Recommendations of 28th GST Council Meeting

Recommendations of 28th GST Council Meeting

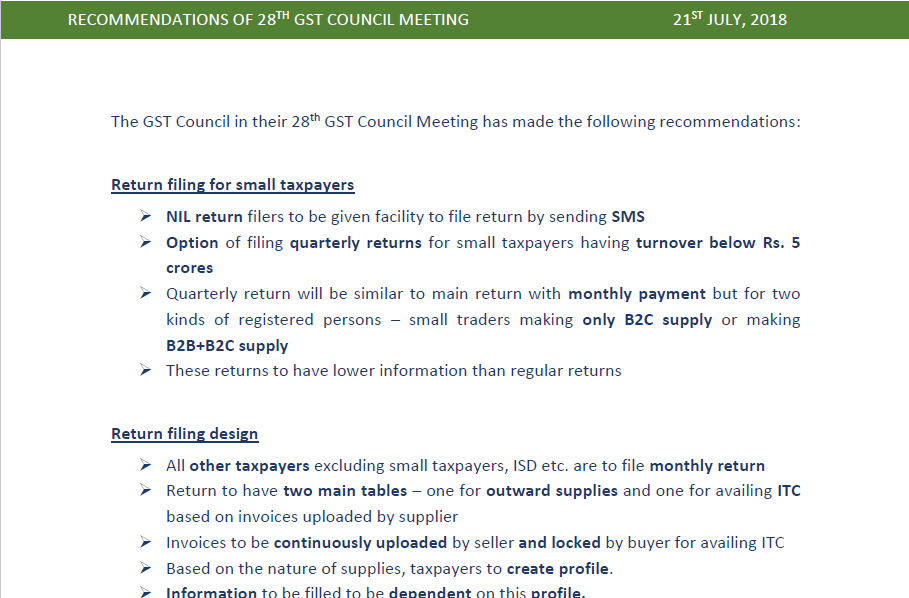

The GST Council in their 28th GST Council Meeting has made the following recommendations:

Return filing for small taxpayers

- NIL return filers to be given facility to file the return by sending SMS

- The option of filing quarterly returns for small taxpayers having turnover below Rs. 5 crores

- Quarterly return will be similar to main return with monthly payment but for two kinds of registered persons – small traders making only B2C supply or making B2B+B2C supply

- These returns to have lower information than regular returns

Return filing design

- All other taxpayers excluding small taxpayers, ISD etc. are to file the monthly return.

- Return to have two main tables – one for outward supplies and one for availing ITC based on invoices uploaded by the supplier.

- Invoices to be continuously uploaded by the seller and locked by the buyer for availing ITC.

- Based on the nature of supplies, taxpayers to create the profile.

- Information to be filled to be dependent on this profile.

- Amendment of invoices and other details to be allowed through amendment return.

- Payment will also be allowed through amendment return resulting in the saving of interest.

Composition taxpayers

- The upper limit for turnover for opting for composition raised from Rs. 1 cr to Rs. 1.5 cr.

- Composition dealers to be allowed to supply services of the higher of: o Rs. 5 lakhs o 10% of the turnover in the preceding financial year.

Reverse charge

- Reverse charge on supplies from unregistered persons to be restricted to only specified goods only in case of notified classes of registered persons.

Registration

- Exemption limit for registration raised from Rs. 10 lakhs to Rs. 20 lakhs for certain States i.e. Assam, Arunachal Pradesh, Himachal Pradesh, Meghalaya, Sikkim, and Uttarakhand.

- Multiple registrations allowed for multiple places of business in the same state.

- Mandatory registration required only for e-commerce operators required to collect TCS.

- Registration to remain temporarily suspended when its cancellation is in process.

Expansion of the list of ‘no supply’ under Schedule III

- Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India(Merchant trade transactions).

- Supply of warehoused goods to any person before clearance for home consumption.

- Supply of goods in case of high sea sales.

Download the full pdf of Recommendations of 28th GST Council Meeting by clicking the image:

Input Tax Credit

- ITC has been widened and is now available on the following:

- Most of the activities or transactions as per Schedule III

- Motor vehicles for transportation of persons having seating capacity > 13, vessels and aircraft o Motor vehicles for transportation of money for or by a bank/financial institution

- Services of insurance, repair, and maintenance in respect of motor vehicles, vessels and aircraft on which credit is available

- Goods/services which are obligatory for an employer to provide employees under any law

- Failure to pay to the supplier within 180 days from the date of issue of the invoice not to attract any interest.

- Order of cross-utilization of ITC rationalized.

Credit/Debit notes

Registered person may issue consolidated credit/debit notes in respect of multiple invoices issued in a financial year.

Shubham Khaitan

Shubham Khaitan

Kolkata, India