Rule 155 of the CGST Act – Recovery through land revenue authority

Rule 155 of the CGST Act-

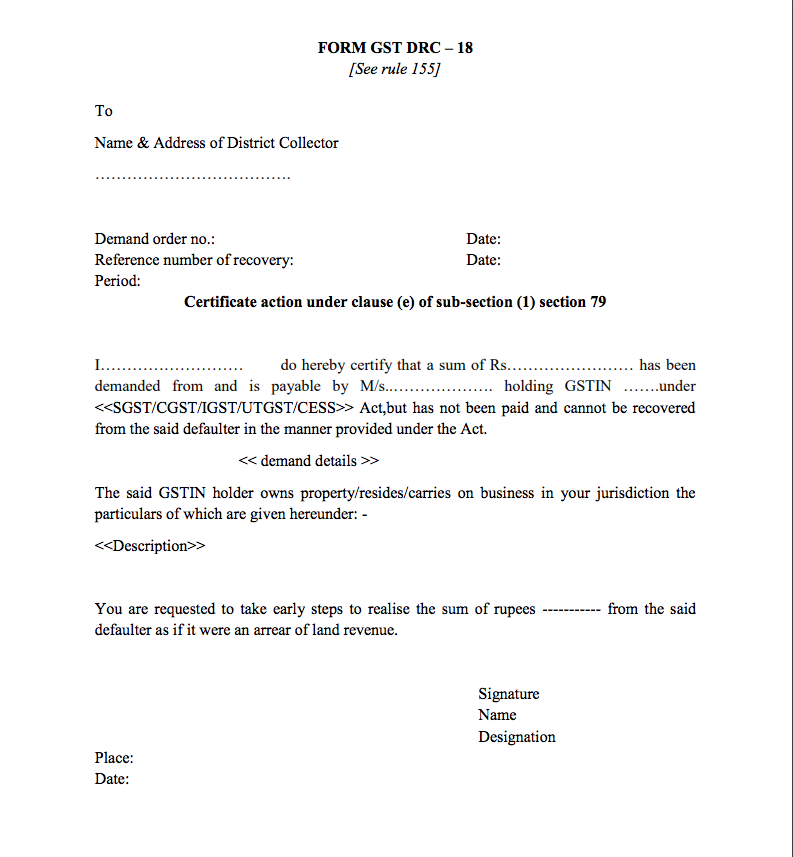

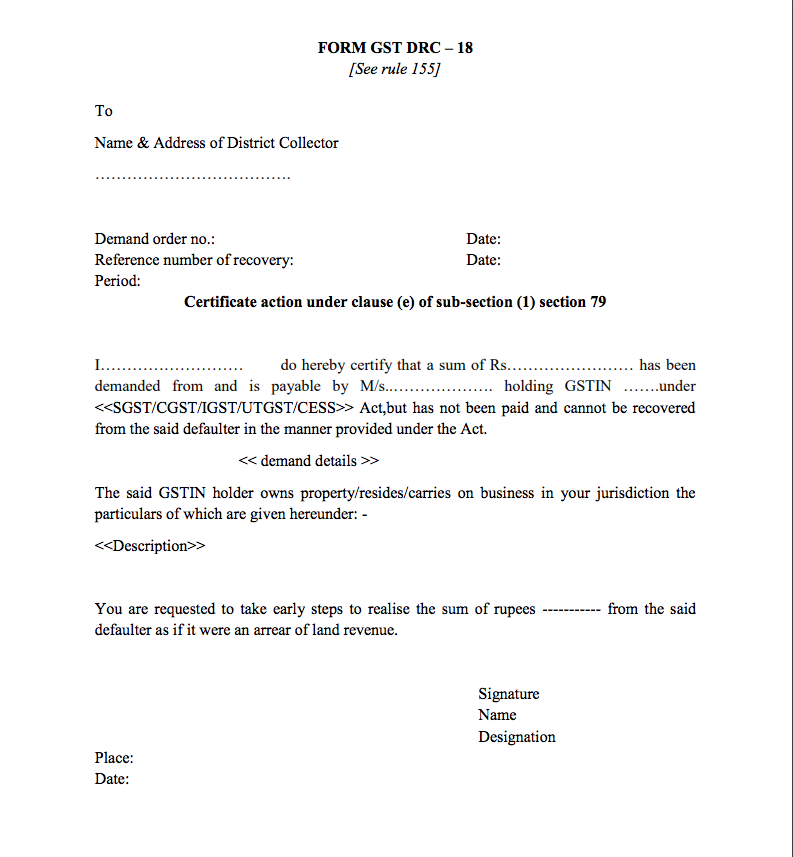

“Where an amount is to be recovered in accordance with the provisions of clause (e) of sub-section (1) of section 79, the proper officer shall send a certificate to the Collector or Deputy Commissioner of the district or any other officer authorised in this behalf in FORM GST DRC-18 to recover from the person concerned, the amount specified in the certificate as if it were an arrear of land revenue.”

Go To Rule 156

Go To Rule 154

Summary of Rule 155 of the CGST Act-

Any dues under section 79(1)(e) are recoverable as land revenue in GST. The officer will send a certificate to Collector or DC or any other authorised officer in Form GST DRC-18. Here is the format of DRC-18.