Refund of services used in export of Goods

The issue, in this case, was Refund of services used in export of Goods. Department denied the refund saying that the duty drawback on goods is given to the tax payer.

Table of Contents

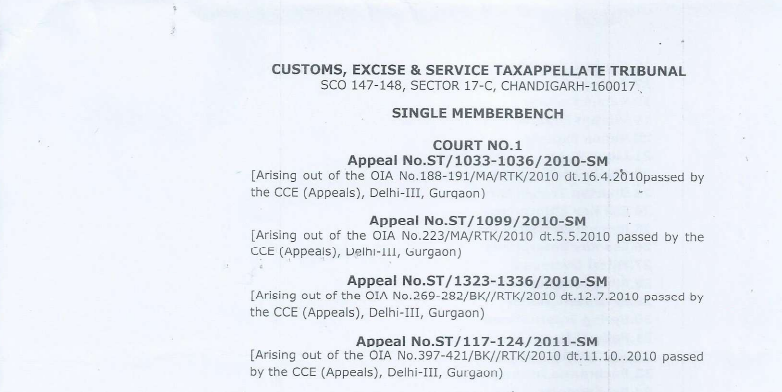

Case Covered:

Mittal International

Versus

CCE, Rohtak/ Gurgaon

Facts of the case:

The facts of the case are that the refund claims were denied to the applicants by the authorities below. The applicant filed refund claims under Notification No. 41/07-ST dt. 6.10.2007, wherein the exporter is entitled to claim refund on export of the goods of the specified services received used in relation to the export of the goods and the said refund claim as per procedure prescribed under the said notification.

I find that the refund claims were denied n the various reasons which are dealt with separately. The major issue was whether a Refund of services used in export of Goods will be allowed?

(a) Refund claim was denied on the ground that the said goods have been exported and drawback is allowed on the export of goods.

The case of revenue is that as the appellants have claimed drawback on export of the goods, therefore, they are not entitled for refund claims on the services used in the export of goods.

Related Topic:

Service Tax Refund on Flat Cancellation

Observations:

As observed hereinabove, the service which were used by the appellants for export of the goods does not form part of the drawback claim, therefore, the appellants are entitled for refund of the service tax paid on the said specified services. The refund claims cannot be denied on this account.

Judgment:

In these circumstances, the legal issue raised by the authorities below for rejection of the refund claim has been answered as above. The matters are remanded back to the adjudicating authority to consider refund claim filed by the appellants in view of the above observations. If the documents are filed by the appellants are in respect of certain services as discussed, the appellants are entitled for refund claim. On filing of those documents by the appellants (if required), adjudicating authority shall consider the same and thereafter the adjudicating authority shall sanction the refund claim to the appellants.

I further hold that, in the case where the documents are already on record the adjudicating authority shall sanction refund claim after verification of the documents at the earliest.

With these terms, the appeals are disposed of by way of remand.

A refund of services used in export of Goods was allowed. This case will be useful in many other cases where the department denies the refund on the same ground.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.