Registration cant be cancelled without giving reasons(Pdf Attach)

Table of Contents

Cases Covered:

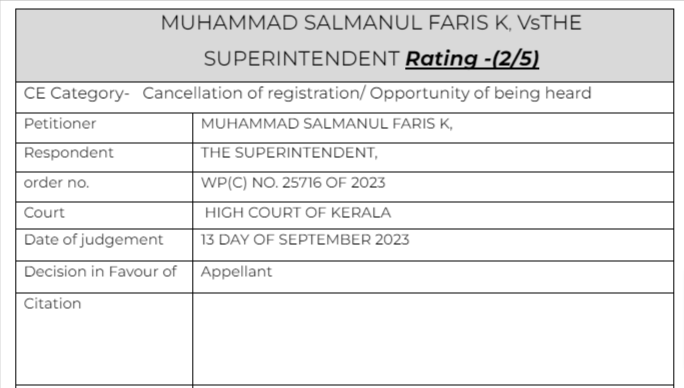

MUHAMMAD SALMANUL FARIS K, VsTHE SUPERINTENDENT

Facts of the cases:

The registration of the Appellant was cancelled on the ground that the petitioner has issued Invoices/Bills to other dealers without supplying goods or providing any services in violation of the GST Act and Rules and such violation of raising Invoices and Bills have made use by the purchasing dealers for availment of the declaration of the input tax credit or refund of tax. It appears that some intelligence input were received for fake invoicing

Observation & Judgement of the court:

The adverse materials collected against the petitioner must be given to him for adverting the same by him. After taking the evidence from the petitioner and providing an opportunity of hearing to him, a fresh order may be passed in accordance with law within a period of three weeks from 18.09.2023. If the show cause is cancelled, the petitioner would be entitled for restoration of the GST registration certificate. However, if the authority takes a decision to cancel the GST registration of the petitioner, he may take recourse to appropriate proceedings as available under law

Read & Download the Full MUHAMMAD SALMANUL FARIS K, VsTHE SUPERINTENDENT

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.