Remission of Duties and Taxes on Exported Products (RoDTEP)

Topics to be covered

There can be no doubt that Prime Minister Narendra Modi’s call to scale up exports to $400 billion this year helped expedite the disentangling of inter-ministerial red tape over the RoDTEP scheme.

A new foreign trade policy, a couple of smaller export-related schemes and a mechanism to fork out the last two years’ pending dues under the earlier export incentive programme are expected by September. This urgency must not be lost.

Having opted out of RCEP, India is looking to re-ignite free trade pact negotiations with Australia, the U.K., the EU and the U.S.

Background

Even as export subsidies violate the WTO’s rules, a limited exception was made for specified developing countries that may continue to provide export subsidies temporarily until they reach a defined economic benchmark of $1,000 per capita gross national income (GNI).

Further, developing countries that had a GNI of over $1,000 per capita at the time when the WTO was set up in 1995, were allowed eight years to wind up their export promotion schemes.

India’s GNI being below the $1,000 per capita-mark, it initially availed of the exemption from no export subsidy obligation.

But in 2015, it surpassed the threshold, thereby pushing it into the “no-exemption” zone.

India did Nothing?

India had ample opportunity to plan. It had 20 years available (1995 to 2015) to get adjusted to a WTO-compatible scenario. That was not done and when the O day arrived, it wanted more time, which was a totally illogical move.

The leeway to withdraw subsisting export subsidies within the eight- year time frame was meant for those developing countries which in 1995 had GNI in excess of $1,000 per capita. It can’t be availed by India which falls in a different category.

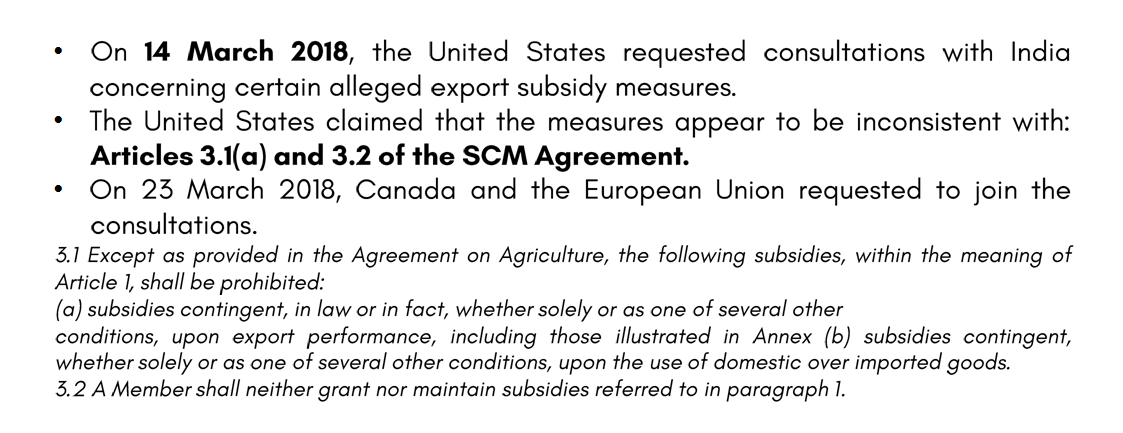

USTR to WTO

Panel and Appellate Body proceedings

On 17 May 2018, the United States requested the establishment of a panel.

At its meeting on 28 May 2018, the DSB established a panel. Brazil, Canada, China, Egypt, the European Union, Japan, Kazakhstan, Korea, the Russian Federation, Sri Lanka, Chinese Taipei, and Thailand reserved their third-party rights.

On 16 July 2018, the United States requested the Director-General to compose the On 23 July 2018, the Director-General composed the panel.

On 3 December 2018, the Chair of the panel informed the DSB that the beginning of the panel’s work had been delayed as a result of a lack of available resources in the Secretariat and that the panel expected to issue its final report to the parties not before the second quarter of 2019.

On 31 October 2019, the panel report was circulated to Members.

Related Topic:

RoDTEP Scheme & Rates: Is It a Fit Case for Invoking Writs?

