Return Formats (Sugam Return – FORM GST RET-3) (Quarterly)

Table of Contents

- FORM GST RET-3 (Sugam)

- FORM GST ANX-1 Annexure of outward supplies and inward supplies attracting reverse charge

- FORM GST ANX-2 Annexure of inward supplies

- FORM GST RET-3 Quarterly return

- FORM GST ANX1A Amendment to FORM GST ANX-1

- FORM GST RET3A Amendment to FORM GST RET-3

- FORM GST PMT08 Payment of self-assessed tax

FORM GST RET-3 (Sugam)

RET 03- Sugam is required to be filed when there are the following supplies:

- B2B supply

- B2C supply

- Reverse charge liable for tax

FORM GST ANX-1 Annexure of outward supplies and inward supplies attracting reverse charge

3A. Supplies made to consumers and un-registered persons (Net of debit/credit notes)

3B. Supplies made to registered persons (other than those attracting reverse charge)(including edit/amendment)

3H. Inward supplies attracting reverse charge (to be reported by the recipient, GSTIN wise for every supplier, net of debit/credit notes and advances paid, if any)

FORM GST ANX-2 Annexure of inward supplies

3A. Supplies received from registered persons (other than those attracting reverse charge)

4. Summary of the input tax credit

| Sr. No. | Description | Value |

| 1. | Credit on all documents which have been rejected (net of debit /credit notes) | |

| 2. | Credit on all documents which have been kept pending (net of debit /credit notes) | |

| 3. | Credit on all documents which have been accepted (including deemed accepted) (net of debit/credit notes) |

FORM GST RET-3 Quarterly return

3. Summary of outward supplies, inward supplies attracting reverse charge, debit/credit notes, etc. and tax liability

A. Details of outward supplies

| Sr. No. | Type of supply | Value |

| 1. | Taxable supplies made to consumers and unregistered persons (B2C) [table 3A of FORM GST ANX-1] | <Auto> |

| 2. | Taxable supplies made to registered persons (other than those attracting reverse charge) (B2B) [table 3B of FORM GST ANX-1] | <Auto> |

| 3. | Liabilities relating to the period prior to the introduction of current return filing system and any other liability to be paid | <User input> |

| 4. | Sub-total (A) [sum of 1 to 3] | <Auto> |

B. Details of inward supplies attracting reverse charge

| Sr. No. | Type of supply | Value |

| 1. | Inward supplies attracting reverse charge (net of debit/credit notes and advances paid, if any) [table 3H of FORM GST ANX-1] | <Auto> |

| 2. | Sub-total (B) [sum of 1] |

C. Details of debit/credit notes issued, advances received/adjusted and other reduction in liabilities

| Sr. No. | Type of supply | Value |

| 1. | Debit notes issued (FORM GST ANX-1) (Other than those attracting reverse charge) | <Auto> |

| 2. | Credit notes issued (FORM GST ANX-1) (Other than those attracting reverse charge) | <Auto> |

| 3. | Advances received (net of refund vouchers and including adjustments on account of wrong reporting of advances earlier) | <User input> |

| 4. | Advances adjusted | <User input> |

| 5. | Reduction in output tax liability on account of the transition from composition levy to normal levy, if any or any other reduction in liability | <User input> |

| 6. | Sub-total (C) [1-2+3-4-5] | <Auto> |

| D. | The total value and tax liability (A+B+C) | <Auto> |

4. Summary of inward supplies for claiming input tax credit (ITC)

A. Details of ITC based on auto-population from FORM GST ANX-1, action taken in FORM GST ANX-2 and other claims

| Sr. No. | Description | Value |

| 1. | Credit on all documents which have been rejected in FORM GST ANX-2 (net of debit /credit notes) | <Auto> |

| 2. | Credit on all documents which have been kept pending in FORM GST ANX-2 (net of debit /credit notes) | <Auto> |

| 3. | Credit on all documents which have been accepted (including deemed accepted) in FORM GST ANX-2 (net of debit/credit notes) | <Auto> |

| 4. | Eligible credit (after 1st July 2017) not availed prior to the introduction of this return but admissible as per Law (transition to new return system) | <User Entry> |

| 5. | Inward supplies attracting reverse charge (net of debit/credit notes and advances paid, if any) [table 3H of FORM ANX-1] | <Auto> |

| 6. | An upward adjustment in input tax credit due to receipt of credit notes and all other adjustments and reclaims | <User input> |

| 7. | Sub-total (A) [sum of 3 to 6] | <Auto> |

B. Details of reversals of credit

| Sr. No. | Description | Value |

| 1. | Credit on documents which have been accepted in previous returns but rejected in the current tax period (net of debit/credit notes) | <Auto> |

| 2. | Supplies not eligible for credit [out of net credit available in table 4A above] |

