Procedure in Respect of Return of Expired Drugs or Medicine

Procedure in Respect of Return of Expired Drugs or Medicine

The pharmaceutical sector was valued at US$ 33 billion in 2017. The country’s pharmaceutical industry is expected to expand at a CAGR of 22.4 per cent over 2015–20 to reach US$ 55 billion. India’s pharmaceutical exports stood at US$ 17.27 billion in 2017-18. In 2018-19 these exports are expected to cross US$ 19 billion. So, let us discuss the procedure in Respect of Return of Expired Drugs or Medicine.

India is the largest provider of generic drugs globally. Indian pharmaceutical sector industry supplies over 50 per cent of global demand for various vaccines, 40 per cent of generic demand in the US and 25 per cent of all medicine in UK.

Medicine spending in India is expected to increase at 9-12 per cent CAGR between 2018-22 to US$ 26-30 billion, driven by increasing consumer spending, rapid urbanisation, and raising healthcare insurance among others.

However, the Industry is facing a very daunting challenge of high levels Sales Returns because of Expiry of Drugs supplied earlier to Wholesalers, Dealers or Retailers or Non-Moving Brands over a period of time or withdrawal of certain medicines. According to the Indian Pharmaceutical Alliance (IPA) had noted that the industry annually receives around Rs 3300 to Rs 5500 crore in expired or damaged stocks.

There have been certain confusions over the applicability of GST and it’s procedures. The Confusions are clarified vide Circular No. 72/46/2018-GST dated 26th October 2018.

The said Circular clarified the procedure to be followed in respect of the return of time expired drugs or medicines under the GST laws. The drugs or medicines are sold by the manufacturer to the wholesaler and by the wholesaler to the retailer on the basis of an invoice/bill of supply as the case may be. They have a defined life term which is referred to as the date of expiry and on crossing the date of expiry, are returned back to the manufacturer through the supply chain.

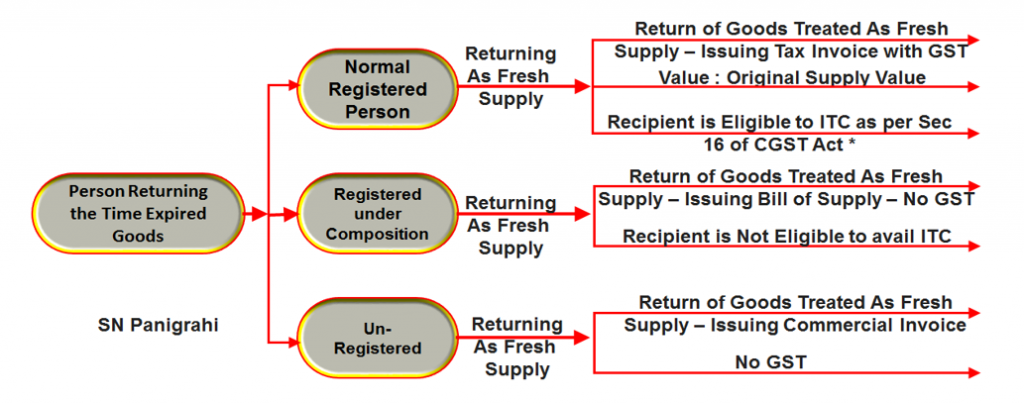

Therefore, the retailer/ wholesaler can follow either of the below-mentioned procedures for the return of the time expired goods:

A. Option : 1

Return of Time Expired Goods to be Treated as Fresh Supply:

a. Person returning the time expired goods is a registered person

- Return of goods to be treated as fresh supply

- Value of the said goods as shown in the invoice on the basis of which the goods were supplied earlier may be taken as the value of such return supply

- Recipient is eligible to avail Input Tax Credit on said return supply subject to section 16 of the CGST Act.

b. Person returning the time expired goods is a composition taxpayer

- Return the said goods by issuing a bill of supply and pay tax at the rate applicable

- Recipient is not eligible to avail ITC of said return supply

c. Person returning the time expired goods is an unregistered person: Recipient may return the said goods by issuing any commercial document without charging any tax.

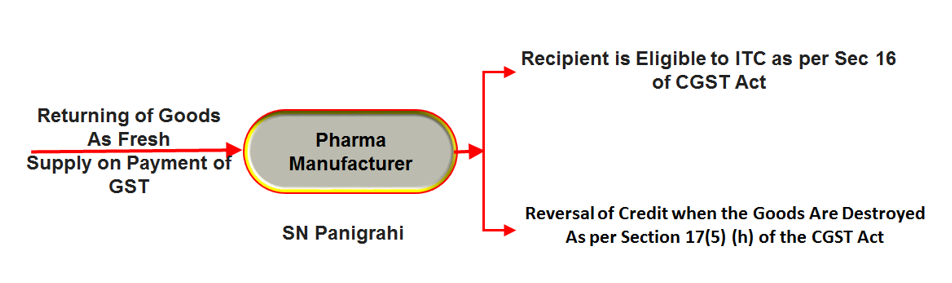

Reversal of Credit when the Goods Are Destroyed by the Manufacturer

Where the time expired goods which have been returned by the retailer/wholesaler are destroyed by the manufacturer, he/she is required to reverse the ITC availed on the return supply in terms of section 17(5) (h) of the CGST Act. However, ITC which is required to be reversed in such scenario is the ITC availed on the return supply and not the ITC that is attributable to the manufacture of such time expired goods.

