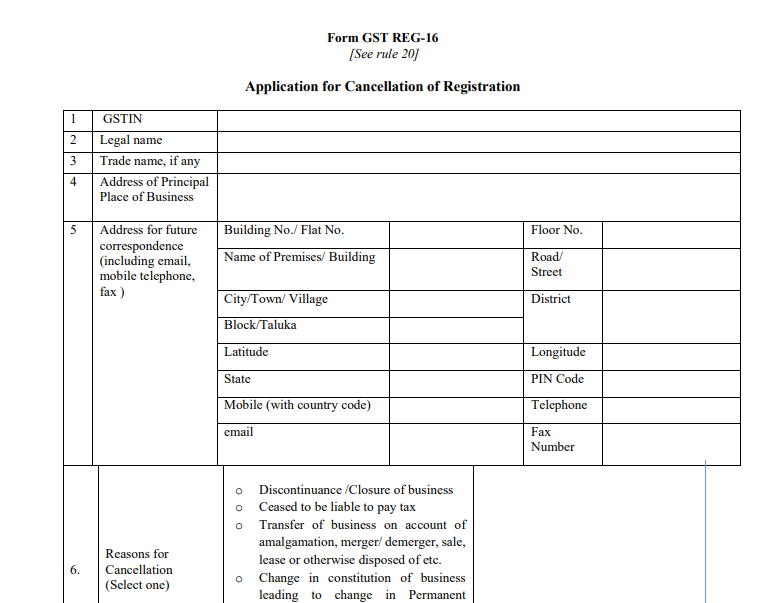

Format of “Form” – REG 16

Table of Contents

Introduction

Cancellation of GST registration means a taxpayer is not registered anymore. He need not to collect or pay tax anymore. But why does the taxpayer wish to cancel his registration? Reasons can be:

- Business discontinue

- Business transfer, amalgamation, demerger, disposal. In such a case a new company apply for registration.

- Change in constitution (like proprietorship to firm)

For all above scenarios file form REG 16.

Who can cancel the registration?

Three persons can apply for cancellation:

- Taxpayer himself

- Tax officer

- Legal heirs, in case of death of taxpayer.

Let’s discuss one on one basis:

Cancellation by Taxpayer

A taxpayer can cancel his registration if his turnover falls below the limit of Rs 20 / Rs 10 lakhs for registration (Rs 40 lakhs for supplier of goods).

Apply for cancelling voluntary registration anytime following prescribed procedure. The proper officer shall, after conducting an enquiry as required would cancel the registration.

Related Topic:

Format of “Form” – REG 25

Cancellation by Tax Officer

Officer will cancel the registration, if the taxpayer:

- Does not conduct any business from the declared place of business OR

- Issues invoice or bill without supply of goods/services (i.e., in violation of the provisions) OR

- Violates the anti-profiteering provisions (for example, not passing on benefit of ITC to customers)

Procedure for cancellation

- If the proper officer has reasons to cancel the registration of a person then he will send a show cause notice to such person in FORM GST REG-17.

- The person must reply in FORM REG–18 within 7 days from date of service of notice why his registration should not be cancelled.

- On satisfaction of officer, pass order in FORM GST REG 20 and drop the proceedings.

- Where the registration is liable to be cancelled, the proper officer will issue an order in FORM GST REG-19. The order will be sent within 30 days from the date of reply to the show cause.

Details required for filing

With respect to:

- Details of inputs, semi-finished, finished goods held in stock on the date of application of cancellation

- Liability thereon

- Details of the payment