. [2019 (4) TMI 1319]

- Proviso inserted in section 50(1) for calculation of interest liability on net basis prospectively – but not notified till date

- Judgment of Madras High Court

- M/s. Reflex Industries Limited [2020 (2) TMI 794]

- 39th GST Council Meeting

- Interest to be paid on net tax liability retrospectively

SAMPLE REPLY TO NOTICES OF VARIATION BETWEEN ITC AS PER GSTR‐3B VS GSTR‐2A

- GSTR‐2A has only domestic ITC while figures taken from GSTR‐3B includes total ITC availed including Imports, RCM, ISD credit, and Other ITC

- Sharing the GSTR‐2A Reco for the Period

- In case there is any variation, follow up action on the same should be included in the reply

GST ON MANAGERIAL REMUNERATION?

- Re: M/s. Alcon Consulting Engineers (India) Pvt. Ltd. [2019 (10) TMI 793] & M/s Clay Craft India Private Limited [RAJ/AAR/2019‐20/33],

- It was held that the remuneration to the Directors paid by the applicant are not covered under clause (1) of the Schedule III to the CGST Act, 2017, as the Director is not the employee of the Company.

- Managerial remuneration is liable to GST and should be paid under RCM as per Sec 9(3) of GST

Who is an Employee?

- No Definition under GST

- Employer‐Employee Relationship ‐ The employer shall exercise absolute and effective control over the employee, not only the sufficient control.

- CBIC in Service tax regime ‐ When a director receives payment in his personal capacity, the same is liable to be taxed in the hands of the director.

- CBIC ‐ [Circular No. 115/09/2009 – ST dated 31‐07‐2009]‐remunerations paid to Managing Director / Directors of companies whether whole‐time or independent when being compensated for their performance as Managing Director/Directors would not be liable to service tax.

- Income Tax‐ Director remuneration is also taxed as income under the head salaries

Undervaluation can’t be ground for detention and seizure of goods

K.P. Sugandh Ltd. Vs. State of Chhattisgarh [2020 (3) TMI 890] ‐ Chhattisgarh High Court observed and held as under:

- The vehicle was intercepted on 14.01.2020. Person‐In Charge carried all the requisite docs.

- The only observation made by the authorities concerned is that the valuation does not seem to have been properly conducted.

- The High Court held that undervaluation of goods in the invoice cannot be a ground for the detention of the goods and vehicle for a proceeding to be drawn under Section 129 of the CGST Act, 2017 read with Rule 138 of the CGST, 2017.

Can Lift installed in Building be termed as “Plant & Machinery”

M/s. Las Palmas Co‐operative Housing Society Limited [2020 (2) TMI 497] ‐ Authority for Advance Ruling, Maharashtra, observed that;

• the applicant plans to replace the existing Lift/Elevator of their society-building along with its supporting structures.

• For that purpose the applicant enters into a contract with the supplier of lift/elevator on the basis of a lump sum contract price.

• The contract entered with the applicant will be considered as ʹworks contractʹ service.

It was held that the erection of the lift/elevator can be done only inside the building structure as an integral part of the building in which the lift is to be installed.

Once the lift is installed and commissioned in the building, it becomes an integral part of the immovable property i.e. the building.

The lift when installed in the building makes the building fit for occupation and becomes a permanent fixture of the building itself. Hence, the same would be considered as immovable property and not ʹplant and machineryʹ.

