Litigation on RCM on Ocean freight: 2019

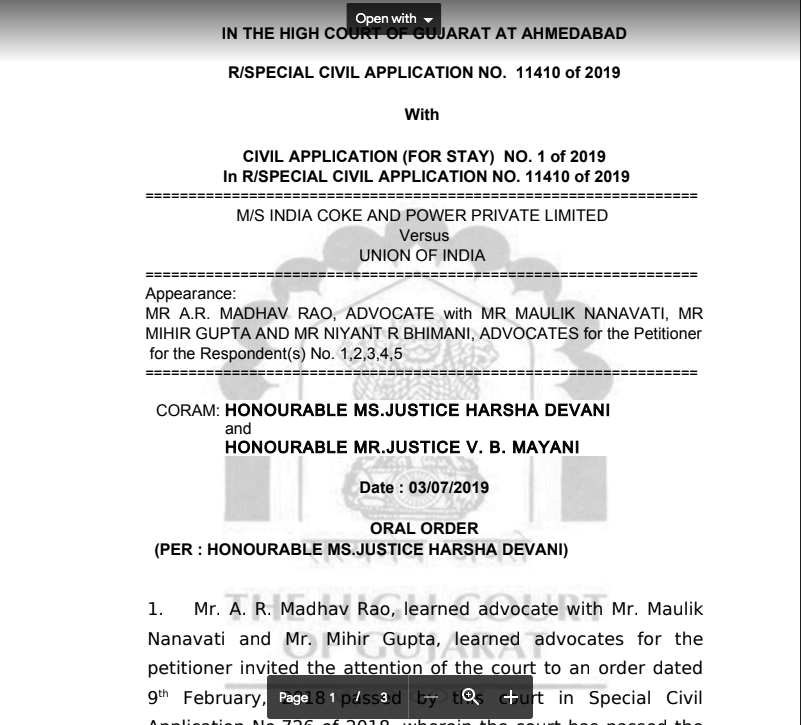

Litigation on RCM on Ocean Freight: From Mohit Minerals to M/s India Coke and power private limited.

It started many months back. The importers were notified by notification no. 10/2017 IGST , entry no. 10. It was under the dispute from day one. Litigation on RCM on Ocean freight is expanding with time.But the litigation started from advance ruling of Mohit Minerals is still in process with the interim relief to M/S INDIA COKE AND POWER PRIVATE LIMITED. Gujrat High court is observing both the cases. Following three points make a strong case in favour of CIF importers.

Related Topic:

[Justin- Notice by Supreme Court] Gujarat High Court Ocean Freight Matters allowing the petitions and pronouncing levy to be ultra vires.

[a] having paid the tax under IGST Act on the entire value of imports; inclusive of the ocean freight, the petitioner cannot be asked to pay tax on the ocean freight all over again under a different notification;

[b] in case of CIF contracts, the service provider and service recipient both are outside the territory of India. No tax on such service can be collected even on reverse charge mechanism, and

[c] in case of High Sea sales, the burden is cast on the petitioner as an importer whereas, the petitioner is not the recipient of the service at all.

An interim relief is given,

“In the meanwhile, no coercive steps shall be taken against the petitioner pursuant to the impugned notification.”

You can read this order here.

The fate of importers is dependent on the outcome of this litigation. Notices to importers are already there. Some relief is expected. But still, if a favourable decision is there, How it will impact others.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.