Refund For Exports With Payment of IGST

Table of Contents

- Refund For Exports With Payment of IGST

- Legal Provisions

- Application for Refund for Export of Goods

- Application for Refund for Export of Services

- Processing of IGST Refund on Export of Goods

- Power to Withheld the Refund Amount

- Clerical Errors in Shipping Bill

- Exports who Claimed Duty Drawback at Higher Rate

- Hon’ble Court View

- Refund Not Allowed to Certain Persons

- Fraudulent and Ineligible Credit

- Comments

- Read the copy:

Refund For Exports With Payment of IGST

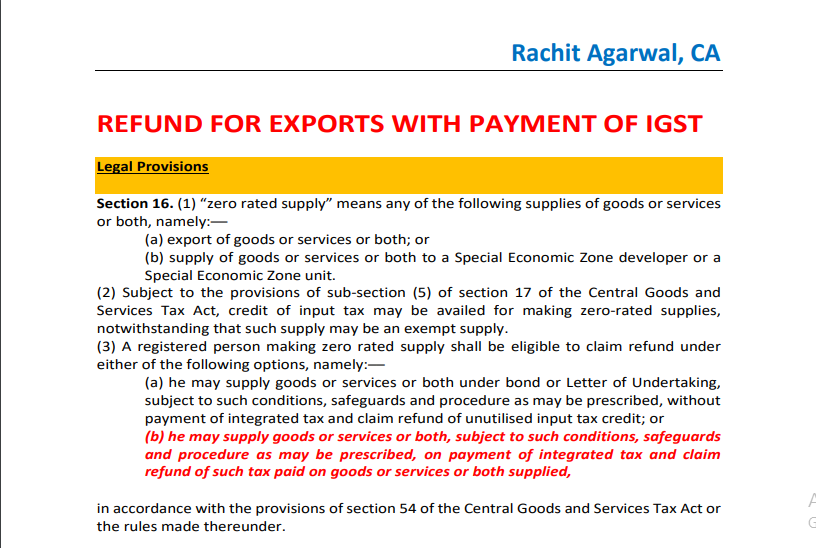

Legal Provisions

Section 16.(1) “zero-rated supply” means any of the following supplies of goods or services or both, namely:––

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

(2) Subject to the provisions of sub-section (5) of section 17 of the Central Goods and Services Tax Act, credit of input tax may be availed for making zero-rated supplies, notwithstanding that such supply may be an exempt supply.

(3) A registered person making zero rated supply shall be eligible to claim a refund under either of the following options, namely:––

(a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim a refund of the unutilised input tax credit; or

(b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim a refund of such tax paid on goods or services or both supplied,

in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.

Comments: Hence the substantive provision allowing the benefit for the refund of IGST paid on Exports is by virtue of the provision of Section 16(3) of the IGST Act, 2017.

Section 54 CGST Act, 2017, and Rule 96 of CGST Rules, 2017 are procedural provisions.

Related Topic:

Important changes for Exporters related to refund

Application for Refund for Export of Goods

As per Rule 96 of CGST Rules, 2017– Shipping Bill filed by the Exporter of the Goods shall be deemed to be an Application for Refund of IGST on Exports

Further, the application would be completed once

a. EGM has been filed by the Person in charge of Conveyance

b. Exporter has filed GSTR 3B

Related Topic:

Delay in refund – Right of assessee to claim interest from department

Application for Refund for Export of Services

The application for refund of integrated tax paid on the services exported out of India shall be filed in FORM GST RFD-01 and shall be dealt with in accordance with the provisions of rule 89”.

Processing of IGST Refund on Export of Goods

The cumulative IGST paid on exports declared in GSTR 3B (table 3.1 b) up to the month should not be less than that declared in GSTR1/6A The Export Invoice data containing the Invoice No, Invoice Date, taxable Value, IGST, Port Code, Shipping Bill No and Shipping Bill Date has properly filled in Table 6 of GSTR 1 and same has been filed Data of GSTR 1 shall be transmitted to the ICEGATE website.

Upon transmission, to ICEGATE the data filed in Table 6 of GSTR 1 shall be validated

If no error found during the course of validation Response Code shall be generated as SB000

However, if there is a mismatch in the data available at the ICEGATE website and invoices details filed in Table 6 of GSTR 1 the refund will not be processed.

