RESTAURANT AND OUTDOOR CATERING SERVICE

Table of Contents

RESTAURANT AND OUTDOOR CATERING SERVICE

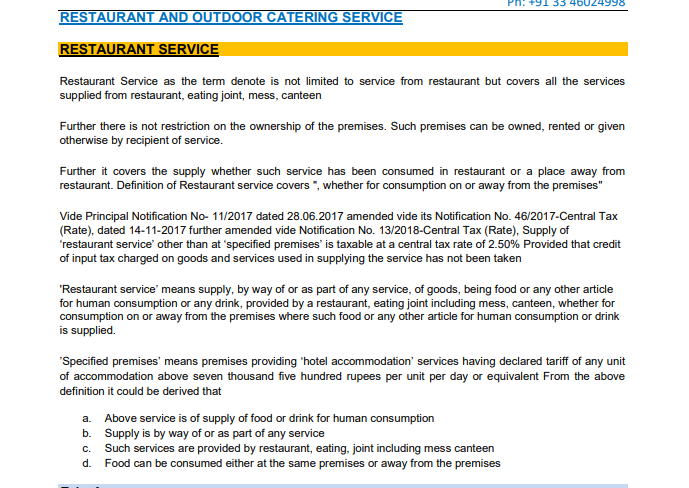

RESTAURANT SERVICE

Restaurant Service as the term denotes is not limited to service from the restaurant but covers all the services supplied from the restaurant, eating joint, mess, canteen

Further, there is no restriction on the ownership of the premises. Such premises can be owned, rented, or given otherwise by the recipient of service.

Further, it covers the supply whether such service has been consumed in a restaurant or a place away from the restaurant. Definition of Restaurant service covers “, whether for consumption on or away from the premises”

Vide Principal Notification No- 11/2017 dated 28.06.2017 amended vide its Notification No. 46/2017-Central Tax (Rate), dated 14-11-2017 further amended vide Notification No. 13/2018-Central Tax (Rate), Supply of ‘restaurant service’ other than at ‘specified premises’ is taxable at a central tax rate of 2.50% Provided that credit of input tax charged on goods and services used in supplying the service has not been taken

‘Restaurant service’ means supply, by way of or as part of any service, of goods, being food or any other article for human consumption or any drink, provided by a restaurant, eating joint including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied.

’Specified premises’ means premises providing ‘hotel accommodation’ services having declared tariff of any unit of accommodation above seven thousand five hundred rupees per unit per day or equivalent From the above definition it could be derived that

a. The above service is of supply of food or drink for human consumption

b. Supply is by way of or as part of any service

c. Such services are provided by the restaurant, eating, joint including mess canteen

d. Food can be consumed either at the same premises or away from the premises

Take Away

In view of the definition, it is not necessary that service is supplied in the restaurant itself. Hence the take away of food article shall also fall within the ambit of definition of Restaurant Service. Food may be prepared at a restaurant and supplied to a place other than a restaurant.

Composite Supply

Restaurant Service is a composite supply of goods being food and supplied by way of service. Restaurant service is the supply of food but such a supply of food is by way of part of service or service. Two or more taxable supplies take place. Such supply is a Composite Supply to be treated as service by virtue of Schedule II of Section 7 of the CGST Act, 2017. The supply of food must be coupled by way of service.

Nature of Establishment of Supply

Supply of Food being by way of supply should be provided by a restaurant, eating joint including mess, canteen

Restaurant Service has been defined but “Restaurant” is not defined under the GST Act. Therefore, we will understand the meaning of the Restaurant as provided in the Cambridge Dictionary. As per the Cambridge Dictionary, a Restaurant is a place where meals are prepared and served to the customer. In our opinion merely the preparation of food does not cover the establishment of the restaurant.

Authority for Advance Ruling in an application filed by Ismail Ahamad Soofi [2018 (19) G.S.T.L. 546 ] “canteen” as per Cambridge English Dictionary is “a place in factory, office, etc., where food and meals are sold often at a lower than usual price”.

Dictionary meanings of the word ‘canteen’ are as under:

A restaurant provided by an organization such as college, factory, or a company for its students or staff (ref: www.oxforddictionaries.com)

A restaurant attached to a factory, school, etc., providing meals for a large number of people (ref: www.colinsdictionary.com)

A place in a factory, office, etc., where food and meals are sold, often at a lower than usual price (ref: www.dictionary.cambridge.org

The taxability of restaurant service will arise only when the supply of food is made from the restaurant, eating joint including mess, canteen. If the supply is not made from such premises, then the supply of food would not be termed as restaurant service. The nature of the establishment from where the supply is made plays a very important role in the classification of supply. If the nature of the establishment is not in the nature of the restaurant, the question of supply of service does not arise. Service provided or to be provided to any person, by a restaurant, eating, joint mess, canteen in relation to serving of food or beverage. Therefore, a service must be to any person by the restaurant and which can be called by any name such as hotel, lunch home, dining or lunch & dinner home. There would be only one supply of being food and no service. There is no supply of two or more taxable supplies. Supply of food would not be a composite supply to treat the supply of food as services as enumerated in Schedule II of Section 7 of the CGST Act, 2017.