Basis of Challenge

- This dispute concerns the United States’s challenge of alleged export subsidies provided by India under five sets of measures: the Export Oriented Units, Electronics Hardware Technology Park and Bio-Technology Park (EOU/EHTP/BTP) Schemes; the Export Promotion Capital Goods (EPCG) Scheme; the Special Economic Zones (SEZ) Scheme; a collection of duty stipulations described in these proceedings as the Duty-Free Imports for Exporters Scheme (DFIS); and the Merchandise Exports from India Scheme (MEIS).

- The alleged export subsidies under the EOU/EHTP /BTP Schemes, EPCG Scheme, SEZ Scheme, and DFIS consist of exemptions and deductions from customs duties and other taxes. The alleged export subsidies under MEIS consist of government issued notes (“scrips”) that can be used to pay for certain liabilities vis-a-vis the Government and are freely transferable.

Special and differential treatment

- India argued before the Panel that the special and differential treatment provisions of Article 27 of the Agreement on Subsidies and Countervailing Measures (SCM Agreement) still excluded it from the application of the prohibition on export subsidies.

- However, the parties did not dispute that India had graduated from the special and differential treatment provision that it originally fell under (Article 27.2(a) and Annex Vll(b)), and the Panel found that no further transition period under Article 27.2(6) is available to India after graduation.

- Article 27 therefore no longer excludes India from the application of the prohibition on export subsidies and from the corresponding dispute settlement procedures, laid out in Articles 3 and 4 of the SCM Agreement, respectively.

Penal’s Decision

The Panel recommended that India withdraw

- The prohibited subsidies under DFIS within 90 days from adoption of the Report;

- that it withdraw the prohibited subsidies under the EOU/EHTP /BTP Schemes, EPCG Scheme, and MEIS, within 120 days from adoption of the Report;

- and that it withdraw the prohibited subsidies under the SEZ Scheme within 180 days from adoption of the Report.

But, On 19 November 2019, India notified the DSB of its decision to appeal to the Appellate Body certain issues of law and legal interpretations in the panel report.

Purpose of RoDTEP

- Exporters incur various costs in manufacturing export products. While some costs like GST and customs duties on imported raw material are either exempted or refunded, there are other costs as mentioned above that are still borne by the exporters.

- Such hidden costs add to increase the final cost of the products that are This way, Indian exporters lose their competitive edge in terms of pricing in the international markets.

- To avoid this and make Indian exports more competitive vis-a-vis other exporting countries, the Government of India has introduced the RoDTEP scheme.

- An expert panel headed by former Home Secretary G.K. Pillaiwas formed to determine the RoDTEP rates.