Following Response Code shall be generated if the data has not been properly validated

| Response Code | Meaning |

| SB000 | Invoice successfully validated |

| SBV00 | SB already validated successfully |

| SB001 | Invalid SB details |

| SB002 | EGM not filed |

| SB003 | GSTIN mismatch |

| SB004 | Invoice already received and validated |

| SB005 | Invalid Invoice Number |

| Gateway EGM not available |

If the necessary matching is successful, ICES shall process the claim for refund and the relevant amount of IGST paid with respect to each Shipping Bill or Bill of export shall be electronically credited to the exporter’s bank account as mentioned with the Customs authorities

The refund of IGST on exports shall be given by generating a scroll of eligible Shipping Bills. The temporary IGST refund scroll shall be generated by the authorized officer in the CLK role in ICES. Consequently, a permanent scroll shall be generated by the authorized officer in the AC_DBK role. Only those SBs for which Temporary Scroll has been generated shall be considered for the final scroll. Once the final scroll is generated, there is no further action required from the sanctioning officer. The scroll will automatically be transmitted to PFMS and there is no further need to send the scroll to the bank separately.

2020 (1) TMI 1090 – CALCUTTA HIGH COURT- CEAT LTD. VERSUS UNION OF INDIA & ORS.

Writ petitioner has complained of inaction on the part of the respondent’s authorities for granting it refund of IGST levy for exports made to Bhutan under section 54

The petitioner is directed to make a representation before the Assistant Commissioner(Preventive), Dinhata, and also serve a copy of this writ petition upon the concerned authority within a period of ten days from the date. Upon receipt of the representation and copy of the writ petition, the authority concerned is directed to grant opportunity of hearing to the petitioner and thereafter pass a reasoned order within a period of four weeks from date of receipt of the representation and communicate the same to the petitioner within a period of one week from date of passing such order.

In a Writ Petition filed before High Court of Delhi by Nagina International reported in TOG951-HC-DEL-GST-2019. Petitioner grievance relates to his claim for refund of IGST/ITC to the tune of Rs. 1,33,95,749/- along with interest. The court directed the Respondents to examine the said claim of the Petitioner and if the same or any part whereof is found to be payable, to release the refund amount within four weeks positively. However, in case the Respondents decided to contest this petition, they should file their counter affidavit.

Hon’ble Kerala High Court in case of P.R Subhagan vs Union of India, CBIC & Other

Petitioner contention that Immediately after the goods are exported, considering the shipping bills as an application for refund of IGST, the Respondents have to refund the said amount to the petitioner. But to date, the said IGST has not been refunded to the petitioner for no fault of the petitioner. Despite repeated follow-ups with the respondents to date, the amount of refund is not paid to the petitioner.

It is ordered that the 3rd respondent or the competent authority of the respondents will take up the claim of the petitioner for grant of refund as referred to in Ext.P5 and after affording reasonable opportunity of being heard to the petitioner will take a considered decision thereon without much delay, preferably within a period of 3 to 4 weeks from the date of production of a certified copy of this order.

Power to Withheld the Refund Amount

As per Rule 96(4) of CGST Rules, 2017, the Refund can be withheld On the Request from the Jurisdictional Commissioner that

a. A registered person who has defaulted in furnishing any return or who is required to pay any tax, interest, or penalty.

b. An order giving rise to a refund is the subject matter of an appeal or further proceedings or where any other proceedings under this Act are pending and the Commissioner is of the opinion that grant of such refund is likely to adversely affect the revenue in the said appeal or other proceedings on account of malfeasance or fraud committed

A further refund can also be withheld if the proper officer of Customs determines that the goods were exported in violation of the provisions of the Customs Act, 1962.

Clerical Errors in Shipping Bill

Hon’ble High Court of Madras in case of VSG Exports Pvt Ltd vs Commissioner of Customs [TOG-297-HC-MAD-GST-2019]- Due to wrong mentioning of the drawback code by the petitioner, refund of IGST for the aforementioned shipping bills could not be processed by the respondents. But only due to the fact that Export General Manifest for the shipping bills has been closed by the computer system, it is not possible to refund the IGST amount to the petitioner. The petitioner cannot be made helpless, just because the computer system does not enable them to refund the IGST amount. Being an undisputed fact that the IGST refund is payable to the petitioner, the petitioner is absolutely entitled to the IGST refund from the respondents.

In a Writ Petition filed before Gujarat High Court by Real Prince Spintex Pvt Ltd [2020 (3) TMI 614],

Clearing and forwarding agent had erroneously selected the option of export without payment of tax while filing the shipping bill, the amount of the IGST paid was shown as ‘Nil’ in the shipping bill. In such circumstances, the customs authorities denied granting a refund of the IGST paid on exports by the writ-applicants

The respondents are directed to immediately sanction the refund of the IGST paid with regard to the exported goods, i.e. “zero-rated supplies”, with 7% simple interest from the date of shipping bill till the date of actual refund.

Related Topic:

Interest Refund For Lockdown Period- All You Need To Know

Comments: Substantive benefit of the Refund of IGST cannot be denied due to procedural errors.

