| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||

This amendment is effective from 1st day of April, 2023 and applies to assessment year 2023-24 relevant to the previous year 2022-23. It is hereby certified that no person is being adversely affected by giving retrospective effect to these rules.

In the Income-tax Rules, 1962, in Appendix II, in Form ITR-7, in PART-B for the assessment year

commencing on the 1st day of April, 2023—

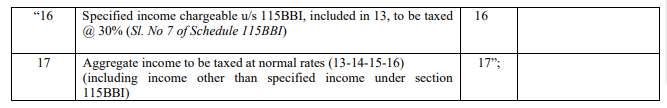

(a) Part B–TI, Part B1, for serial number 16 and entries relating thereto, the following serial number and entries thereto shall be substituted, namely:—

Prem

Prem

designer

Adilabad, India

gst taxation

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.