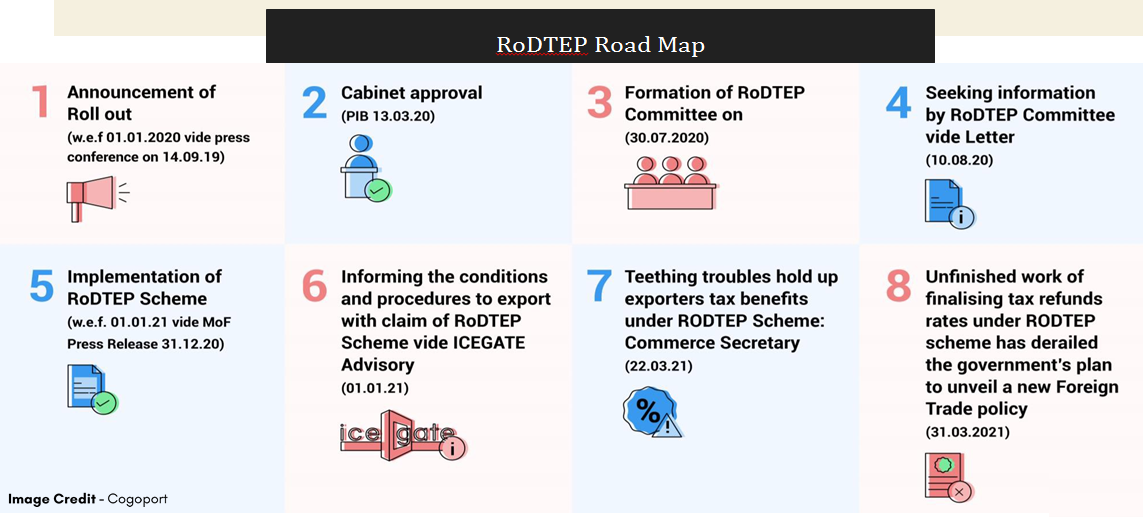

RoDTEP Road Map

Guidelines

The government has finally issued Notification 19 dated 17th August 2021, amending the FTP 2015-20 through inserting sub-para {e) in para 4.01 and para 4.54 to 4.59 stating various guidelines in respect of the scheme.

- The rebate shall not be available in respect of those duties and taxes, which are exempted/ remitted/credited.

- Ceiling rates under the Scheme will be done by a Committee in the Department of Revenue/Drawback Division with the suitable representation of the DoC/DGFT.

- As the scheme is limited by the budget, the budget will be finalized by the Ministry of Finance in consultation with the DoC.

- The rebate allowed is subject to the receipt of sale proceeds within the time allowed under the Foreign Exchange Management Act, 1999 failing which such rebate shall be deemed never to have been allowed.

- Important to note that, adequate safeguards to avoid any misuse on account of non-realization and other systemic improvements as in operation under Drawback Scheme, IGST and other GST refunds relating to exports would also be applicable for claims made under the RoDTEP Scheme.

