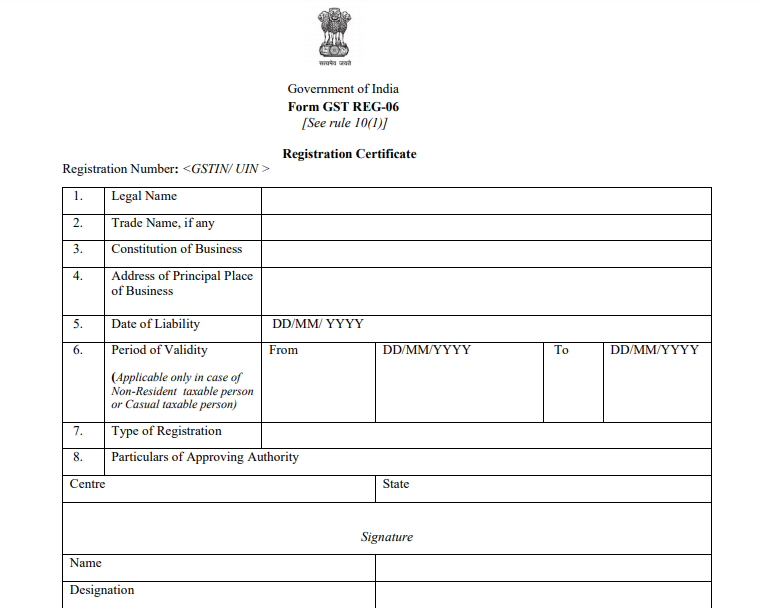

Format of “Form”- REG 06

Table of Contents

Introduction

Turnover is the basic criteria for registration requirement in GST. The general threshold is Rs. 20 lac. In case of sales of goods it is Rs 40 lac. But the limit of Rs. 40 lac is only for specified states. Otherwise the threshold is Rs. 20 lac.

Thus we can say that the limit for suppliers of services is always Rs. 20 lac (or Rs 10 lac in some states). When there is a mix of goods and services, the threshold is again Rs. 20 lac (Rs 10 lac in specified states). In case of exclusive sale of goods it is Rs 40 lac for states who adopted it. But for other states it is still Rs 20 lac.

REG 06 is a certificate which contains the GSTIN which is unique for all taxpayers. It is provided after successful submission and verification of application under REG 01. Such a certificate is available online with a download facility.

Details contained in GST Registration Certificate

- Registration Number;

- Legal Name;

- Trade Name, if any;

- Constitution of Business;

- Address of Principal Place of Business;

- Date of liability;

- Period of validity (applicable only in case of a non-resident taxable person or casual taxable person);

- Type of registration;

- Particulars of approving authority;

- Date of issue of the certificate. etc.

Validity

For a normal taxpayer, the registration certificate has no expiry date. It is valid until the registration is not surrendered by the person voluntarily or cancelled by the officer.

However, the validity period is applicable for casual taxable person and non resident taxable person. Such a person can apply for registration for 90 days with extended period of 90 days.

Amendments in Registration Certificate

Registered person can make changes in the information provided at the time of application. These changes are bifurcated into “core field” and “non core field”. Core field needs approval of authorized person whereas a person can amend “non core” field itself.