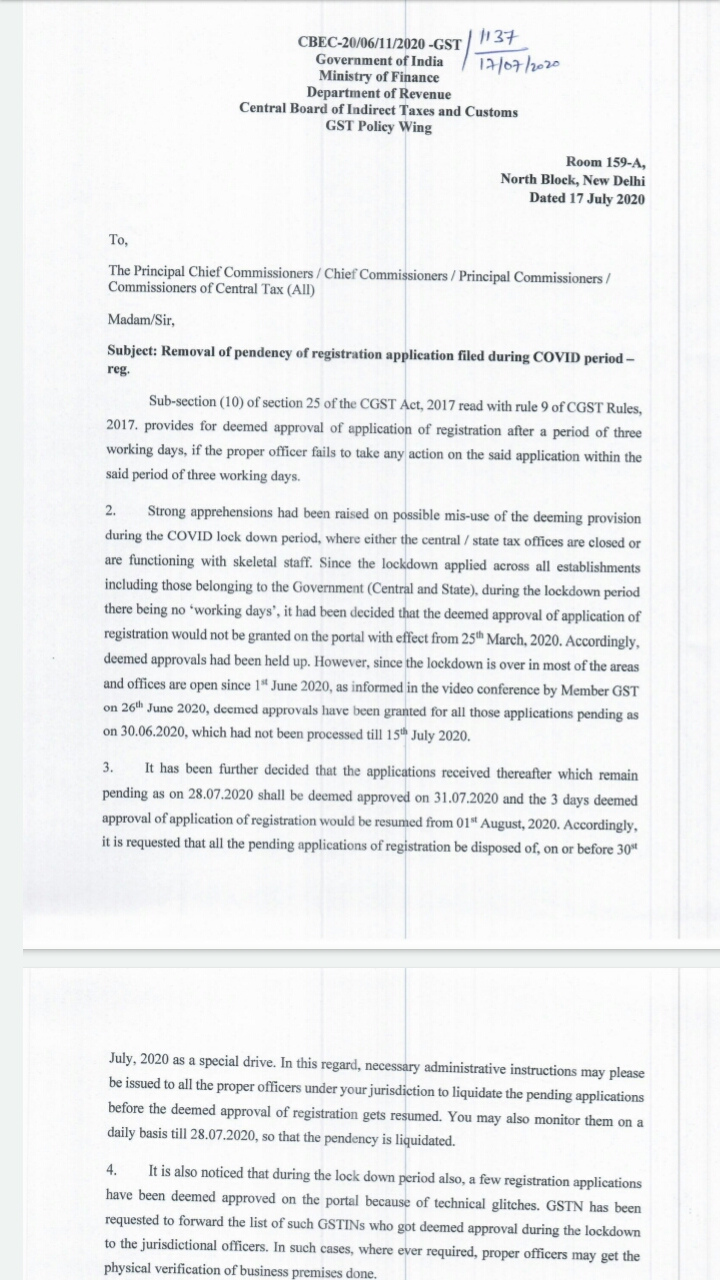

Removal of Pendency of Registration Application Filed During COVID Period

To,

The Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/ Commissioners of Central Tax (All)

Madam/Sir,

Subject: Removal of pendency of registration application filed during COVID period-reg.

sub-section (10) of section 25 of the CGST Act, 2017 read with rule 9 of the CGST Rules, 2017, provides for demand approval of the application of registration after a period of three working days, if the proper officer fails to take any action on the said application within the said period of three working days.

2. Strong apprehensions had been raised on the possible misuse of the deeming provision during the COVID lock-down period, where either the central/state tax offices are closed or are functioning with skeletal staff. Since the lockdown applied across all establishments including those belonging to the Government (Central and State), during the lockdown period there being no ‘working days’, it had been decided that the deemed approval of the application of registration would not be granted on the portal with effect from 25th March 2020. Accordingly, deemed approvals had been held up. However, since the lockdown is over in most of the areas and offices are open since 1st June 2020, as informed in the video conference by Member GST on 26th June 2020, deemed approvals have been granted for all those applications pending as on 30.06.2020, which had not been processed till 15th July 2020.

3. It has been further decided that the application received thereafter which remains pending as on 28.07.2020 shall be deemed approved on 31.07.2020 and the 3 days deemed approval of applications of registration would be resumed from 01st August 2020. Accordingly, it is requested that all the pending applications of registration be disposed of, on or before 30th July 2020 as a special drive. In this regard, necessary administrative instructions may please be issued to all the proper officers under your jurisdiction to liquidate the pending applications before the deemed approval of registration gets resumed. You may also monitor them on a daily basis till 28.07.2020 so that the pendency is liquidated.

4. It is also noticed that during the lockdown period also, a few registration applications have been deemed approved on the portal because of technical glitches. GSTN has been requested to forward the list of such GSTNs who got deemed approval during the lockdown to the jurisdictional officers. In such cases, where ever required, proper officers may get the physical verification of business premises done.

Read the Copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.