Prosecution in GST and FIR under IPC both can be done simultaneously (Pdf Attach)

Table of Contents

Cases Covered:

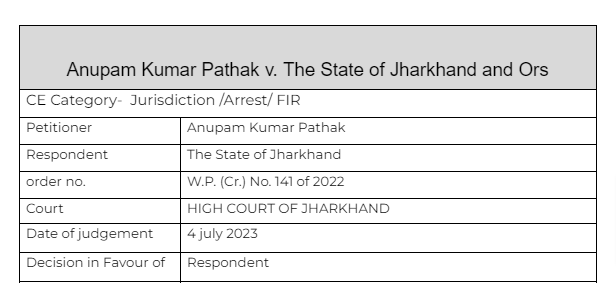

Anupam Kumar Pathak v. The State of Jharkhand and Ors

Citations:

1. Ramesh Chandra Jain & another v. State of Jharkhand

2. The State of Maharashtra & another v. Sayyed Hassan Sayyed Subhan & others

3. Jayant and others v. State of Madhya Pradesh

Facts of the cases:

The petition has been filed for quashing of the First Information Report as well as entire criminal proceeding in connection with Patratu (Bhurkunda) P.S. Case No.45/2021, corresponding to Commercial P.S. Case No.3/2021, registered for the offences under Sections 120B/406/420/471 of the Indian Penal Code and under Sections 132(1)(b), 132(1)(c), 132(1)(e) and 132(1)(f) of the Jharkhand Goods and Services Tax Act, 2017 (hereinafter to be referred to as ‘JGST Act, 2017’), pending in the court of the learned Sub-Judge-II-cum-Special Judge, Economic Offences, Dhanbad.

As such the bank account of the petitioner linked with the GST registration maintained in Punjab National Bank has been freeze. Request has been made to provide I.P. address of the computer by which e- way bill was being generated after registration.

a request has been made for institution of a criminal case under sections 120B/406/420/471 of the Indian Penal Code, and other relevant provisions as also under sections 132 (1)(b), 132(1) (c), 132 (1) (e), 132 (1) (f) of J.G.S.T Act, 2017.

The petitioner submits that when the punishment is prescribed in the Code itself, it is well settled that IPC sections are not attracted when Special Law is there. To buttress this argument, he relied upon the judgment passed by a Coordinate Bench of this Court in Ramesh Chandra Jain & another v. State of Jharkhand in Cr.M.P. No.609/2005, judgment dated 29.08.2012. On these grounds, he submits that the entire criminal proceeding may kindly be quashed.

Observations & Judgement of the court:

Here the main question was whether the proceedings in both GST and IPC can initiate for the one offense?

The Respondent submits that when criminality is made out, Special Law as well as IPC sections are attracted and to buttress this argument, he relied upon paragraphs 7 and 8 of the judgment passed by the Hon’ble Supreme Court in The State of Maharashtra & another v. Sayyed Hassan Sayyed Subhan & others in Criminal Appeal No.1195 of 2018, dated 20.09.2018.

“7. There is no bar to a trial or conviction of an offender under two different enactments, but the bar is only to the punishment of the offender twice for the offence. Where an act or an omission constitutes an offence under two enactments, the offender may be prosecuted and punished under either or both enactments but shall not be liable to be punished twice for the same offence. “

“Provisions as to offences punishable under two or more enactments – Where an act or omission constitutes an offence under two or more enactments, then the offender shall be liable to be prosecuted and punished under either or any of those enactments, but shall not be liable to be punished twice for the same offence.”

Case of Jayant and others v. State of Madhya Pradesh with one analogous case; [(2021) 2 SCC 670] was referred.

Relying on para 21.4 and 21.5 of this judgement the court the prayer was rejected

Read & Download the Full Anupam Kumar Pathak v. The State of Jharkhand and Ors

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.