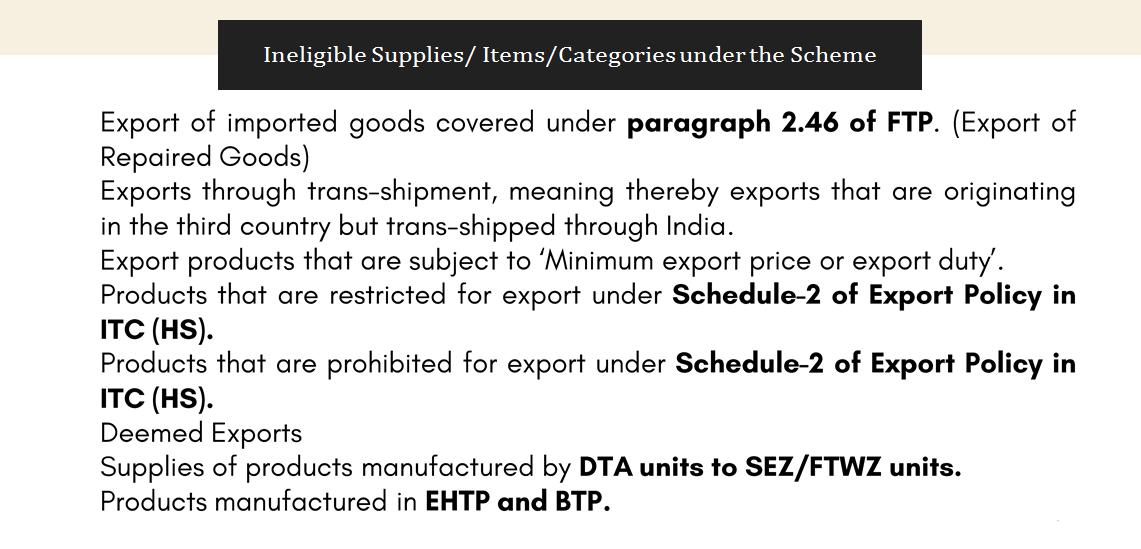

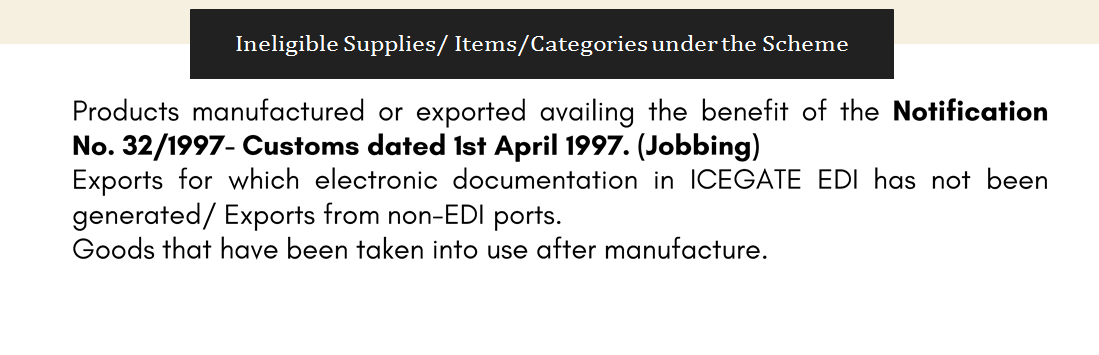

Ineligible Supplies/ Items/Categories under the Scheme

- Products manufactured partly or wholly in a warehouse under Section 65 of the Customs Act, 1962 {52 of 1962}. {MOOWR Scheme}

- Products manufactured or exported in discharge of export obligation against an Advance Authorization or Duty-Free Import Authorization or Special Advance Authorization issued under a duty exemption scheme of relevant Foreign Trade Policy.

- Products manufactured or exported by a unit licensed as a hundred percent Export Oriented Unit (EOU) in terms of the provisions of the Foreign Trade Policy.

- Products manufactured or exported by any of the units situated in Free Trade Zones or Export Processing Zones or Special Economic Zones.

Conditions

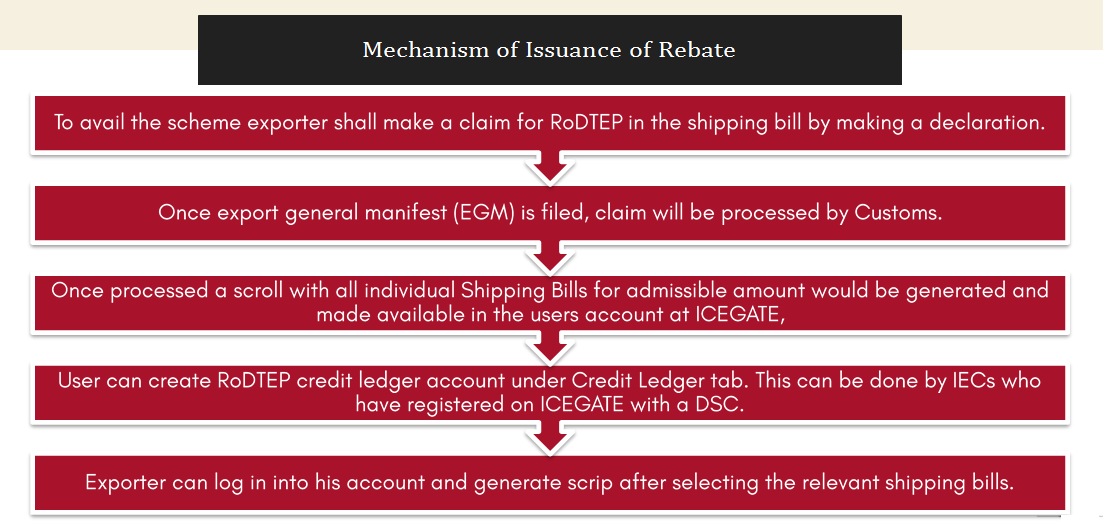

- One of the important features proposed in the Budget 2020 under Customs Law was the implementation of the system of Duty Credit Ledger. 51B is proposed to be inserted in the Customs Act, 1962

- Now as per Section 51B(2), only ‘Custom Duty’ can be paid through the ledger.

- Necessary rules and procedures regarding grant of RoDTEP claim under the Scheme and implementation issues would be notified by the CBIC, Department of Revenue on an IT-enabled platform to end digitization.

- Necessary provisions for recovery of rebate amount where foreign exchange is not realized, suspension/withholding of RoDTEP in case of frauds and misuse, as well as the imposition of penalty will also be built suitably by CBIC.