Exports who Claimed Duty Drawback at Higher Rate

Circular No. 37/2018-Customs, dated 9-10-2018.

A reading of these Notifications and Rules would suggest that in all cases where IGST refund is availed, the authorities concerned may not allow a higher rate of drawback. However, there is no provision in the Central Goods and Services Tax Act, 2017 or the Integrated Goods and Services Tax [Act], 2017 or that there are no such circular or instructions even, under the GST law which would provide for restriction of IGST refund for the reason that higher rate of drawback is claimed.

Notification 131/2016-Cus. (N.T.), dated 31-10-2016

Condition 7 of the notification dated 31-10-2016 mentions that if any exporter claims drawback under Column (4) and (5), it means that drawback includes Customs, Central Excise, and Service Tax component and it’s called Higher drawback. Similarly, if any exporter claims drawback under Column (6) and (7), it means the drawback included Customs only and it’s called Lower drawback

Notification No. 59/2017- Cus, dated 29-6-2017

Condition 11 of Notification No. 131/2016-Cus. (N.T.), dated 31-10-2016 has been amended by Notification No. 59/2017, dated 29-6-2017. Condition No. 11(d) mentions that drawback under Column (4) and (5) i.e. Higher Drawback is not applicable to the goods if goods are exported by claiming refund of integrated goods and services tax paid on such exports.

Amit Cotton Industries Versus Principal Commissioner Of Customs [2019 (29) G.S.T.L. 200 (Guj.)]-

Petitioner Plea- The shipping bill filed by an exporter of goods shall be deemed to be an application for refund. As such, no formal refund application is required to be filed. Needless to mention that since in the case of the petitioner, they had filed their GSTR-1 return for the month of July 2017 automatically the system must have acted in accordance with the said provisions and the refund ought to have been credited to the concerned bank account. The refund could only be withheld if the circumstances mentioned in Rule 96(4) arises. There is no provision in the Central Goods and Services Tax Act, 2017 or the Integrated Goods and Services Tax [Act], 2017 or that there are no such circular or instructions even, under the GST law which would provide for restriction of IGST refund for the reason that higher rate of drawback is claimed. The refund is withheld is completely erroneous, illegal, arbitrary. Petitioner has paid-back the differential drawback (Between Higher drawback and Lower drawback) along with interest to claim IGST refund.

Respondents Plea- Petitioner has availed higher drawbacks as evident from their shipping bills and because of this, the system has denied them the IGST refund. The petitioner is ineligible for the IGST refund, it is not proper to accuse the Respondent no. 1 and Respondent no. 2 for the non-sanction of IGST refund. Exporter has claimed Higher Drawback and violated condition 11(d) of the Notification 131/2016-Cus. (N.T.), dated 31-10-2016 as amended by notification 59/2017, dated 29-6-2017 to gain unlawful benefit

Hon’ble Court View

Rule 96(4) makes it abundantly clear that the claim for refund can be withheld only in two circumstances as provided in sub-clauses (a) and (b) respectively of clause (4) of Rule 96 of the Rules, 2017.

First, the circular upon which reliance has been placed, in our opinion, cannot be said to have any legal force. The circular cannot run contrary to the statutory rules, more particularly, Rule 96 referred to above. The circular explains the provisions of the drawback and it has nothing to do with the IGST refund. Thus, the circular will not save the situation for the respondents. We are of the view that Rule 96 of the Rules, 2017, is very clear.

In a Writ Petition filed before High Court at Madras by Precot Meridian Ltd [2020 (34) G.S.T.L 27

Petitioner has made certain exports with payment of Integrated Tax claiming Higher Duty Drawback. Subsequently, the higher duty drawback amount repaid with interest.

Held the respondents were directed to refund the amount of IGST paid by the petitioner for the goods exported from India within a period of six weeks from the date of receipt of a copy of this order

In a Writ Petition filed before High Court of Kerala by G.Nxt Power Corp reported in 2019 (29) G.S.T.L 616 (Ker.). The Petition has made certain exports with payment of IGST and the same time availed the higher duty drawback. Held that refund of IGST would be allowed after deducting the higher rate of duty drawback for the refund amount along with the interest @ 7%

In a Writ Petition filed before the High Court of Kerala by Nilamer Exports reported in 2019(29) G.S.T.L 692 (Ker). Petitioner has made certain exports with payment of IGST and has availed higher duty drawback and claimed the refund of IGST paid. Held that relying on the decision of this court in case of G.Next Power Corp vs Union of India, the refund is allowed after deduction of the amount of Higher Duty Drawback from the refund amount claimed.