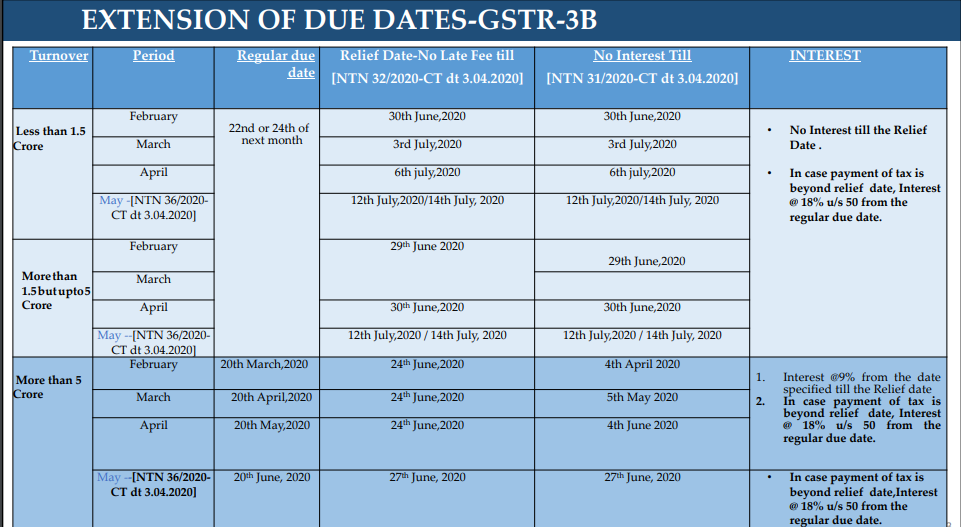

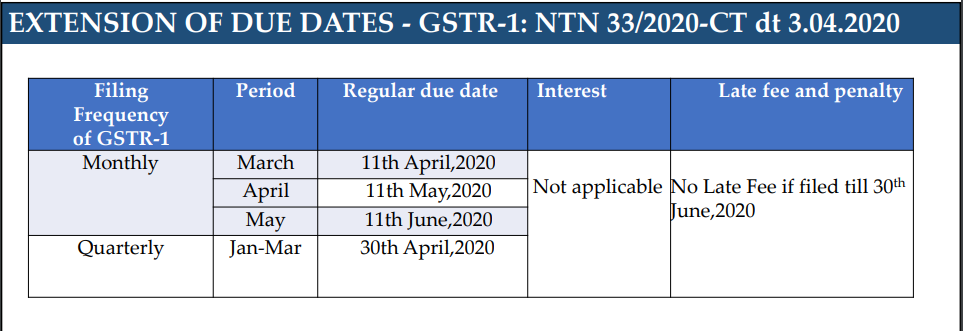

GST RELIEF MEASURES FOR COVID ‐19 PANDEMIC

Relief for Composition Taxpayers

- NTN 30/2020‐CT dt 3.04.2020

- Intimation in respect of opting to pay tax under composition scheme for the FY 2020‐21 can be filed till 30.06.2020 in Form GST CMP‐02.

- Statement in Form GST ITC‐03 in relation to above intimation to be filed up to 31.07.2020

- NTN 34/2020‐CT dt 3.04.2020

- Quarterly Statement: Composition taxpayer or registered person availing the benefit under Notification 2/2019 – Central Tax (Rate) shall be required to furnish details of self‐assessed tax in Form GST CMP‐08 for the quarter ending March 2020 by 07.07.2020 [not within 18 days from the end of quarter].

- Yearly Return: The yearly return for 2019‐20 shall be required to be filed in Form GSTR 4 by the above persons till 15.07.2020.

Download the copy:

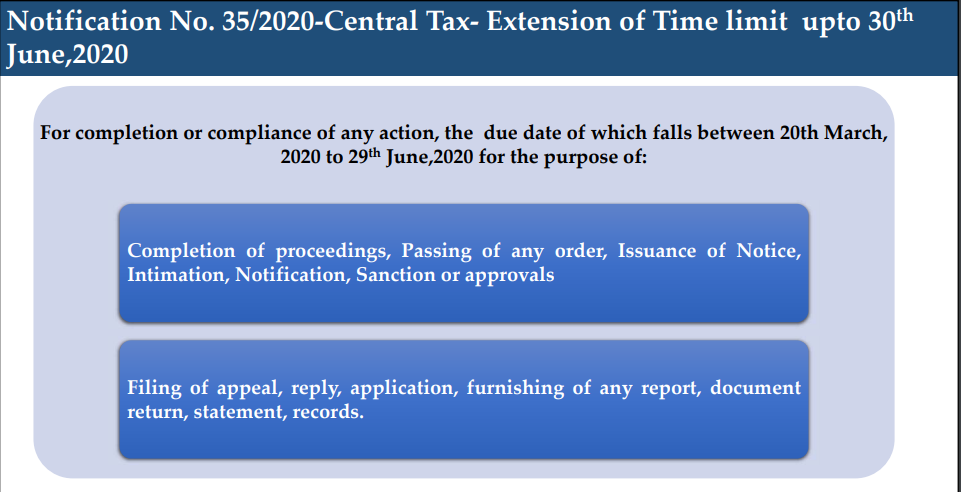

Notification No 35/2020 – Central Tax‐ Non-Applicability of Extension

- E‐Way bill‐ Where e‐way bill expires between 20.03.2020 and 15.04.2020, validity deemed to have been extended till 30.04.2020

