[update] Registration cant be kept suspended for long time

The case is updated on 12-01-2024. The updated copy is attached here.

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

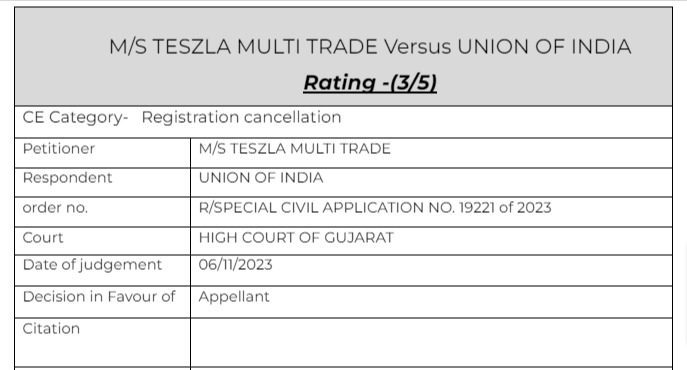

M/S TESZLA MULTI TRADE Versus UNION OF INDIA

Facts of the cases:

It appears that the petitioner has been issued Show Cause Notice for cancellation of registration on 13.12.2022. In the meantime, the registration of the petitioner has been suspended with effect from that day. The petitioner on 13.12.2022 has requested for clarification from the respondents as to why the authority came to conclusion that the registration has been obtained by means of fraud, wilful misstatement or suppression of facts. The reply has also been filed on 13.12.2022.

Meantime, it appears that the respondents have issued “ADVISORY” to the clients or parties which the petitioner is dealing with, inter alia stating that registration of the petitioner has been cancelled. This is not so once Notice is issued, the question of suspension has to be decided within a period of 30 days. No decision has yet been taken on the issue whether the petitioner’s registration is required to be cancelled. Almost a year has gone by.

Observation & Judgement of the Court:

Issue Notice to the respondents, returnable on 06.12.2023. On or before the returnable date, respondents are directed to take a decision on the question whether the suspension of petitioner’s registration needs to be continued or not. Speaking order shall be passed. Respondents are also restrained from issuing such kind of Advisory that they have issued to one Vijay Traders on 20.09.2023 intimating cancellation of registration, which in fact, is not so. Direct service is permitted

Read & Download the Full Judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.