RCM on services by Directors: Part II

Introduction to the issue:

RCM on services by Directors is a complex issue. I wrote an article on this same issue for a basic understanding. Why is it complex? All companies registered in GST are facing the heat of this issue. Entry no. 6 of notification no. 13/2019 covers the services by a director.Download full list of supplies covered in RCM.The exact text of the notification is here:

Supply covered: Services supplied by a director of a company or a body corporate to the said company or the body corporate.

Supplier covered: A director of a company or a body corporate

Recipient Covered: The Company or a body corporate located in the taxable territory.

The deepest of its impact depends on how we are going to interpret this entry?

Whether this RCM is applicable on the services by a person, called director, no matter in what capacity he does it. Or will it cover the services as a Director or in capacity of a director. It will make huge impact on every single corporate located in India.

Let us try to understand RCM on services by Directors with some examples

We can have numerous examples.

A director let out his office space to the company in which he is a director. It is a taxable service but by a person who is also a director. It is not provided in the capacity of a director.

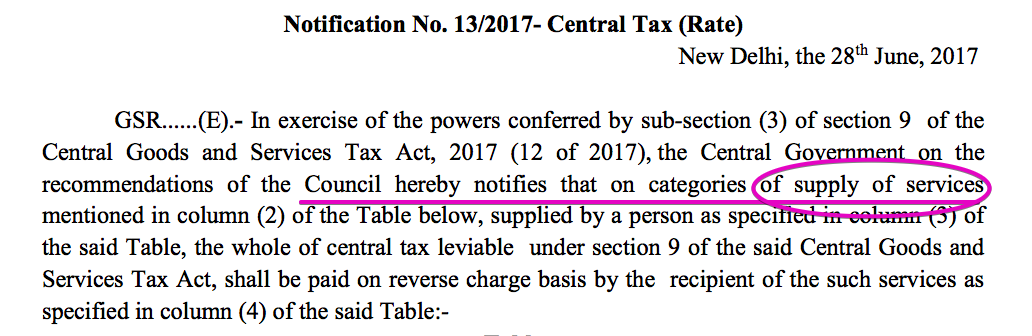

Let us have a look on the opening line of RCM notification.

See the highlighted part of this notification. It notifies the categories of services and not the service providers. So in the entry no. 6 (Full updated List)of this notification says,

“Services supplied by a director of a company or a body corporate to the said company or the body corporate.”

It says any service that is provided by Director. So if you are a director, any service provided by you shall be categorized as a service liable for RCM.

Let us have another example:

A person is running a business in an individual capacity. His proprietorship concern provides some services to the company in which he is also a Director. Whether the RCM is applicable?

He hasn’t provided these services incapacity of a Director. Or in other words these are not services by a director. But then in the eyes of GST law, whether two different entities exist? The proprietor and Director, DO they have a separate identity for GST?

The answer to this question is no. Thus even in that case, RCM shall be applicable. There can be a contrary view also. When he is providing services via his proprietorship, he is not acting as a director. But again, the language of the entry doesn’t contain any such condition. Any services by a person who is also a director will simply fall in RCM

With this, I would like to close this article and I would like to discuss contrary views on this topic. You can post a comment or question in QA.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.