Relaxation in Compliances Under Various Laws Due To COVID-19 Lockdown

Table of Contents

Relaxation in Compliances Under Various Laws Due To COVID-19 Lockdown

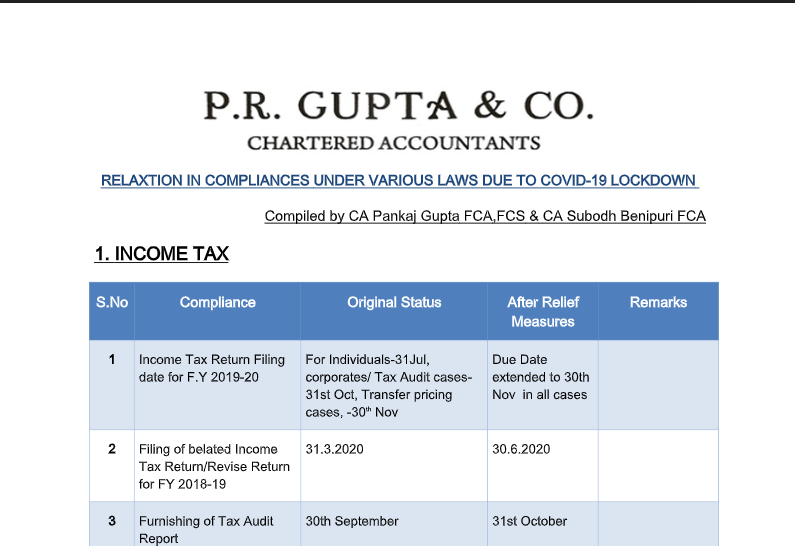

1. Income Tax

| S.No | Compliance | Original Status | After Relief Measures |

Remarks |

| 1 | Income Tax Return Filing the date for F.Y 2019-20 |

For Individuals-31Jul, corporates/ Tax Audit cases- 31st Oct, Transfer pricing cases, -30th Nov |

Due Date extended to 30th Nov in all cases |

|

| 2 | Filing of belated Income Tax Return/Revise Return for FY 2018-19 |

31.3.2020 | 30.6.2020 | |

| 3 | Furnishing of Tax Audit Report |

30th September | 31st October | |

| 4 | Furnishing of Transfer Pricing Report |

31st October | 31st October | No Change |

| 5 | Time Limitation for Payment u/s 80(c)/ 80CCB/80CCD/80(D)/80E/ 80G for FY 2019-20 |

31.3.2020 | 30.6.2020 | |

| 6 | The time limit for Investment u/s 54EC/54/54F.e from Sec 54 to 54GB |

As prescribed | If time limitation is expiring between 20.3.20 to 29.6.20, then extended till 30.6.2020 |

|

| 7 | Period of stay in India for POI for determining residential status for FY 2019-20 |

The actual period of stay in India | From 22 nd March to 31 st March will not be counted |

Lockdown period should not be counted for the FY 2020-21 but no relaxation so far |

| 8 | Filing of Statement of Financial transactions ( Form 61A) |

31st May 2020 | 30th June 2020 | |

| 9 | Filing of Statement of Reportable Accounts ( Form 61B) |

31 st May 2020 | 30th June 2020 | Not specifically clarified but should be this position only |

| 10 | Time Limitation for giving reply to Notices, Appeal etc. |

As per existing limitation | Where the limitation is falling between 22 Mar to 29 Jun, last date shall be taken as 30th June |

|

| 11 | Application for Registration/Re- registration for charitable societies |

As applicable | If time limitation is expiring between 20.3.20 to 29.6.20, then extended till 31.12.2020 |

|

| 12 | Time Limit for Starting SEZ operations u/s 10AA |

If expiring by 31.3.2020 | Extended till 30.6.2020 |

If the letter of approval already issued up to 31.3.2020 |

| 13 | Time barring of Assessments |

31.3.20 / 30.9.20 / 31/12.20 | Extended by 3 months respectively |

|

| 14 | Interest on delay in Payment of Advance Tax, Self-Assessment Tax, Regular Tax, Equalization Levy, STT/CTT |

Tax Due Date falling between 20.3.20 to 30.6.2020 |

Interest shall be levied at @ 9% instead of 12% for the period 20.3.2020 till 30.6.2020 |

Provided Payment is made till 30.6.2020 |

| 15 | Advance Payment Tax Dates for FY 2020-21 |

Due Dates 15th June 15th September 15th Dec 15th Mar |

for 15th June installment, Concessional Interest @ 9% instead of 12% till 30.6.2020 |