<User input> |

| 3. | Reversal of input tax credit as per the law (Rule 37, 39, 42 & 43) |

<User input> |

| 4. | Other reversals including downward adjustment of ITC on account of the transition from composition levy to normal levy, if any | <User input> |

| 5. | Sub-total (B) [sum of 1 to 4] | <Auto> |

| C. | ITC available (net of reversals) (A- B) | <Auto> |

D. ITC declared during first two months of the quarter

| Sr. No. | Description | Value |

| 1. | First month | <Auto> |

| 2. | Second month | <Auto> |

| Sub-total (D) [sum of 1& 2] | <Auto> | |

| E. | Net ITC available (C-D) | <Auto> |

5. Amount of TDS and TCS credit received in electronic cash ledger

| Sr. No. | Type of tax |

| 1. | TDS |

| 2. | TCS |

| 3. | Total |

6. Interest and late fee liability details

7. Payment of tax

8. Refund claimed from electronic cash ledger

9. Verification

FORM GST ANX1A Amendment to FORM GST ANX-1

3. Amendment to details of outward supplies and inward supplies attracting reverse charge

3A. Amendment to supplies made to consumers and un-registered persons (Net of debit/credit notes)

3H. Amendment to inward supplies attracting reverse charge (to be reported by the recipient GSTIN wise, net of debit/credit notes and advances paid, if any)

FORM GST RET3A Amendment to FORM GST RET-3

3. Amendment to the summary of outward supplies, inward supplies attracting reverse charge and tax liability

A. Details of the amendment to outward supplies

| Sr. No. | Type of supply | Value |

| 1. | Taxable supplies made to consumers and unregistered persons (B2C) [table 3A of FORM GST ANX-1A] | <Auto> |

| 2. | Liabilities relating to the period prior to the introduction of the current return filing system and any other liability to be paid | <User input> |

| 3. | Sub-total (A) [sum of 1 & 2] | <Auto> |

B. Details of the amendment to inward supplies attracting reverse charge

| Sr. No. | Type of supply | Value |

| 1. | Inward supplies attracting reverse charge (net of debit /credit notes and advances paid, if any) [table 3H of FORM GST ANX-1A] | <Auto> |

| 2. | Sub-total (B) [sum of 1] | <Auto> |

C. Details of the amendment to adjustment of liability

| Sr. No. | Type of supply | Value |

| 1. | Reduction in output tax liability on account of the transition from composition levy to normal levy, if any or any other reduction in liability | |

| 2. | Sub-total (C) [sum of 1] | |

| D. | The total value and tax liability (A+B-C) | <Auto> |

4. Amendment to the summary of inward supplies for claiming input tax credit (ITC)

A. Details of the amendment to ITC based on auto-population from FORM GST ANX-1A

| Sr. No. | Type of supply | Value |

| 1. | Inward supplies attracting reverse charge (net of debit/credit notes and advances paid, if any) [table 3H of FORM GST ANX-1A] | <Auto> |

| 2. | An upward adjustment in input tax credit due to receipt of credit notes and all other adjustments and reclaims | <User input> |

| 3. | Sub-total (A) [sum of 1 & 2 | <Auto> |

B. Details of the amendment to reversals of credit

| Sr. No. | Type of supply | Value |

| 1. | Supplies not eligible for the credit | <User input> |

| 2. | Reversal of input tax credit as per law (Rule 37, 39, 42 & 43) | <User input> |

| 3. | Sub-Total (B) [sum of 1 & 2] |

<Auto> |

| C. | Net ITC available (A-B) |

<Auto> |

5. Interest and late fee details

6. Payment of tax

7. Verification

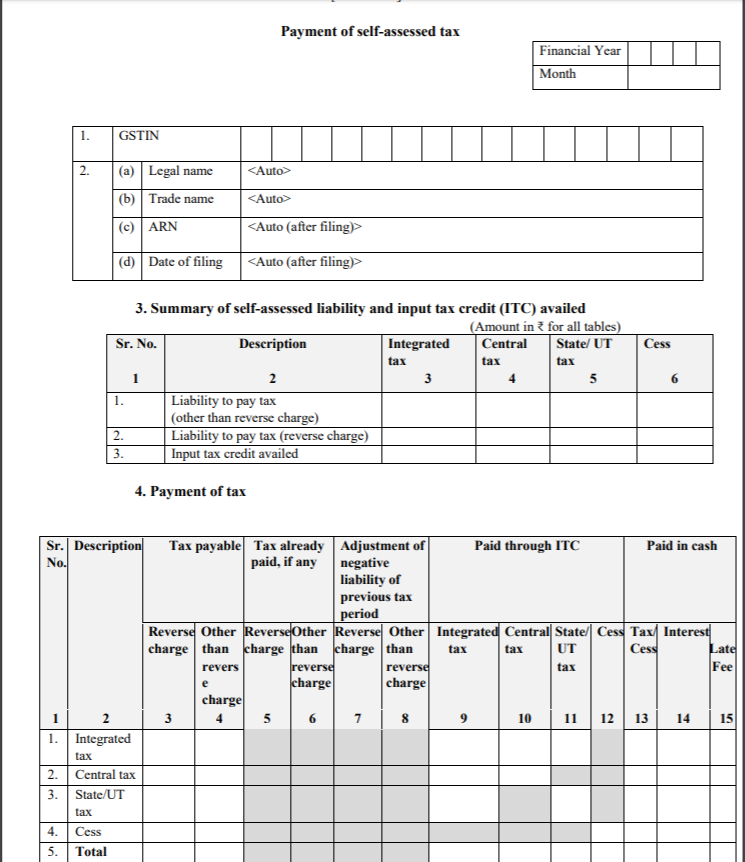

FORM GST PMT08 Payment of self-assessed tax

3. Summary of self-assessed liability and input tax credit (ITC) availed

4. Payment of tax

5. Verification

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.