Initially, there was a distinction between the services provided by air-conditioned and non-air-conditioned restaurants. However, vide Notification No. 46/2017-C.T. (Rate), dated 15-11-2017 was issued, as per which the GST rate applicable to services provided by restaurants, eating joint including mess, canteens, etc. was reduced to 5% subject to a condition that input tax charged on goods and services used in supplying the service has not been taken (hereinafter referred as ‘ITC condition’).

Corporate Supply of Food to the Employees by Caterer or through Caterer

It is common practice that the Company engages Caterer for the supply of food to their employees in the factory as well as in the office. In this situation, food preparation can be done at the Caterer’s premises or at the premise provided by the Company

a. Food Preparation at Caterers Premises- In a situation wherein the food is supplied from the Caterer’s kitchen, the same would fall within the ambit of Restaurant Service. ‘Restaurant service’ means supply, by way of or as part of any service, of goods, being food or any other article for human consumption or any drink, provided by a restaurant, eating joint including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied. In view of the above definition, food can be supplied from the restaurant or canteen to be consumed at a place away from the premises where such food is supplied. The supply of such service would be taxable @ 5% with no credit of Input Tax

b. Food Preparation at the Company’s Premises: The company at times offers their part of the premises for the preparation of the food and allows the service of the from such premises. Hence food is not supplied from the restaurant owned or occupied by Caterer but from the premises owned or occupied by the company. It is worthy to note that there is no restriction on the ownership of the premises from where the food is to be supplied. The only condition is the food to be supplied from by a restaurant, eating joint including mess, canteen. Hence the supply of the food prepared at the Canteen of the company’s premises would fall within the ambit of Restaurant Service. Food can be supplied from the restaurant or canteen to be consumed at a place away from the premises where such food is supplied. The supply of such service would be taxable @ 5% with no credit of Input Tax. The above view has been upheld in an application before AAR under GST, Karnataka by Elior India Catering LLP [2019 (31) G.S.T.L. 362 (A.A.R. – GST)].

In an application filed before AAR under GST, Gujarat by Gurukrupa Hospitality Services [2020 (4) TMI 595]- Agreement with one of their client for running of the canteen and its total affairs including the supply of snacks, tea, lunch, and dinner to its employee and workers according to the conditions mentioned in the agreement. The canteen space and some equipment have been provided by the client to the applicant. W.e.f 26.07.2018- Applicant is taxable under the category of “Accommodation, food and beverages services” and is covered under Sr. No. 7 (i) of the Table to Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 attracting GST @ 5% (CGST:2.5% + SGST: 2.5%). Before insertion of Explanation, 1 vide Notification No.13/2018-Central Tax (Rate) dated 26.07.2018 supply of services of the applicant is taxable under “Accommodation, food and beverages services” as a part of “Outdoor Catering Services” and is covered under Sr. No. 7(v) attracting GST @ 18%. Explanation 1 as follows:- This item includes such supply at a canteen, mess, cafeteria or dining space of an institution such as a school, college, hospital, industrial unit, office, by such institution or by any other person based on a contractual arrangement with such institution for such supply, provided that such supply is not event-based or occasional

Supply of Ice-cream, Chocolate, Cakes

C.B.E. & C. Circular No. 27/01/2018-GST, dated 4-1-2018

What will be the rate of tax for bakery items supplied where eating place is attached – manufacturer for the purpose of composition levy?

Any service by way of serving of food or drinks including by a bakery qualifies under section 10(1)(b) of CGST Act and hence GST rate of composition levy for the same would be 5%.

In view of the above clarification, sale bakery items where eating place is attached, such supply would fall within the ambit of restaurant services and will be subject to tax @ 5% without the credit of the input tax.

In an application filed before AAR under GST, Karnataka by Hatsun Agro Product Ltd [2019 (31) G.S.T.L. 349 (A.A.R. – GST)]- IBACO outlet is completely different from a normal ice cream shop selling packed ice creams. The applicant also submits that they not only sell ice creams but also provide services like scooping of ice cream, mixing of toppings, serving of ice cream, seating facility, air-conditioning facility, drinking water facility, provision of dustbin and tissue papers, etc. This gives the customer a good ambiance and overall different experience vis-a-vis compared to a normal ice cream parlor. Similar to the aforesaid process the ice cream cakes are also sold to customers in a similar manner, where the customer provides various customizations of the combination of ice creams. It is found that the applicant is supplying ice cream and other items of food that are made to order along with certain services. Hence the applicant is supplying both services and goods and they are naturally bundled. Above supplies are classified under Chapter [Heading] “9963” and chargeable to tax at a rate of 2.5%

Supply of Packaged Food:

Supply of Packaged food being sweets, namkeens, cold drinks, and other edible items are supplied to customers from a restaurant will also be treated as restaurant service and will be taxable @ 5% with no credit of input tax.

However, if the supply of sweets and namkins are supplied from a place other than a restaurant or a separate demarcated area from a restaurant then the supply of sweets and namkins would not fall within the ambit of restaurant service. As the same being not supplied from the restaurant, hence no service could be deemed to be provided to treat the supply as a composite supply. The person making such a supply would also be eligible to claim the credit of input tax. Such premises should not have any nexus with the restaurant.

