Procedure for Enabling Dealers to Migrate to GST Regime

Procedure for Enabling Dealers to Migrate to GST Regime

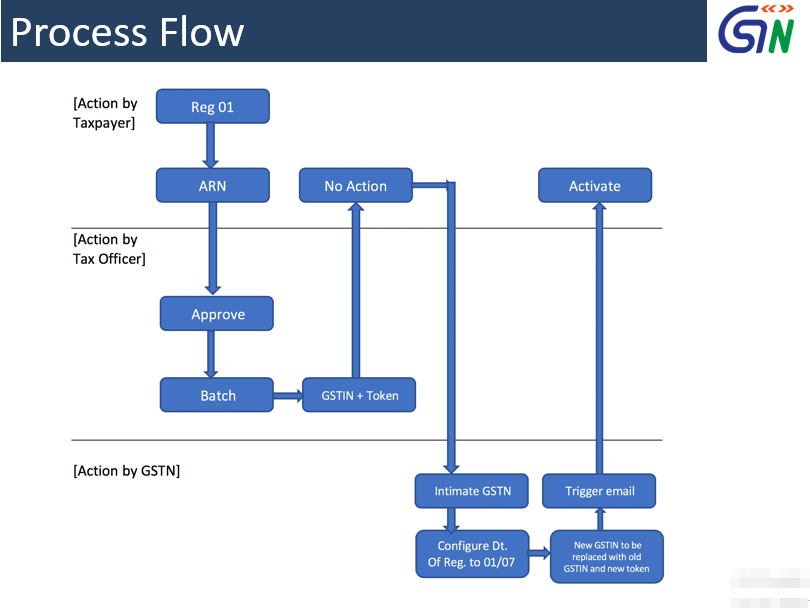

GST Network has published a Powerpoint Presentation in which they have explained the procedure for enabling Dealers to migrate to GST regime.

GST Network’s Approach to Resolve:

State SPOC’s / CBIC to provide the list of GSTIN’s on gstn.nodal@gstn.org.in. Who have activated part A of the enrolment application and created user id and password.

- Before proceeding ahead states/CBIC to direct the jurisdictional authorities to ensure that the SOP mentioned along with this PPT is understood and actions are taken accordingly.

- Taxpayers to do new Registration as Normal Taxpayer with all the correct details and submit the Registration Form GST REG-01. In the business detail tab, they need to furnish TIN / Central Excise registration no. / Service tax registration no.

- Post-approval of the new registration application, Taxpayer will receive a system generated email with new GSTIN ID and token. The taxpayer needs to ignore the first email as a different GSTIN id will get generated for the new application. The taxpayer needs to send the new GSTIN received + ARN (application reference no) with old GSTIN on migration@gstn.org.in

- Tax Payer shall not use the GSTIN particulars received through the first email for creating User id/Password. He should wait for confirmation form GSTN.

- Once the backend activity of migration is completed. Automated System Generated Email will be sent to Tax Payer mentioning correct Old GSTIN with the request to log in with old GSTIN and token

- Tax Payer is required to login with the received credentials using the first-time login link. https://services.gst.gov.in/services/newlogin and create login credentials for the same.

Download the Full ppt on Procedure for Enabling Dealers to Migrate to GST Regime by clicking on the below Image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.