Points to be Noted

- Now, as the scheme is bound by Budget, Rs 19,400 crore would be available for 2021-22 for both the RoDTEP and the Rebate of State and Central Taxes and Levies (RoSCTL).

- The RoSCTL scheme was announced for the export of garments and apparel.

- For the RoDTEP scheme, the amount is Rs 12,454 crore, and the remaining Rs 6,946 crore for RoSCTL.

- As the RoDTEP scheme came into effect from January 1 this year, additional funds will be provided on a pro-rota basis for the period Jan-March 21.

- Since then there the exporters are filing Shipping Bills with necessary disclosures for claiming the incentive.

- RoDTEP covers as many as 75% of the tariff lines and 8,555 products, with the rates ranging between 3% and 4.3% of the freight-on-board value of the exported products. The list includes some 1,000 more products than under MEIS.

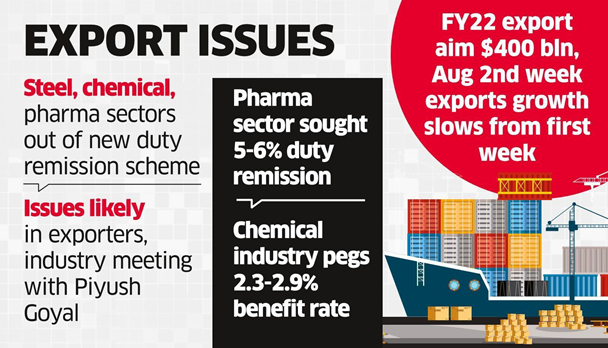

- These are tobacco products, mineral products, chemicals, pharmaceuticals and fertilisers, wood pulp, fibrous cellulosic material, apparel and made up textile articles, iron, steel, and articles thereof.

- Maybe because the government believes these sectors are doing well and, therefore, do not need to be reimbursed.

Steel Pharma

Major Concerns

Lower Rates:

- The scheme disappointed many exporters as the rates are much lower than MEIS rates with lesser budget allocation.

- The rates have not taken into account the taxes embedded in their raw material like steel in the engineering products in a large number of cases.

Deprive Large Sectors:

- The benefit appears not to be available to major exports such as steel, pharma, and exports made under Advance Authorization, EOU (Export oriented unit), SEZ (Special Economic Zone}, etc.

- It will have an adverse impact on the competitiveness of Indian exports and will send negative sentiment amongst the exporters.

Key Judgments of MEIS

- 2021 {3} TMI 91 – Bombay High Court Portescap India Private Limited Versus Union Of India & Ors.

- 2019 {6} TMI 811 – Madras High Court M/S. Global Calcium Private Limited Versus The Assistant Commissioner Of Customs {Ede} , The Commissioner Of Customs

- 2019 {2} TMI 1187 – Madras High Court M/S. Pasha International Versus The Commissioner Of Customs, The Assistant/Deputy Commissioner Of Customs {Exports}, The Joint Director General Of Foreign Trade

- SAINT GOBAIN INDIA LTD. Versus UNION OF INDIA – 2018 {11} TMI 536 – KERALA HIGH COURT

TaxTru’s Remarks

- should start by stating that if we see the allocation towards the scheme, which is way smaller compared to MEIS that had a Budget allocation of Rs 39,097 crore for FY 20.

- The reimbursement rate of taxes and duties on eligible export items vary from 0.01% to 4.3% of the Free on Board (FOB) value. (With maximum Cap)

- Items such as gems & jewelry would have a refund rate of 01% whereas items such as shirt fabrics are at 4.3%.

- Sectors such as steel, pharma, and chemicals are kept out of the RoDTEP (DON’T KNOW WHY!)

- Also, we await the decision on exports on account of Advance Authorizations, by EOUs & by SEZs.

- These schemes have existed for quite some time as export enablers and their exclusion from RoDTEP benefits could rob them of some popularity, considering there was no such exclusion under the earlier MEIS scheme.