Applicable only if Payment of tax is made till 30.6.2020 |

| 16 | Payment under Vivad Se Vishwas Scheme Without additional Interest |

30.06.2020 | Can pay till 31.12.2020 |

|

| 17 | Pending refunds for Assesses other than Corporates |

As per Applicable dates | Immediate refunds to be made |

2. Tax Deducted / Collected at Source ( TDS/ TCS)

| S.No | Compliance | Original Status | After Relief Measures |

Remarks |

| 1 | TDS/TCS Rates in Non Salary cases |

Professional-10%, Technical Fees-2% Rent-10%/2% Contractor-2%/1%, Brokerage/Commission-5% TDS immovable property-1% TDS on Payment of Rent> 50K p.m—5% Payment to contractor/ professional above 50 Lacs in case of Non business entity…1% |

For all deductions made between 14.5.20 to 31.3.2021, rates will be 75% of original Rate. |

This relief is only in No reduction in |

| 2 | All TDS/TCS returns for Q-4 of FY 2019-20 |

TDS …31.05.2020 TCS….15.05.2020 |

30.06.2020 | |

| 3 | Statement in Form 26QB/26QC/26QD including for Payment |

Feb20…30.3.20 Mar20… 30.4.20 Apr20…30.5.20 |

Extended till 30.06.2020 |

|

| 4 | Issue of TDS Certificates |

16,16A . Q-4 /19-20—15.6.2020 16B, 16C, 16D…… for March…15 th May For April…14 th June |

Extended till 30.06.2020 |

|

| 5 | Interest on delayed payment of TDS for the period 20.3.2020 to 30.2020 |

Non deduction: 1% p.m. Non -payment: 1.50% p.m. |

0.75 % on Non- payment if paid till 30.6.20 |

No penalty /prosecution if deposited by 30.6.20 |

| 6 | Form 15G/15H for FY 2020-21 ( If already have certificate for FY 2019-20) |

Submit before the deduction date. | Existing Certificate will apply up to 30.6.2020. But only if apply for FY 2020-21 up to 30.6.2020 |

if no certificate submitted for FY 2019-20, then no relief. |

| 7 | Certificate u/s 197 for Lower Rate of TDS/TCS (other than Non-Resident) ( If already have certificate for FY 2019-20) |

Applicable after receipt of certificate |

Existing Certificate will apply up to 30.6.2020. But only if apply for FY 2020-21 up to 30.6.2020 |

if no certificate issued for FY 2020- 21 & no certificate for FY 2019-20, then no relief. |

| 8 | Applicability of certificate u/s 197 for Lower Rate of TDS/TCS for Non- Resident) u/s 195 |

Applicable after receipt of certificate |

Existing certificate for FY 2019-20 will apply up to 30.6.2020 if same nature of transaction. But only if apply for FY 2020-21 up to 30.6.2020 |

No certificate for FY 2019-20, but certificate for FY 2020-21 applied but not issued, then 10% plus surcharge plus Cess if Non- Resident having PE in India |

| 9 | Procedure for Application u/s 197/209C(9) |

To be filed through TRACES Portal with DSC |

Can be filed through Email to Assessing Officer by filing Form 13 |

To Resend info on email to A.O where application for FY 2020-21 already made through E- portal. |

3. Goods & Service Tax (GST)

| S.No | Compliance | Original Status | After Relief Measures |

Remarks |

| 1 | GSTR-1 | Applicable original dates | No extension of due date but for Levy of Interest and late fees for Mar, Apr, & May 20 and Last Qtr return for FY 2019- 20, date extended till 30th June |

However, no levy of Late fees, if filed till the extended date, otherwise levy from day 1 of original due date |

| 2 | GSTR- 3B For Taxpayers up to Turnover up to 1.5 Cr in preceding FY |

Applicable original dates | For Feb—30th June For-Mar—3rd jul For Apr… 6th jul For May—12/14th July |

No Interest and Late fees if filed in Extended Time |

| 3 | GSTR- 3B For Taxpayers Turnover>1.5 crores but up to 5 Cr |

Applicable original dates | For Feb—29th June For-Mar—29th June For Apr… 30th June For May—12/14th July |

No Interest and Late fees if filed in Extended Time. |

| 4 | GSTR- 3B For Taxpayers having Turnover >5 Cr |

Applicable original dates | For Feb—24th June For-Mar—24th June For Apr….. 24th June For May— 27th June No Late fees if filed in Extended Time |

If filed within extended due Interest NIL up to 15 days of original due date and thereafter at Concessional Rate of 9% p.a |

| 5 | GSTR-5,6,7,8 | Applicable original dates | 30th June,20 | |

| 6 | GSTR-9 & 9C For Fy 2018-19 |

30th June,20 | 30th Sept20 | |

| 7 | E-Way Bill | Generated on or before 24th March and Expiring between 20th March to 15th April…as prescribed |