Comments: In view of the above Landmark Judgment,

a. A refund of IGST paid on Exports cannot be withheld for the reason that the Duty Drawback has been claimed at a higher rate/

b. The further refund can only be within for reasons as per Rule 96(4) of CGST Rules, 2017

Refund Not Allowed to Certain Persons

The persons claiming refund of integrated tax paid on exports of goods or services should not have

(a) received supplies on which the benefit of the Government of India, Ministry of Finance Notification No. 48/2017-Central Tax, dated the 18th October 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1305 (E), dated the 18th October 2017 except so far it relates to the receipt of capital goods by such person against Export Promotion Capital Goods Scheme or

| S. No. | Description of supply |

| (1) | (2) |

| 1. | Supply of goods by a registered person against Advance Authorisation 1 [Provided that goods so supplied, when exports have already been made after availing input tax credit on inputs used in the manufacture of such exports, shall be used in manufacture and supply of taxable goods (other than nil rated or fully exempted goods) and a certificate to this effect from a chartered accountant is submitted to the jurisdictional Commissioner of GST or any other officer authorized by him within 6 months of such supply,

Provided further that no such certificate shall be required if input tax credit has not been availed on inputs used in the manufacture of export goods.] |

| 2. | Supply of capital goods by a registered person against Export Promotion Capital Goods Authorisation |

| 3. | Supply of goods by a registered person to Export Oriented Unit |

| 4. | Supply of gold by a bank or Public Sector Undertaking specified in the notification No. 50/2017-Customs, dated the 30th June 2017 (as amended) against Advance Authorisation. |

(b) notification No. 40/2017-Central Tax (Rate), dated the 23rd October 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1320 (E), dated the 23rd October 2017 or

Comments- Goods procured at a tax rate of 0.05% by the Merchant Exporter

(c) notification No. 41/2017-Integrated Tax (Rate), dated the 23rd October 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1321 (E), dated the 23rd October 2017 has been availed; or

Comments- Goods procured at a tax rate of 0.1% by the Merchant Exporter

(d) availed the benefit under notification No. 78/2017-Customs, dated the 13th October 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1272(E), dated the 13th October 2017 or

(e) notification No. 79/2017-Customs dated the 13th October 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1299 (E), dated the 13th October 2017 except so far it relates to the receipt of capital goods by such person against Export Promotion Capital Goods Scheme.]]

Fraudulent and Ineligible Credit

Para-1- Standard Operating Procedures were issued by CBIC vide Circular No.131/1/2020-GST dated the 23rd day of January 2020.

It was observed that there were a number of the exporters who were found to be nonexistent. Further fraudulent credit and ineligible credit has been availed by the exports and the refund has been claimed. In order to verify the existence of the exporters and fraudulent and ineligible credit, Standard Operating Procedures were issued.

Para-2 Till the verification is completed

1. The refund scrolls in such cases are kept in abeyance till the verification report in respect of such cases is received from the field formations.

2. Further, the export consignments/shipments of concerned exporters are subjected to a 100 % examination at the customs port.

Para-3 genuine exporters do not face any hardship. In this context, it is advised that exporters whose scrolls have been kept in abeyance for verification would be informed at the earliest possible either by the jurisdictional CGST or by Customs.

Para 3.1- Verification shall be completed by jurisdiction CGST office within 14 working days of furnishing of information in proforma by the exporter.

Para 3.2 After a period of 14 working days from the date of submission of details in the prescribed format, the exporter may also escalate the matter to the Jurisdictional Pr. Chief Commissioner/Chief Commissioner of Central Tax by sending an email to the Chief Commissioner concerned and they should take appropriate action to get the verification completed within next 7 working days(email IDs of jurisdictional Chief Commissioners are in Annexure B)

Para 4. In case, any refund remains pending for more than one month, the exporter may register his grievance at www.cbic.gov.in/issue by giving all relevant details like GSTIN, IEC, Shipping Bill No., Port of Export & CGST formation where the details in prescribed format had been submitted, etc.. All such grievances shall be examined by a Committee headed by Member GST, CBIC for resolution of the issue

Comments

1. As a part of the Verification Procedure, the refund has been withheld and 100% examination of the export consignment has been continued for the months, however, reports are still pending.

2. There are no guidelines where the Verification process has not been completed within the due course of time.

3. A refund cannot be withheld by the virtue of Standard Operating Procedures. Rule 96(4) of CGST Rules, 2017 has been very clearly spelled out the conditions and situations wherein the refund of the IGST paid on the exports can be withheld. Standard Operating Procedures lacks the Legal Competence to withhold a refund.

4. There was no Annexure-B attached to the Circular.

Read the copy:

CA Rachit Agarwal

CA Rachit Agarwal