remission of duty on work-in-progress and semi-finished goods due to fire broke out in the factory

Table of Contents

Introduction:

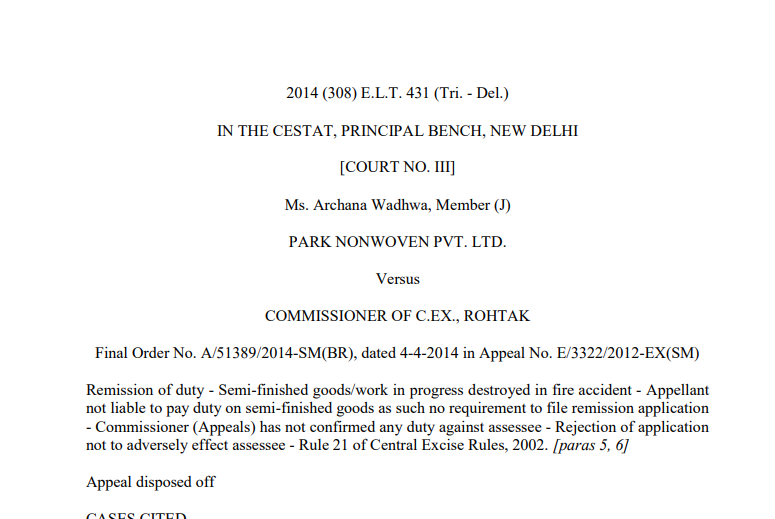

A case of remission of duty on work-in-progress and semi-finished goods due to fire broke out in the factory.2014 (308) E.L.T. 431 (Tri. – Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

PARK NONWOVEN PVT. LTD.

Versus

COMMISSIONER OF C.EX., ROHTAK

Final Order No. A/51389/2014-SM(BR), dated 4-4-2014 in Appeal No. E/3322/2012-EX(SM)

Remission of duty work in progress destroyed in fire accident – Appellant not liable to pay duty on semi-finished goods as such no requirement to file remission application – Commissioner (Appeals) has not confirmed any duty against assessee – Rejection of application not to adversely affect assessee – Rule 21 of Central Excise Rules, 2002. [paras 5, 6]

The appeal disposed of

CASES CITED

Lakshmi Precision Tools Ltd. v. Commissioner — 2006 (199) E.L.T. 77 (Tribunal) — Referred [Para 4]

Urmi Chemicals v. Commissioner — 2014 (301) E.L.T. 356 (Tribunal) — Referred [Para 4]

REPRESENTED BY: Shri Dinesh Verma, Advocate, for the Appellant.

Shri B.B. Sharma, AR, for the Respondent.

Order:

The appellants have filed the written submission. I have also heard both sides duly represented by Shri Dinesh Verma learned Advocate and Shri B.B. Sharma learned AR.

2. The short issue involved in the present appeal is as to whether the appellant is entitled to the remission of duty in terms of the provision of Rule 21 of the Central Excise Rules, in respect of the semi-finished goods/work in process, destroyed in a fire accident. The Commissioner has denied the remission application on the ground that no remission is required for semi-finished goods inasmuch as Rule 21 of Central Excise Rules, 2002 is applicable for finished excisable goods and in-process goods.

3. I find that there is no dispute about the fact of the fire accident as also about the destruction of the semi-finished goods. The Commissioner has also observed that the revenue is not asking the appellant for reversal of input credit involved in such destroyed semi-finished goods. The assessee is under no obligation to pay duty on the semi-finished goods inasmuch as admittedly the same are not fully manufactured goods.

4. Tribunal in the case of Urmi Chemicals v. CCE, Mumbai-III – 2014 (301) E.L.T. 356 (Tri.- Mumbai) has held that the semi-finished goods cannot be cleared and therefore, no duty liability would arise in respect of the destroyed semi-finished goods. In the case of Lakshmi Precision Tools Ltd. – 2006 (199) E.L.T. 77 (Tri.-Chennai), it was held that the stock in-process goods cannot be called upon to pay duty.

5. Admittedly, in the present case, the appellant is not liable to pay duty on the semi-finished goods. As such, there is no requirement to file the remission application. No duty can be confirmed against them in respect of the said semi-finished goods. In fact, I find that the vide impugned order of Commissioner (Appeals) has not confirmed any duty against the assessee and has simplicitor rejected the remission application, which is not going to adversely affect the appellants.

6. Accordingly, without going into the technical issue is as to whether the remission is required in semi-finished goods are not, as I am of the views the appellant is not liable to pay any duty, the rejection or acceptance of the remission application is in effect. The appeal is accordingly disposed of in the above manner.

Download the copy:

Advocate Dinesh Verma

Advocate Dinesh Verma