In this case the expiry of the E waybill shall be deemed to be extended till 31 st May 2020. |

|

| 8 | Composition Scheme | As per applicable dates |

Can be opted till 30 th June |

Should not file Returns for first Qtr of FY 2020-21 |

| 9 | Electronic Cash Ledger | The transfer was not possible |

Can file PMT-09 for |

|

| 10 | Filing of LUT for FY 2020- 21 |

Before the supply of export services without payment of GST |

Can be filed till 30th |

|

| 11 | DSC for GST Return-3B |

Required in Corporate & LLP Cases |

Not required, can be |

No relaxation for GSTR-1 |

| 12 | Revival of GST Registration Cancelled till 14.3.20 |

Where cancelled due to |

Application for |

|

| 13 | New GST Registration by IPR/RP |

20 th April,20 |

30th June,20 or within |

|

| 14 | Input GST credit – restriction rule of 110% with reference to GSTR2A |

Feb to Aug20 |

Relaxation given |

However, FORM GSTR-3B for Sept. 2020 shall be furnished with the cumulative adjustment of input tax credit |

| 15 | Payment under Sabka Vishwas Scheme |

31.3.2020 |

Extended till |

4. Companies Act / MCA Filings

| S.No | Compliance | Original Status | After Relief Measures |

Remarks |

| 1 | Audit under Companies Act for FY 2019-20 |

29th Sept 2020 (with Short Notice ). |

No relaxation so far | |

| 2 | Filing of Documents with MCA, AOC-4, MGT-7 etc. for FY 2019-20 | Within 30 days/60 days of holding AGM | No relaxation so far | |

| 3 | Filing of Documents with MCA, for Companies which is pending to be filed (except Increase in the Authorized Capital ( SH –7), Charge related documents (CHG –1,4,8,9) |

As per Applicability with additional fees/ penalty/ prosecution |

Up to 30.9.2020 without additional fees No prosecution/penalty if filed till 30.9.20 |

Company Fresh Start Scheme of 2020 (Conditions to apply and certain cases are excluded) |

| 4 | Any document due to be filed till 31 st Aug2020 for an LLP |

As per Applicability with fine |

Up to 30.9.20 without additional fees No prosecution/penalty if filed till 30.9.20 |

LLP Settlement Scheme of 2020 |

| 5 | DIN KYC Verification | 30th April,20 | 30th September,20 | |

| 6 | Violations regarding CSR Reporting, Inadequacies in Board Report, Filing Defaults, delay in holding AGM etc. |

These were considered criminal in Nature and subject to prosecution of concerned Directors etc. |

These violations have now been decriminalized Withdrawal of 14000 prosecution cases Power of RD increased |

Majority of Compoundable offences to be shifted to Internal Adjudication Mechanism, |

| 7 | Penalties for Default by Small Companies, OPC, Producer Company and Startups |

As Applicable | Penalties Lowered | Provision of Part IX A(Producer Companies) of Companies Act 1956 introduced in Companies Act,2013 |

| 8 | MSME Return for half year ending 31 st Mar,20 |

30th April 2020 | 30.09.2020 | |

| 9 | Return of Deposit in DPT- 3 for FY 2019-20 |

30th June 2020 | 30.09.2020 | |

| 10 | Board Meetings-Gap between two meetings |

Not to exceed 120 days | increased to 180 days | Applicable till 30.09.2020. |

| 11 | Board Meetings – where accounts were being approved /Board Report |

Video conferencing not allowed |

Allowed till 30.6.2020 | No Relaxation where approval of Prospectus, amalgamation etc. & financial statement by Audit committee |

| 12 | Companies (Auditor’s Report) Order, 2020 |

Applicable from FY 2019- 20 |

Applicable from FY 2020-21 |

|

| 13 | Meeting of Independent Directors |

The independent directors are required to hold at least one meeting in a year, without the attendance of non-independent directors and members of management |

For the year 2019-20, if the Independent directors of a company to hold even one meeting, the same shall not be viewed as a violation |

|

| 14 | The requirement of filing a declaration for Commencement of Business by newly incorporated enterprises |

Within 6 months of incorporation |

Additional time of 6 months allowed |

|

| 15 | Minimum residency in India under Section 149 of Companies Act |

Minimum residency- period of at least 182 days by at least one Director of every company |