- Time and Value of Supply

- GSTR 3B except for Return of TDS deductor, input service distributor, Nonresident taxable person. This person can furnish return for March 2020, April 2020, and May 2020 on or before 30.06.2020

- Registration requirement

- Lapse of composition scheme on exceeding the turnover limit

- Provisions of the casual taxable person and nonresident taxable person in relation to registration

- Tax invoice

- GSTR – 1

Notification No 35/2020 – Central Tax‐ Non-Applicability of Extension

- Levy of Late fees

- Interest on delayed payment of tax

- Power to arrest

- Liability of partners of firm to pay tax

- Penalty

- Detention, seizure, and release of goods and conveyance in transit

Now we shall provide you with some conditions and case laws where SCN were found to be defective or the adjudicating authority exceeded its legal mandate

- The time taken to adjudicate was beyond reason

Although there has been no time period fixed for adjudicating the matter after issuing the SCN, it has to be decided in a reasonable time. By no stretch of imagination 13 years is a reasonable time to adjudicate on SCN notice. In the case of ‘Parle International Limited Vs. Union of India and others, the adjudicating authority had issued show-cause notices dated 01.06.2006 and 28.11.2006. The petitioner responded to the above show-cause notices by submitting detailed replies on 04.09.2006 and 25.01.2007 respectively denying the allegations made against it. After about 13 years the adjudicating authority sent letters to the petitioner regarding fixing of dates for a personal hearing. The petitioner upon getting those letters got aggrieved by the attempt of the respondents to revive the SCN after 13 years. It filed the present writ petition on 06.09.2019 seeking a direction to the respondents for a declaration that such delayed adjudication would render the show-cause notices and consequential proceedings null and void. The honorable court upheld the petitioner’s contention and quashed the impugned order dated 11.11.2019.

- The SCN did not contain the ground on which duty was demanded

The plea taken by the department in the adjudicating order to demand duty from the assessee was not originally present in the show cause notice issued to the assessee. In the case of Caprihans India Ltd v. Commissioner Of Central Excise, the tribunal had to set aside the order on the simple ground that it was beyond the show cause notice served earlier.

- Authorities have traveled beyond the scope of SCN already issued

While issuing the adjudication order the adjudicating authorities have gone beyond the scope of the matter which has been mentioned in the SCN. In the cases of Huhtamaki Ppl Ltd Vs C.C.E. & S.T. (CESTAT Ahmedabad), and M/s Jetlite(INDIA) Limited Vs CCE, New Delhi the tribunal held that the issue which was not originally raised in the SCN, cannot be imported while issuing the adjudication order.

- Time-Barred issuance of the SCN

In the case of DCB Bank Ltd V/S Commissioner of Service Tax-I, Mumbai, the tribunal held that there was no dispute regarding the application of the law of Service Tax, but the department on becoming cognizant of the matter issued the SCN after a period of three and a half years and hence the Petitioner’s appeal was held and the stay order was granted against the Adjudication order.

Implementation of the decision to expedite pending refund claims – Instruction No. 2/1/2020‐GST dated 09‐04‐2020

- All pending GST refunds including IGST refunds shall be expeditiously processed.

- The decision to process pending refund claims has been taken with a view to providing immediate relief to the taxpayers in these difficult times even though the GST Law provides 15 days for issuing acknowledgment or deficiency memos and a total of 60 days for disposing of refunds claims without any liability to pay interest.

- However. due diligence may be done before granting the refunds on merits, considering all the relevant legal provisions and circulars.

- Efforts should be made to dispose of all the pending refund claims by 30th April 2020

CA Chitresh Gupta

CA Chitresh Gupta

Delhi, India