RCM on renting of motor vehicle amended via 29/2019-CTR dt. 31-12-2019

Table of Contents

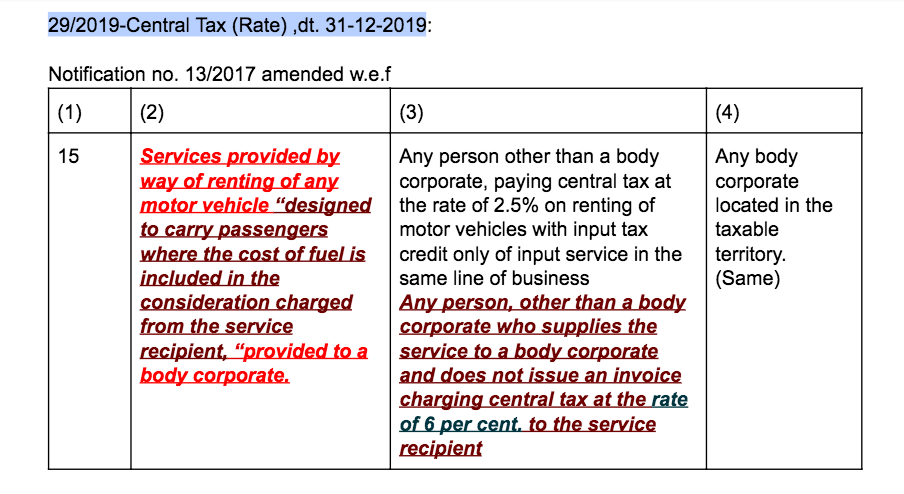

Important changes in RCM on renting of motor vehicle: 29/2019-Central Tax (Rate) ,dt. 31-12-2019

Notification no. 13/2017 amended w.e.f

| (1) | (2) | (3) | (4) |

| 15 | Services provided by way of renting of any motor vehicle “designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, “provided to a body corporate. | Any person other than a body corporate, paying central tax at the rate of 2.5% on renting of motor vehicles with input tax credit only of input service in the same line of business

Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6 per cent. to the service recipient |

Any body corporate located in the taxable territory.

(Same) |

See with color impact:

Important points:

- Only the renting of motor vehicle designed for carrying passengers are covered under RCM. Earlier the word motor vehicle was only written there. It covered all types of motor vehicles. But the purpose was to cover only the motor vehicles meant to carry passengers. Important changes made are: (1) Motor vehicle word is replaced with motor vehicle designed to carry passengers

- Renting of Trucks, cranes, JCB machines will not be covered by RCM provisions.

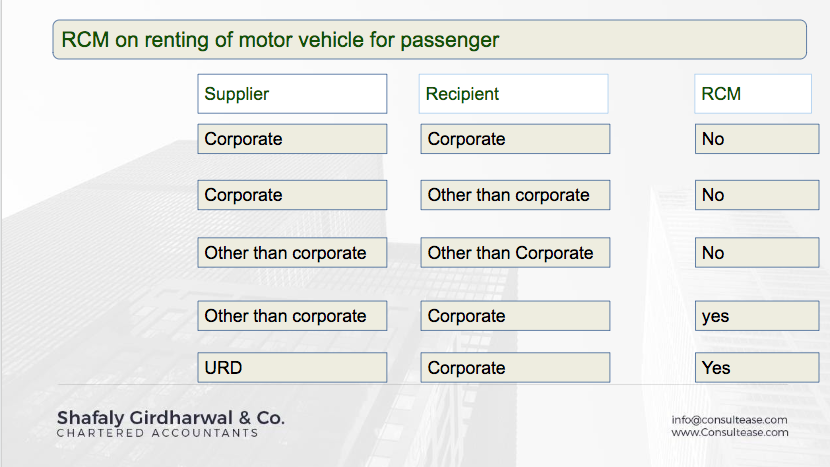

- Renting by a body corporate will not be covered under this entry. So RCM is applicable only on renting of motor vehicle meant to carry passengers by person other than a corporate entity to a corporate entity.

- Renting shall cover the fuel charges also. In case the fuel is not covered in consideration it will not be covered in RCM.

- A person charging tax @12 % in FCM is not covered in RCM.

- A person making supply to other than a corporate entity will be charging in forward charge.

Related Topic:

RCM on renting of motor vehicle amended via 29/2019-CTR dt. 31-12-2019

Understand all instances for coverage of RCM under entry no. 15 in 13/2017

We can understand all these instances of RCM applicability under this head via the following instances.

What will be the applicability in case of Unregistered supplier?

In this case the language used is including “Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6 per cent. to the service recipient’

Following two scenarios may happen:

Supplier is URD but corporate: RCM in this case will not be applicable because in this entry applies only on non corporate supplier.

Supplier is URD but non corporate: In this case RCM will be applicable. As I discussed earlier the language of current entry is covering URD also

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.