FAQ’s on QRMP return scheme of GST [Recent Changes]

Table of Contents

- What are the recent changes related to the QRMP Scheme?

- Whats is the QRMP return scheme of GST?

- Who can opt for the QRMP return scheme of GST?

- Who is not eligible for the QRMP return scheme of GST?

- What is the scheme of return filing under the QRMP return scheme of GST?

- What is the fixed sum method?

- How can we apply for the QRMP return scheme of GST?

- What is the migration scheme into the QRMP return scheme of GST?

- How the recipient of a quarterly filer will get the input tax credit?

What are the recent changes related to the QRMP Scheme?

- Auto population of GSTR 3b Liability- GSTR 3b contains the data of sale and ITC. It also calculates the final tax liability. This liability is based on tax payable and ITC received. Now, this data is auto-populated from GSTR 1 or IFF. The auto-populated data is editable. You can revise it upward or downward and file a return with the amended data. But this may be reported to the department.

- Filing of NIL GSTR 1 via SMS- Now GSTR 1 can be filed via SMS. This facility is available for quarterly GSTR 1 also. Only NIL returns can be filed via SMS. You can file it by sending a message in the specified format to 14409. The format of the message is < NIL > space < Return Type (R1) > space< GSTIN > space < Return Period (mmyyyy) >.

Example: NIL R1 07XXXXX1234H8Z6 062021 (where return period must be last month of the quarter)

However, NIL filing through SMS can’t be done in the following scenarios:

•If IFF for Month 1 or 2 of a quarter is in the Submitted stage, but not Filed.

•If invoices are Saved in IFF for Month 1 or 2 of a quarter, which was not submitted or filed by the due date.

- Return of canceled registrations- Taxpayers were facing issues in the filing of returns on cancellation of GST registration. The situation is clarified by CBIC now. You need to file a return for a full quarter if the registration is canceled during a quarter.

Whats is the QRMP return scheme of GST?

The QRMP stands for quarterly return and monthly payment. This is the latest scheme of GST return filing. It is applicable from 1-1-2021.

Who can opt for the QRMP return scheme of GST?

Every registered taxpayer required to file the GSTR 3b and GSTR 1 can opt for it. A composition dealer shifting from composition levy to the normal levy can also opt for it. A person making the exports or SEZ supplies can also opt for this scheme.

Who is not eligible for the QRMP return scheme of GST?