Hence the only distinction is whether there is a provision for an eating place or not.

In an appeal filed before Appellate Authority of Advance Ruling by Kundan Mistan Bhandar [2019 (24) G.S.T.L. 94 (App. A.A.R. – GST)]- it was held that the sale of sweets, namkeens, cold drinks, and other edible items from sweetshop counter will be treated as supply of goods with applicable GST rates of the items being sold and input credit will be allowed on such supply. Further held that the Sale of sweets, namkeens, cold drinks, and other edible items through the restaurant will be treated as ‘composite supply’ with restaurant supply being the principal service. Existing GST rates on restaurant service will also be applicable to all such sales and no input credit will be allowed.

In an application filed before AAR under GST, Karnataka by Mountain Trail Foods Pvt Ltd reported in 2019 (31) G.S.T.L 617 (AAR-GST). The applicant in the business of preparation of beverages at the Chai point location and takeaway (parcel) prepared food products at their outlets (restaurants). The company also sells packed ready-to-eat products, confectionery, and packed bakery products of various brands, co-branded products, Loose-leaf Tea, Assam Tea, Premium Tea packets. Dip Teabags. Chai Bottle, Chai Mugs. Packaged food products cannot be consumed as-is basis. First few lines of this notification state as under “…….. hereby notifies that the central tax, on the intra-State supply of services of the description as specified in column (3) of the Table below. Since this notification is applicable only to the supply of services and not the supply of goods. Since the goods as specified above are supplied and output tax is payable on the same, the applicant is eligible to take applicable input tax credit which is admissible as per the GST laws

OUTDOOR CATERING

Vide Principal Notification No- 11/2017 dated 28.06.2017 amended vide its Notification No. 46/2017-Central Tax (Rate), dated 14-11-2017 further amended vide Notification No. 13/2018-Central Tax (Rate), Supply of ‘outdoor catering’, at premises other than ‘specified premises’ provided by any person other than suppliers providing ‘hotel accommodation’ at ‘specified premises’ or suppliers located in specified premises is taxable at a central tax rate of 2.50% Provided that credit of input tax charged on goods and services used in supplying the service has not been taken.

Outdoor catering’ means supply, by way of or as part of any service, of goods, being food or any other article for human consumption or any drink, at Exhibition Halls, Events, Conferences, Marriage Halls and other outdoor or indoor functions that are event-based and occasional in nature.

Supply of goods being food or any other article for human consumption by way service on certain occasions will be treated as Outdoor Catering. Supply on occasion is one of the important aspects of treating the supply of food as outdoor catering services.

In an application filed before AAR under GST, Gujarat by Gurukrupa Hospitality Services [2020 (4) TMI 595]-Notification No.13/2018-Central Tax (Rate) dated 26.07.2018 seeks to amend, Notification No.11/2017-Central Tax (Rate) so as to notify CGST rates of various services as recommended by Goods and Services Tax Council in its 28th meeting held on 21.07.2018. Explanation 1 inserted at column (3) at Sl. No. 7 (i) of the Table to Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017, reads as under:

Explanation 1.- This item includes such supply at a canteen, mess, cafeteria, or dining space of an institution such as a school, college, hospital, industrial unit, office, by such institution or by any other person based on a contractual arrangement with such institution for such supply, provided that such supply is not event-based or occasional.

scope of outdoor catering under 7(v) is restricted to supplies in case of outdoor/indoor functions that are event-based and occasional in nature.

Indian Coffee Workers’ Co-Op. Society Ltd. Vs. CCE & ST, Allahabad [2014 (34) S.T.R. 546 (All.)] = 2014 (4) TMI 407 – ALLAHABAD HIGH COURT, wherein it was held as follows –

“8. Analyzing the provisions of clause (24) of Section 65 of the Finance Act, 1994, in order to be a caterer, a person should be one who supplies food, edible preparations, beverages (alcoholic or nonalcoholic) or crockery and similar articles or accouterments for any purpose or occasion. The supply may be made directly or indirectly. Consequently, there has to be, firstly, a supply of food, edibles, beverages or crockery and similar articles or accouterments. Secondly, this supply may be for any purpose or occasion. A purpose is an effectuation of a particular object. An occasion is an event defined with reference to time that may take place either as an isolated occurrence or be sporadic or periodical. Thirdly, the supply may be directed by the person himself or indirectly through another. In order to be an outdoor caterer within the meaning of clause (76a), a person must, at the outset, be a caterer. Clause (76a) provides a statutory definition of who is regarded as an outdoor caterer. A caterer is an outdoor caterer because services in connection with catering are provided at a place other than his own. The use of the expression ‘in connection with catering’ broadens the ambit of the definition by bringing within its purview, not merely a service of catering but a service that has a connection with catering. The place where the service is to be provided must be a place other than that of the caterer himself. The inclusive part of the definition includes a place that may be provided to the caterer by the person receiving the service either by an agreement of tenancy or otherwise.

Download the copy:

CA Rachit Agarwal

CA Rachit Agarwal