Illustration: Supposedly, manufacturer has availed ITC of Rs. 10/- at the time of manufacture of medicines valued at Rs. 100/-. At the time of return of such medicine on the account of expiry, the ITC available to the manufacturer on the basis of fresh invoice issued by wholesaler is Rs. 15/-. So, when the time expired goods are destroyed by the manufacturer he would be required to reverse ITC of Rs. 15/- and not of Rs. 10/-.

Note: Most of the cases the Time Expired Goods are Destroyed in a Controlled Manner by the Manufacturer of Pharma / Medicines. Therefore they need to Reverse the Credit.

B. Option : 2

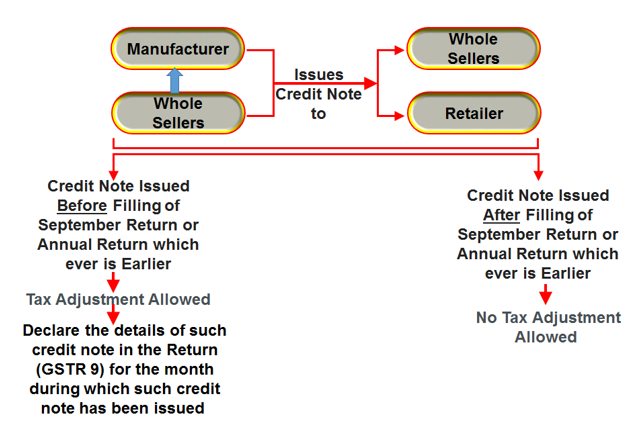

Return of time expired goods by issuing Credit Note:

- As per section 34(1) of the CGST Act, the manufacturer or the wholesaler who has supplied the goods to the wholesaler or retailer, as the case may be, has the option to issue a credit note in relation to the time expired goods returned by the wholesaler or retailer, as the case may be.

- If the credit note is issued within the time limit specified in section 34(2) of the CGST Act, the tax liability may be adjusted by the supplier, provided the person returning the time expired goods has either not availed the ITC or if availed has reversed the ITC so availed against the goods being returned. However, if the time limit has expired, a credit note may still be issued but the tax liability cannot be adjusted by him in his hands

- Further, in case they are returned beyond the time period specified and a credit note is issued, there is no requirement to declare such credit note on the common portal by the supplier as tax liability cannot be adjusted in this case.

The provisions of Section 34, ibid, are reproduced for the benefit of readers as under;

Sec 34. (1) of CGST Act :Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note containing such particulars as may be prescribed.

(2) Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as may be prescribed:

Provided that no reduction in output tax liability of the supplier shall be permitted if the incidence of tax and interest on such supply has been passed on to any other person.

Illustration:

|

Case |

Date of Supply of goods from manufacturer/ wholesaler to wholesaler/ retailer |

Date of return of time expired goods from retailer/wholesaler to wholesaler/manufacturer |

Treatment in terms of tax liability & credit note |

|

Case 1 |

1st July 2017 |

20th September 2018 |

The credit note will be issued by the supplier (manufacturer/wholesaler) and the same to be uploaded by him on the common portal. Subsequently, the tax liability can be adjusted by such supplier provided the recipient (wholesaler/retailer) has either not availed the ITC or if availed has reversed the ITC. |

|

Case 2 |

1st July 2017 |

20th October 2018 |

The credit note will be issued by the supplier (manufacturer/wholesaler) but there is no requirement to upload the same on the common portal. Subsequently, tax liability cannot be adjusted by such supplier. |

Although, this circular discusses the return of expired goods, it may be applicable to goods returned on account of reasons other than the one detailed above.

Comment: Very significant clarification in this circular as it is encouraged to be followed in other sectors also. Interesting to note that the examples do not consider a case where the ‘return supply’ is after Oct 20 (maximum time allowed under section 34 to issue credit note). As such, it appears from this circular that as returns are not by way of credit note, this might be a way to return goods even after the time allowed under section 34 by effecting a ‘return supply’ rather than credit note. It is also interesting that ‘expired goods’ are permitted to avail the same HSN as the ‘original goods’. Much benefit remains to be availed by the interpretation furnished by this circular.

The Procedure Prescribed in this Circular may be adopted not only for Time Expired Pharma Goods but also extended to any type of Sales Return

Circular No. 72/46/2018-GST dated 26th October 2018.