Following tax payers are not eligible for the QRMP Scheme-

- Composition dealer

- ISD

- NRTP

- OIDAR Service provider

- TDS deductor

- TCS deductor

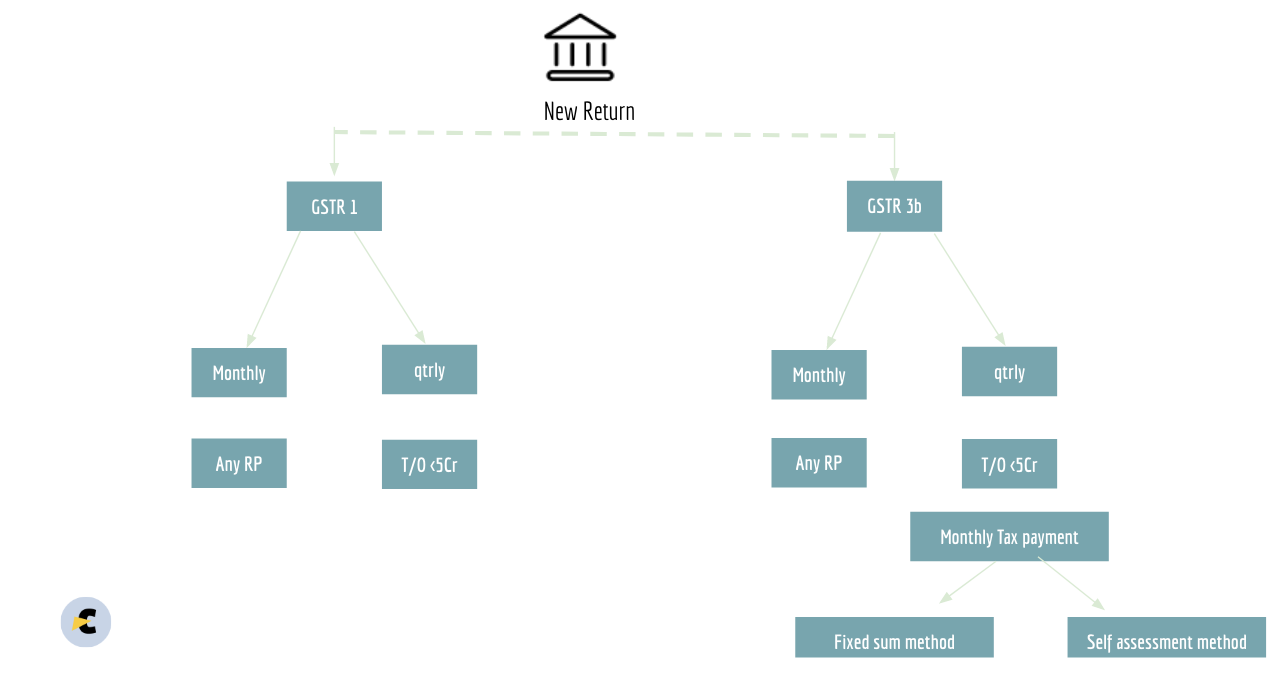

What is the scheme of return filing under the QRMP return scheme of GST?

Some salient features of this scheme are-

- Both GSTR 1 and 3b can be filed on a quarterly basis

- A registered person with a turnover up to 5 crores in the previous financial year can opt for quarterly filing

- In spite of quarterly filing the registered person is eligible to upload invoices using the IFF facility. These invoices will also get auto reflected in GSTR 2A and 2B of the buyer.

- The payment of tax is monthly irrespective of the return filing frequency opted by the taxpayer.

- The tax can be paid by a quarterly filer by fixed sum method or by self-assessment method.

What is the fixed sum method?

It is a payment mechanism for the quarterly filers of GSTR 3b. The registered person in GST can file GSTR 3b quarterly in the new scheme. But the payment of tax is monthly. Now the taxpayers don’t want to make all the calculations for the tax payment as he is required to file the return quarterly. Thus the CBIC introduced this fixed sum payment of tax method. He can pay 35% of the tax paid in the last quarter via cash ledger in the first month of the quarter. Then the same 35% in the second month of the quarter. In the last month of the quarter, he can pay the balance.

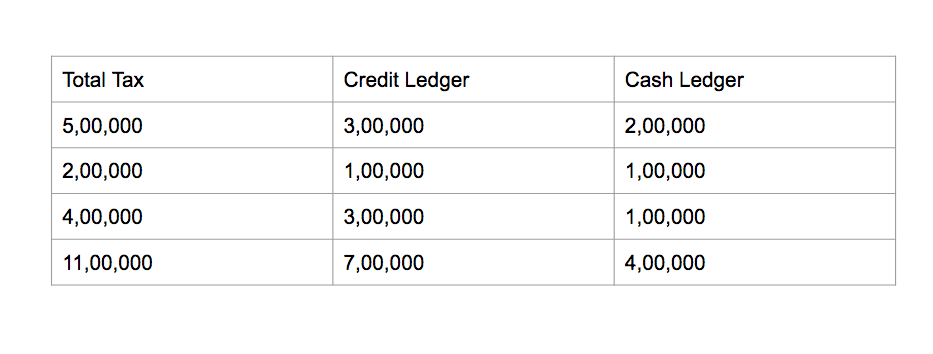

Let us understand it with an example.

The tax paid in the last quarter was.

The tax paid via cash ledger in the last quarter is Rs. 4,00,000.

Now the tax payable in first month= 35%of 4,00,000 = 1,40,000

In the next month of the quarter, the tax payment is = 1,40,000

Now in the last month let us assume the total tax liability was Rs. 5,00,000.

The taxpayer is required to pay Rs.2,20,000 more in the last month and file the return.

How can we apply for the QRMP return scheme of GST?

The taxpayer can opt for it online on the GST portal. The time limit to opt it is from the first day of the second month of the previous quarter to the last day of the first month of the next quarter. There are some conditions to be fulfilled to opt for this scheme.

- All GSTR 3b’s required to be filed till the date should be filed by the taxpayer.

- GSTR 1 shall not have any unsaved data.

- The eligibility for this scheme will be lost if the turnover crosses the threshold in any month.

What is the migration scheme into the QRMP return scheme of GST?

The migration into a new scheme is proposed by GSTN. Taxpayers will auto-shift into the new scheme. The quarterly filers will shift to the quarterly filing. The monthly filers will shift to the monthly filing. But out of these, the eligible taxpayers can change the scheme quarterly. An option to shift into a quarterly scheme is given at the GSTN portal. So you can wait for auto-shift and then can move to the desired scheme.

How the recipient of a quarterly filer will get the input tax credit?

The buyer of a quarterly filer can take the ITC based on auto reflection in GSTR 2A & 2B. The quarterly filer can upload data of invoices on monthly basis. A special facility is provided for it. It is called the IFF facility.

The taxpayer can upload a B2B invoice up to Rs. 50 lac each month using this facility. Thus the ITC of quarterly files is also available to the recipient.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.