Non- compliance shall not be treated as violation |

|

| 16 | Requirement under section 73(2)(c) of CA-13 to create the deposit repayment reserve of 20% of deposits maturing during the financial year 2020-21 |

before 30th April 2020 | shall be allowed to be complied with till 30th June 2020. |

|

| 17 | The requirement to invest or deposit at least 15% of amount of debentures maturing in specified methods of investments or deposits |

before 30th April 2020, under rule 18 of the Companies (Share Capital & Debentures) Rules, 2014 |

may be complied with till 30th June 2020 |

|

| 18 | General Meetings of Members-EGM/AGM |

Video conferencing was not allowed |

Video Conferencing allowed until 30th June 2020 |

Detail procedure prescribed in MCA circulars |

| 19 | Compliance of Secretarial Standards |

SS-1 & SS-2 are compulsory in Nature |

Relaxation is given as per Guidance Note dt.15.4.2020 by ICSI |

|

| 20 | Minutes of the meetings Refer Secretarial Standard (SS-1 & SS-2) |

To be physically signed where minutes kept physically & with DSC when in Electronic form |

can be digitally signed by Chairman |

But after Lockdown needs to sign physically |

| 21 | The signing of documents by Directors Rule 8 of Companies (Registration Offices and Fees) Rules, 2014 for. Authentication of documents |

Physical Signing mandatory for Notices and Balance Sheet etc. |

No Relaxation However, may refer to The Information Technology Act 2000 and Evidence Act. |

MCA should come out with detail guidelines |

| 22 | Signing by Auditors /CA | Physical Signing mandatory ( Except where DSC allowed) |

signing through DSC allowed |

As per ICAI Announcement dated 13.04.2020 |

| 23 | UDIN by CA | Latest within 15 days from the date of signing the attestation document |

No Change |

5. Labour Laws & Other Acts

| S.No | Compliance | Original Status | After Relief Measures | Remarks |

| 1 | MSME Definition | Manufacture:- Micro if Investment if <25 Lacs, Small if investment <5cr and Medium if <10cr Services:- Micro if Investment <10 Lacs, Medium if investment <2cr and Medium if Investment <5cr |

Manufacture & Services, same criteria Micro—Investment less than 1 CR &Turnover less than 5CR Small—Investment less than 10 CR & Turnover less than 50CR Medium—Investment less than 20 CR &Turnover less than 100CR |

Registration certificate should be obtained for availing different benefits like concessional Loans, Payment within 45 days etc. -Emergency Credit Line to Businesses/MSMEs from Banks and NBFCs up to 20% of entire outstanding credit as on 29.2.2020 |

| 2 | Moratorium of Term loan and Deferment of Interest on Working Capital |

As per original Terms | moratorium extended till August 31, 2020 |

|

| 3 | Export Credits (Pre and Post Shipment Payment against Imports (under FEMA Regulations) |

9 months 6 months |

15 months 12 months |

|

| 4 | Application under Service Export from India Scheme (SEIS) for FY 2018-19 |

31.3.2020 |

31.12.2020 |

|

| 5 | For filing various reports etc by listed companies under SEBI Regulations |

As applicable |

Extended normally by one month |

|

| 6 | For companies employing up to 100 workers (for workers covered under PMGKY) |

Payment of 12% |

support is extended for |

|

| 7 | Contribution to PF for all establishments for next here months Except Central and State public Sector Undertakings |

12% for Employer and |

Reduced to 10% for both |

No penalty action due to delay in payment for period under Lockdown |

| 8 | Contribution to PF (Establishments up to 100 employees and 90 per cent of those earning less than Rs 15,000 per month) |

12% for Employer and |

Payment from March to |

Very few organization will be able to fulfil this criteria |

| 9 | Non Refundable Advance to workers from their PF Accounts |

Non-refundable |

PF Withdrawal of 75 per |

|

| 10 | Contribution to ESI |

The due date for filing ESI |

Due date of ESI |

No Penalty/prosecution for the delay in deposit of dues for the Lockdown period |

| 11 | Various Provisions of Labour Laws |

As per Existing |

Relief being provided |

Note:

(For Private Information only and not for quoting. Can be used for own consumption only after ascertaining the correctness of the information. Advised to consult your Tax Consultant/Adviser in case of any clarification or further guidance.)

Read the copy:

CA Pankaj Gupta

CA Pankaj Gupta

Mr. Pankaj Gupta is a Fellow Member of the Institute of Chartered Accountants of India (ICAI) and also Fellow Member of The Institute of Company Secretaries of India (ICSI). He has his own CA practice at Noida under the Firm Name “ P.R. Gupta & Co.” and has over 40 years of professional experience dealing in Direct Taxes, Indirect Taxes, Corporate Laws, and FEMA Laws, etc. Clientele includes Non-Residents Individuals and corporate entities. He has remained office-bearer of many professional organizations like ICAI, ICSI, Noida Management Association. He has been instrumental in organizing various professional seminars and has been a speaker at various forums and contributing professional Articles.