- Looking at the rates of incentive and intents of the scheme which provide zero rebating of exports, are WTO compatible and thus will continue for a long time until all the products and services are brought within the ambit of GST and the embedded incidence is completely neutralized.

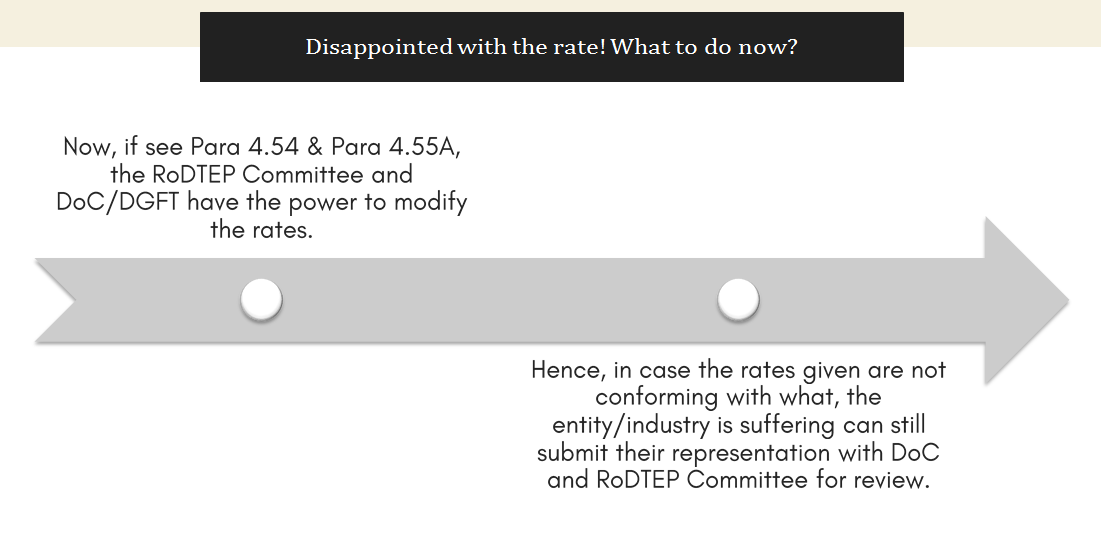

Disappointed with the rate! What to do now?

- TaxTru was actively involved in the preparation of various representations and Performas (Rl, R2 & R3) given by the RoDTEP Committee to various trade bodies/houses for calculation of the rate.

- But it seems (not surprisingly), the government has not taken into account such suggestions and came out with their assumptions and presumptions while giving out the rate of incentives.

- Since this scheme is applicable from 1st January, we should closely monitor the mechanism through which the availment mechanism will be implemented. What if there is an error? {M/S. K.I. INTERNATIONAL LIMITED VERSUS THE COMMISSIONER OF CUSTOMS {APPEAL-II), THE COMMISSIONER OF CUSTOMS, THE ASSISTANT COMMISSIONER OF CUSTOMS {EDC) 2021 {6) TMI 1007 – MADRAS HIGH COURT.

[pdf_attachment file=”1″ name=”optional file name”]

CA Navjot Singh

CA Navjot Singh

ACA, M.Com & B.Com • Associate Member of the Institute of Chartered Accountants of India having more than 3 years of experience in Indirect Tax Laws, Appeals, Tax Restructuring, Tax Advisory, and consulting pertaining to GST, Service Tax, VAT, Excise, and Customs. • Specialist in the field of refund in tax regimes like GST, Service tax, Excise, Customs, and VAT. • Has amassed abundant expertise over the years in DGFT & Customs-related issues. • Has conducted GST impact analysis of a large number of companies and helping them implementing GST • Has argued a large number of cases before Revenue Authorities and Tribunals across India. • Has conducted a large number of Indirect-tax audits for MNCs and Listed Companies. • Documentation and representation for Exporters and Importers with the office of Directorate General of Foreign Trade (DGFT) & Directorate of Revenue Intelligence (DRI) • Assisting in preparation of documents, representations, and coordination with various targeted departments for processing various subsidy/incentives as announced by the Center/State Governments.