FAQ’s on FORM GST PMT 09

What is PMT 09? PMT 09 is the prescribed challan for shifting the wrongly paid ITC. It is recently introduced by CBIC. If you have paid a wrong tax, like CGST in place of SGST, you can shift it using this challan. It is live

What is PMT 09? PMT 09 is the prescribed challan for shifting the wrongly paid ITC. It is recently introduced by CBIC. If you have paid a wrong tax, like CGST in place of SGST, you can shift it using this challan. It is live

Introduction: Wrongly paid GST can be shifted easily now. Have you also paid GST in the wrong head and now stuck due to that. Many are there like you. Tax wrongly paid under any head can be shifted to correct head now. CBIC made a

Introduction: Clinical research is a buzzing service in India. The supplier provides the services of clinical research for the recipient located outside India. In these services, various activities related to research are done. Now whether that service will be an export of service or not.

original copy of cliantha research limited advance ruling MAHARASHTRA AUTHORITY FOR ADVANCE RULING GST Bhavan, 8h floor, H-Wing, Mazgaon, Mumbai ~ 400010. (Constituted under section 96 of the Maharashtra Goods and Services Tax Act, 2017) BEFORE THE BENCH OF Shri B. Timothy, Addl. Commissioner of

Introduction: Sanofi Advance ruling on ITC of free gifts given by Maharastra AAR is an important one. Here we will discuss Sanofi Advance ruling on ITC at length. This discussion is quite important for : Pharma sector companies FMCG companies Other companies using a lot

AAR of Sanofi India limited: This is one of the landmark AAR for promotional items and free gifts. In AAR of Sanofi India, limited detailed discussion was made on this issue. Order: The present application has been filed under section 97 of the Central Goods

Introduction: In a recent communication plan for GST audit by the department is rolled out. The taxpayer is not getting out of annual return and GST audit by a professional dilemma. Section 65 & 66 of CGST Act gives deptt a right for audit. This

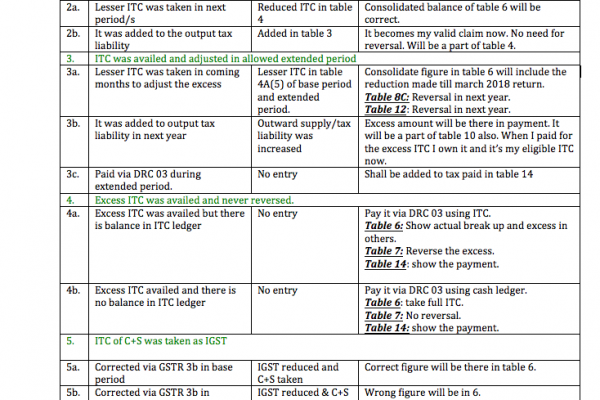

Know all the ITC tables in GSTR 9: The annual return is a compilation of entire data of the base period. It covers two major parts: supply and ITC. In this article, we will cover all errors and mistakes done in monthly returns. Treatment of

35TH GST COUNCIL MEETING RECOMMENDATIONS by CA Shubham Khaitan: The 35th GST Council Meeting was the first meeting of the Council after the swearing in of the new Government. The following are the major decisions taken in the 35th GST Council meeting: ➢Extension

GST annual return date extended by GST council. There was a huge demand from taxpayers for its extension. There are many complexities in the annual return. A big respite is given to the taxpayers. The annual return is the return for a year to be